The Statutory Auditors and Third Country Auditors Regulations 2016

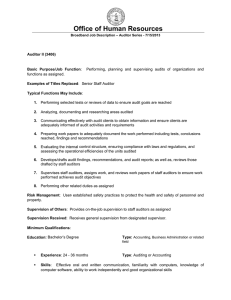

advertisement