CT Scanning Systems

advertisement

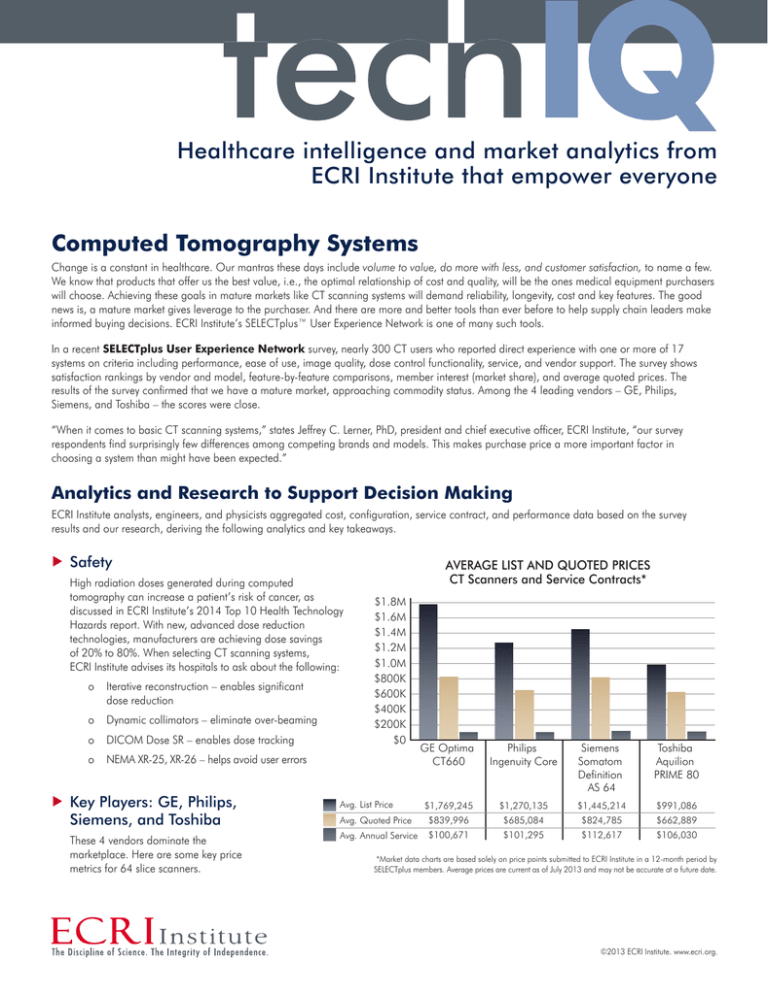

Healthcare intelligence and market analytics from ECRI Institute that empower everyone Computed Tomography Systems Change is a constant in healthcare. Our mantras these days include volume to value, do more with less, and customer satisfaction, to name a few. We know that products that offer us the best value, i.e., the optimal relationship of cost and quality, will be the ones medical equipment purchasers will choose. Achieving these goals in mature markets like CT scanning systems will demand reliability, longevity, cost and key features. The good news is, a mature market gives leverage to the purchaser. And there are more and better tools than ever before to help supply chain leaders make informed buying decisions. ECRI Institute’s SELECTplus™ User Experience Network is one of many such tools. In a recent SELECTplus User Experience Network survey, nearly 300 CT users who reported direct experience with one or more of 17 systems on criteria including performance, ease of use, image quality, dose control functionality, service, and vendor support. The survey shows satisfaction rankings by vendor and model, feature-by-feature comparisons, member interest (market share), and average quoted prices. The results of the survey confirmed that we have a mature market, approaching commodity status. Among the 4 leading vendors – GE, Philips, Siemens, and Toshiba – the scores were close. “When it comes to basic CT scanning systems,” states Jeffrey C. Lerner, PhD, president and chief executive officer, ECRI Institute, “our survey respondents find surprisingly few differences among competing brands and models. This makes purchase price a more important factor in choosing a system than might have been expected.” Analytics and Research to Support Decision Making ECRI Institute analysts, engineers, and physicists aggregated cost, configuration, service contract, and performance data based on the survey results and our research, deriving the following analytics and key takeaways. u Safety High radiation doses generated during computed tomography can increase a patient’s risk of cancer, as discussed in ECRI Institute’s 2014 Top 10 Health Technology Hazards report. With new, advanced dose reduction technologies, manufacturers are achieving dose savings of 20% to 80%. When selecting CT scanning systems, ECRI Institute advises its hospitals to ask about the following: o Iterative reconstruction – enables significant dose reduction o Dynamic collimators – eliminate over-beaming o DICOM Dose SR – enables dose tracking AVERAGE LIST AND QUOTED PRICES CT Scanners and Service Contracts* $1.8M $1.6M $1.4M $1.2M $1.0M $800K $600K $400K $200K $0 o NEMA XR-25, XR-26 – helps avoid user errors u Key Players: GE, Philips, Siemens, and Toshiba These 4 vendors dominate the marketplace. Here are some key price metrics for 64 slice scanners. Avg. List Price GE Optima CT660 Philips Ingenuity Core Siemens Somatom Definition AS 64 Toshiba Aquilion PRIME 80 $1,769,245 $1,270,135 $1,445,214 $991,086 Avg. Quoted Price $839,996 $685,084 $824,785 $662,889 Avg. Annual Service $100,671 $101,295 $112,617 $106,030 *Market data charts are based solely on price points submitted to ECRI Institute in a 12-month period by SELECTplus members. Average prices are current as of July 2013 and may not be accurate at a future date. ©2013 ECRI Institute. www.ecri.org. and Reliability Service Response Time SERVICE RESPONSE TIME Average User Rating by CT Vendor u Uptime 5 If your CT scanner is down, you are not generating revenue and you risk poor customer satisfaction, both of which affect your bottom line. Response time, training, and preventive maintenance are key markers for vendor support and are all close for each vendor. What does the vendor offer for remote monitoring and diagnostics that could avoid downtime during clinical use? 4.4 4.2 4.3 4.4 GE Philips Siemens Toshiba 0 Source: ECRI Institute SELECTplus User Experience Newtork, 5/2013. u Feature Matching – Little to Differentiate While manufacturers often push features and benefits, they now must demonstrate value in the form of higher reliability, lower cost, or better outcomes. There is no data in our survey results that show differential outcomes related to CT systems. u Upgrade or Replace New features, particularly in the area of dose reduction, are important – look at the costs of replacing versus upgrading. Depending on age, once your upgrade costs pushes 50% of the cost of a new system, replacement makes sense. FEATURE-TO-FEATURE COMPARISON Model Slices Detector Coverage, mm Bore Size, cm Generator Power, kW Imaging Workstation Coronary Artery Calcium Scoring Dose Reduction Software Iterative Reconstruction Technology GE Philips Optima CT 660 Ingenuity Core 64 40 70 72 syngo CT Vitrea SmartScore 4.0 64 40 70 105 Extended Brilliance HeartbeatCS syngo Calcium Scoring OptiDose DoseRight CAREDose ASIR iDose SAFIRE SURE Cardio Scoring SURE Expose 3D AIDR 3D VolumeShare Siemens Somatom Definition AS 64 64 29 78 80 or 100 Toshiba Aquilion PRIME 80 80 40 78 72 Source: ECRI Institute SELECTplus User Experience Newtork, 5/2013. tech Your Checklist for CT Scanner Acquisition – Dose reduction is critical. Get explanations üSafety that take the mystery out of dose reduction software. – Price is king in this mature market. Push the üCost vendors. – Uptime commitments without assurances üReliability are empty. Penalties don’t solve problems. Get SELECTplus, the nation’s leading healthcare technology procurement advisory service, assists hospitals and health systems worldwide with the safe, cost-effective acquisition of capital medical equipment and health information technologies. For more information, contact us at jmyers@ecri.org or call (610) 825-6000, ext. 5287. commitments on how uptime will be kept as close to 100% as possible. and Support – Negotiate on long term üService service commitments that include upgrades. (repair or replace) – Look at age, dose reduction üRoR capabilities and current reliability and differential cost to find the best solution. ©2013 ECRI Institute. www.ecri.org.