ULDD Phase 2 Implementation Considerations

advertisement

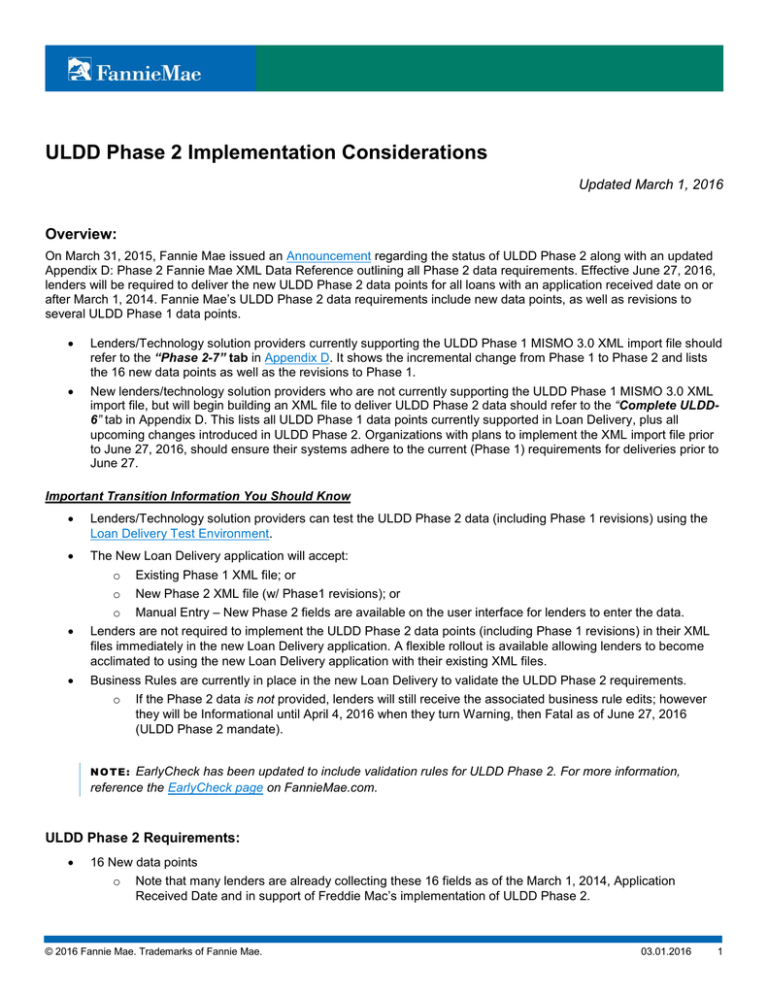

ULDD Phase 2 Implementation Considerations Updated March 1, 2016 Overview: On March 31, 2015, Fannie Mae issued an Announcement regarding the status of ULDD Phase 2 along with an updated Appendix D: Phase 2 Fannie Mae XML Data Reference outlining all Phase 2 data requirements. Effective June 27, 2016, lenders will be required to deliver the new ULDD Phase 2 data points for all loans with an application received date on or after March 1, 2014. Fannie Mae’s ULDD Phase 2 data requirements include new data points, as well as revisions to several ULDD Phase 1 data points. Lenders/Technology solution providers currently supporting the ULDD Phase 1 MISMO 3.0 XML import file should refer to the “Phase 2-7” tab in Appendix D. It shows the incremental change from Phase 1 to Phase 2 and lists the 16 new data points as well as the revisions to Phase 1. New lenders/technology solution providers who are not currently supporting the ULDD Phase 1 MISMO 3.0 XML import file, but will begin building an XML file to deliver ULDD Phase 2 data should refer to the “Complete ULDD6” tab in Appendix D. This lists all ULDD Phase 1 data points currently supported in Loan Delivery, plus all upcoming changes introduced in ULDD Phase 2. Organizations with plans to implement the XML import file prior to June 27, 2016, should ensure their systems adhere to the current (Phase 1) requirements for deliveries prior to June 27. Important Transition Information You Should Know Lenders/Technology solution providers can test the ULDD Phase 2 data (including Phase 1 revisions) using the Loan Delivery Test Environment. The New Loan Delivery application will accept: o Existing Phase 1 XML file; or o New Phase 2 XML file (w/ Phase1 revisions); or o Manual Entry – New Phase 2 fields are available on the user interface for lenders to enter the data. Lenders are not required to implement the ULDD Phase 2 data points (including Phase 1 revisions) in their XML files immediately in the new Loan Delivery application. A flexible rollout is available allowing lenders to become acclimated to using the new Loan Delivery application with their existing XML files. Business Rules are currently in place in the new Loan Delivery to validate the ULDD Phase 2 requirements. o If the Phase 2 data is not provided, lenders will still receive the associated business rule edits; however they will be Informational until April 4, 2016 when they turn Warning, then Fatal as of June 27, 2016 (ULDD Phase 2 mandate). NOTE: EarlyCheck has been updated to include validation rules for ULDD Phase 2. For more information, reference the EarlyCheck page on FannieMae.com. ULDD Phase 2 Requirements: 16 New data points o Note that many lenders are already collecting these 16 fields as of the March 1, 2014, Application Received Date and in support of Freddie Mac’s implementation of ULDD Phase 2. © 2016 Fannie Mae. Trademarks of Fannie Mae. 03.01.2016 1 82 Revisions to Phase 1 data points that are defined by the “Data Point Change Type” column, provided on the Phase 2-7 tab within Appendix D. The following descriptions of the “Data Point Change Type” column on the Phase 2-7 tab in Appendix D: o Documentation change to be made as soon as possible (54 data points) – Lender needs to validate a potential system code change (there should be no code change required, however, this assessment should be verified by the lender). o Code change to be made as soon as possible (6 data points) – Required code change which can be made as soon as possible to the ULDD XML file and prior to implementation of Phase 2 in Loan Delivery. o Code change to be made Q2 2016 (22 data points) – A required code change; the change cannot be made until the lender is using the Phase 2 XML file in the new Loan Delivery application. New ULDD Phase 2 Data Points To locate the new ULDD Phase 2 data points, take the following steps: Go to the Phase 2-7 Tab in Appendix D Apply a filter on the first row header Go to column E – Data Point New / Revision Apply a filter for New Sort ID 33 85 147 148 149 150 194 244 251 287 293 312 580 591.1 596 599 600 Data Point New / Revision New New New New New New New New New New New New New New New New New Data Point Change Type MISMO Data Point Name FNM Conditionality Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible ManufacturedHomeWidthType PropertyValuationFormType BuydownChangeFrequencyMonthsCount BuydownDurationMonthsCount BuydownIncreaseRatePercent CR CR CR CR CR Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible BuydownInitialDiscountPercent BorrowerPaidDiscountPointsTotalAmount TotalMortgagedPropertiesCount LoanLevelCreditScoreValue BorrowerReservesMonthlyPaymentCount RefinanceCashOutAmount CR R R R R CR Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible Code change to be made as soon as possible DisclosedIndexRatePercent CreditReportIdentifier CreditScoreProviderName BankruptcyIndicator LoanForeclosureOrJudgmentIndicator EmploymentBorrowerSelfEmployedIndicator CR CR O CR CR CR NOTE: Sort ID 591.1 CreditScoreProviderName is listed for alignment with Freddie Mac, however it is Optional for ULDD Phase 2 for Fannie Mae. You do not have to include this data point in the ULDD Phase 2 XML file; however, if you do include it, it will be ignored. Phase 1 Revisions: Documentation Change to be made as Soon as Possible Phase 1 revisions that are labeled in Appendix D as “Documentation change to be made as soon as possible” are those in which the lender needs to validate a potential system code change. There are 54 data points that fall in this category © 2016 Fannie Mae. Trademarks of Fannie Mae. 03.01.2016 2 (listed in Table below); the Fannie Mae Implementation Notes were revised for these fields for better clarify. These data points do not require a code change unless the lender originally coded incorrectly. If the lender did code incorrectly, the change can be made immediately to the existing loan delivery Phase 1 XML import file. To locate these data points, take the following steps: From the Phase 2-7 Tab in Appendix D Apply a filter on the first row header Go to column F – Data Point Change Type Apply a filter for Documentation change to be made as soon as possible - validate for potential code change Reminder: All Phase 2 requirements (including Phase 1 Revisions) are effective for loans with an application received date on or after March 1, 2014, and delivered through Loan Delivery on/after June 27, 2016. Sort ID Appendix D Tab MISMO Data Point Name 24 Phase 2-7 SpecialFloodHazardAreaIndicator 41 Phase 2-7 ProjectAttachmentType CR 48 Phase 2-7 ProjectName CR 65 Phase 2-7 PropertyFloodInsuranceIndicator 82 Phase 2-7 AppraisalIdentifier CR 92 Phase 2-7 HomeEquityCombinedLTVRatioPercent CR 118 Phase 2-7 InterestRateRoundingType CR 121 Phase 2-7 PerChangeMaximumDecreaseRatePercent CR 122 Phase 2-7 PerChangeMaximumIncreaseRatePercent CR 123 Phase 2-7 PerChangeRateAdjustmentEffectiveDate CR 124 Phase 2-7 PerChangeRateAdjustmentFrequencyMonthsCount CR 126 Phase 2-7 CR 131 Phase 2-7 138 Phase 2-7 AdjustmentRuleType PerChangePrincipalAndInterestPaymentAdjustmentP ercent LoanAmortizationType 195 Phase 2-7 PurchasePriceAmount CR 218 Phase 2-7 InterestOnlyEndDate CR 221 Phase 2-7 RelatedInvestorLoanIdentifier CR 222 Phase 2-7 RelatedLoanInvestorType CR 226 Phase 2-7 BalloonIndicator 236 Phase 2-7 InitialFixedPeriodEffectiveMonthsCount 255 Phase 2-7 LTVRatioPercent R 292 Phase 2-7 TotalMonthlyProposedHousingExpenseAmount R 311 Phase 2-7 PriceLockDatetime R 318 Phase 2-7 MortgageTypeOtherDescription 327 Phase 2-7 AutomatedUnderwritingSystemTypeOtherDescription CR 332.1 Phase 2-7 AdjustmentRuleType CR 332.2 Phase 2-7 PerChangeRateAdjustmentFrequencyMonthsCount CR 333 Phase 2-7 LoanAmortizationType CR 337 Phase 2-7 BalloonIndicator CR 337.1 Phase 2-7 InitialFixedPeriodEffectiveMonthsCount CR 348 Phase 2-7 MortgageTypeOtherDescription 385 Phase 2-7 LoanAcquisitionScheduledUPBAmount © 2016 Fannie Mae. Trademarks of Fannie Mae. FNM Conditionality R R CR R R CR O O CR 03.01.2016 3 Sort ID Appendix D Tab MISMO Data Point Name FNM Conditionality 389 Phase 2-7 LoanDefaultLossPartyType CR 391 Phase 2-7 REOMarketingPartyType CR 394 Phase 2-7 BalloonResetIndicator CR 404 Phase 2-7 LoanProgramIdentifier CR 412 Phase 2-7 MICertificateIdentifier CR 442 Phase 2-7 UPBAmount R 473 Phase 2-7 MortgageTypeOtherDescription O 497 Phase 2-7 LoanAmortizationType CR 499 Phase 2-7 BalloonIndicator CR 544 Phase 2-7 FullName CR 555 Phase 2-7 CountryCode CR 560 Phase 2-7 StateCode CR 571 Phase 2-7 BorrowerClassificationType CR 572 Phase 2-7 BorrowerMailToAddressSameAsPropertyIndicator CR 582 Phase 2-7 CreditRepositorySourceIndicator CR 597 Phase 2-7 BorrowerFirstTimeHomebuyerIndicator CR 614 Phase 2-7 TaxpayerIdentifierValue CR 627 Phase 2-7 PartyRoleIdentifier CR 628 Phase 2-7 PartyRoleType 641.1 Phase 2-7 FullName CR 672 Phase 2-7 PoolInterestRateRoundingType CR 673 Phase 2-7 PoolInvestorProductPlanIdentifier CR R Phase 1 Revisions: Required Code Change to be made as Soon as Possible Phase 1 revisions that are labeled in Appendix D as “Required code change to be made as soon as possible” are changes that can be made as soon as possible to the existing loan delivery XML import file. There are 6 Phase 1 data points that fall in this category (listed in Table below). To locate these data points, take the following steps: From the Phase 2-7 Tab in Appendix D Apply a filter on the first row header Go to column B – FNM Data Point Mandate Date Apply a filter for July 2012 and November 2012 Go to column F – Data Point Change Type Apply a filter for Code change to be made as soon as possible Sort ID Appendix D Tab MISMO Data Point Name FNM Conditionality R 51 Phase 2-7 ConstructionMethodType 111 Phase 2-7 IndexSourceTypeOtherDescription CR 208 Phase 2-7 HMDARateSpreadPercent CR 215 Phase 2-7 InterestCalculationType R 325 Phase 2-7 AutomatedUnderwritingRecommendationDescription CR 335 Phase 2-7 InterestCalculationType CR © 2016 Fannie Mae. Trademarks of Fannie Mae. 03.01.2016 4 The enumeration “Compound” was removed for InterestCalculationType (Sort IDs 215 and 335) in the new Loan Delivery application If you send Compound in the new Loan Delivery application, the value will be retained; however, it will not be available in the drop-down option in the user interface.. The business rules around this change will be rolled out in a phased approach; on December 1, 2015, the edits will be Warning, allowing additional time to begin using the Phase 2 XML file. As of June 27, 2016, these edits will turn fatal and the data must be corrected prior to delivery. NOTE: Phase 1 Revisions: Code Change to be Made Q2 2016 Phase 1 revisions that are labeled in Appendix D as “Code change to be made Q2 2016” are required code changes that cannot be made until the ULDD Phase 2 XML file is being used in the new Loan Delivery application. There are 22 Phase 1 data points that fall in this category (listed in Table below). To locate these data points, take the following steps: From the Phase 2-7 Tab in Appendix D Apply a filter on the first row header Go to column B – FNM Data Point Mandate Date Apply a filter for July 2012 and November 2012 Go to column F – Data Point Change Type Apply a filter for Code change to be made 2Q 2016 Sort ID 2 43 44 77 78 Appendix D Tab Phase 2-7 Phase 2-7 Phase 2-7 Phase 2-7 Phase 2-7 89 90 368 414 510 Phase 2-7 Phase 2-7 Phase 2-7 Phase 2-7 Phase 2-7 Phase 2-7 PropertyValuationMethodType PropertyValuationMethodTypeOtherDescription InvestorFeatureIdentifier MICompanyNameTypeOtherDescription LoanRoleType R CR CR CR CR CurrentHELOCMaximumBalanceAmount CR Phase 2-7 Phase 2-7 Phase 2-7 Phase 2-7 Phase 2-7 Phase 2-7 HELOCBalanceAmount HELOCIndicator LoanStateDate LoanStateType CR CR CR CR Phase 2-7 UPBAmount LienPriorityType MortgageType AppraiserLicenseIdentifier PartyRoleType AppraiserLicenseIdentifier CR CR CR CR CR CR Phase 2-7 PartyRoleType CR 511 512 513 514 515 516 517 519 525 528 534 537 Phase 2-7 Phase 2-7 Phase 2-7 MISMO Data Point Name AboutVersionIdentifier ProjectDesignType ProjectDesignTypeOtherDescription BedroomCount PropertyDwellingUnitEligibleRentAmount FNM Conditionality R CR CR CR CR These data points require changes to: Format Conditionality New Enumerations Cardinality © 2016 Fannie Mae. Trademarks of Fannie Mae. 03.01.2016 5 Data Points with a Cardinality Change: Sort ID MISMO Data Point Change (SFCs) is increasing from 6 allowable values to 10 allowable values Borrower is increasing from 2 allowable containers to 4 allowable containers Related Loan is increasing from 1 allowable container to 3 allowable containers. Row number in Appendix D (Cardinality Tab) 368 InvestorFeatureIdentifier 357 611 Party Role Type 496 Loan Role Type 600 Employment Borrower Self Employed Indicator Container will be limited to one occurrence. 602 N/A DEAL The number of DEALS has been updated. The maximum number has been updated to 10,000. Previously there was no maximum. 18 544 499 Sort IDs Impacted by Expansion of a 3rd and 4th Borrower: Sort ID 540 541 542 543 544 545 546 548 549 554 555 557 560 567 568 571 572 573 576 577 578 579 580 582 583 590 596 597 MISMO Data Point FirstName LastName MiddleName SuffixName FullName LegalEntityType LegalEntityTypeOtherDescription AddressLineText AddressType CityName CountryCode PostalCode StateCode BorrowerAgeAtApplicationYearsCount BorrowerBirthDate BorrowerClassificationType BorrowerMailToAddressSameAsPropertyIndicator BorrowerQualifyingIncomeAmount CounselingConfirmationType CounselingConfirmationTypeOtherDescription CounselingFormatType CounselingFormatTypeOtherDescription CreditReportIdentifier CreditRepositorySourceIndicator CreditRepositorySourceType CreditScoreValue BankruptcyIndicator BorrowerFirstTimeHomebuyerIndicator © 2016 Fannie Mae. Trademarks of Fannie Mae. 03.01.2016 6 Sort ID 598 599 600 608 609 610 611 613 614 MISMO Data Point CitizenshipResidencyType LoanForeclosureOrJudgmentIndicator EmploymentBorrowerSelfEmployedIndicator GenderType HMDAEthnicityType HMDARaceType PartyRoleType TaxpayerIdentifierType TaxpayerIdentifierValue File Validation Updates: The following file validations and business rules/edits are being updated for ULDD Phase 2. These edits are being put in place to ensure the Phase 2 XML files are properly structured for import in the new Loan Delivery application. The following file validation (WN1146) currently allows a commitment to import when there is the existence of a pool container in the XML file, even though the XML being imported is a Whole Loan. This file validation will turn Fatal (ER1146) on June 27, 2016. Note that if the XML file contains a pool container and the lender has indicated that the file is a Whole Loan, the commitment will be rejected and the commitment will not import. Edit Severity Error Message WN1146 Warning Whole Loan delivery was requested and the imported file contains Pool information. The file is being processed as a Whole Loan delivery and this Pool information is being ignored. ER1146 Fatal The file was not processed because Whole Loan delivery was selected and one or more DEAL_SETs in the file have Pool information. If the intention is a Whole Loan delivery, please select a valid Whole Loan file and re-import. If the intention is an MBS delivery, please select MBS and re-import The following file validations will reject the Whole Loan XML file if it contains a Contract Number (Sort ID 400). The file validation is Warning (WN3121) and switching to Fatal (ER3120) on June 27, 2016, allowing lenders additional time to transition to the Phase 2 XML file and new edits. Edit Severity Error Message WN3121 Warning Commitment number not allowed on an MBS delivery. ER3120 Fatal Commitment number not allowed on an MBS delivery. The following is a new file validation that will reject a Pool if it contains a Commitment Number (Sort ID 399). The file validation is Warning (WN3126) and will be switching to Fatal (ER3125) on June 27, 2016. Edit Severity Error Message WN3126 Warning Contract number not allowed on a Whole Loan delivery ER3125 Fatal Contract number not allowed on a Whole Loan delivery The following is a new file validation for the field, Employment Borrower Self Employed Indicator (Sort ID 600). This data point features a cardinality change and is restricted to only one occurrence. The file validation is Warning (WN3201) and switching to Fatal (ER3210) on June 27, allowing lenders time to transition to sending a single occurrence. © 2016 Fannie Mae. Trademarks of Fannie Mae. 03.01.2016 7 Edit Severity Error Message WN3201 Warning More than one <XPATH/Container> was found within <parent container>. Only the first was accepted, all others were not imported. ER3210 Fatal DEAL was not processed because <XPATH/Container> cannot have more than one occurrence within <parent container> container. Correct the data and re-import. Special Feature Code Updates: The following updates are being made to Special Feature Codes (SFCs) for ULDD Phase 2. Business rules are being put in place to ensure the data is delivered according the Phase 2 requirements in the new Loan Delivery application. Old SFC NEW SFC Type SFC 357 SFC 801 Cash and MBS SFC 127 In August 2014, DU announced the retirement of SFC 214. DU loans, regardless of the party submitting the loan to DU, should be identified with Cash and Seller Acquired SFC 127. When using new Loan Delivery, your Phase 2 import XML files MBS after Evaluation should contain SFC 127 in place of SFC 214, to be consistent with DU. (DU loans) Refer to the Selling Guide Announcement (SEL-2014-06) and the DO/DU Release Notes for DU Version 9.1 August Update for details. SFC 214 Description Property Inspection Waiver Important Details about this Update In March 213, Fannie Mae announced that SFC 357 should no longer be used; rather lenders should use SFC 801 (Level 1 Property Inspection Waiver). Refer to the Property Inspection Waiver Release Notes for details. Usage of Default Zero Values in Your ULDD XML File: When preparing the XML import file for ULDD Phase 2, it is important to only send data related to the loan transaction. Work with your technology team or solution provider to ensure that only relevant data points are populated in your file and that no values default to zero. If the data point does not apply, it should not be populated in the XML file. Example: If the ULDD XML file contains an Adjustable Rate Mortgage (ARM) data field with a default zero value on a Fixed Rate loan transaction, the Loan Delivery application will treat these as “zero” values and will use it in processing. Therefore, lenders must ensure that default zeros are not being transmitted so that the transaction can complete successfully. Additional Data Reminders: When delivering “Postal Code” (Sort IDs 16 and 557), be sure to submit the data exactly how it is recorded on the Note. The Postal Code should not contain dashes; it can be either 5 or 9 digits; however, only the leading 5 digits are used. © 2016 Fannie Mae. Trademarks of Fannie Mae. 03.01.2016 8