The School District of St - St. Joseph School District

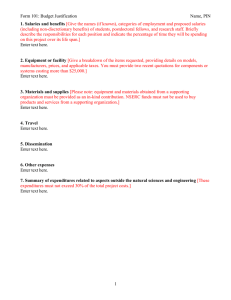

advertisement