Anderson University Mobile Device Policy Modified: 10/24/2014 1

advertisement

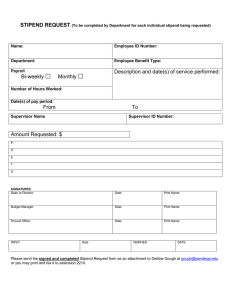

Anderson University Mobile Device Policy Modified: 10/24/2014 The President's Executive Staff have approved a new mobile device policy effective as of January1, 2015. In recent years, the University has seen a tremendous increase in the demand for University-provided cell phones. The provision and maintenance of these cell phones has become a significant budgetary cost and a workload concern. Moreover, the IRS now provides guidance on certain criteria and documentation required in order for business-provided cell phones or reimbursements to qualify as non-taxable. Therefore, to reduce costs, eliminate administrative overhead, and bring the University into compliance with IRS tax policy, the University is announcing a new mobile device policy, which will go into effect on January 1, 2015. Below is the new policy: 1. Purpose a. The purpose of this policy is to authorize appropriate AU employees to receive a set stipend allowance for the use of a personal cell phone in the execution of duties associated with employment. The objective is to provide a monthly allowance to designated employee(s) to offset the cost of using such devices for AU business purposes. b. The policy also provides guidance on the treatment of University-owned mobile devices for certain University departments. c. Stipends are intended to reimburse the employee for the business use of the device and are not intended to fund the cost of the device nor pay for the entire monthly bill. The assumption is that most employees also use their wireless communication devices for personal calls and/or data consumption. d. Mobile phones, tablets, and other wireless devices should not be selected as an alternative to other means of communication, such as land lines and radio phones, when such alternatives would provide adequate and less costly service to the University. e. The University does not reimburse, purchase or enter into mobile device or data contracts except as noted below in section 3 regarding University-owned devices. 2. Cell Phone Qualified employees a. Cell phone stipends will be provided for cell phone qualified employees (defined below). Generally, cell phones will be provided for employees meeting the following requirements: i. The employee’s job requires that they work regularly in the field and need to be immediately accessible. ii. The employee’s job requires that they need to be immediately accessible outside of normal business hours with regularity. iii. The employee is responsible for critical infrastructure and needs to be immediately accessible at all times. iv. The employee travels frequently and needs to be accessible or have access to information technology systems while traveling. b. Cell Phone Qualified employees are defined in one of two categories, as follows: i. Category 1: The job requires the employee to be immediately accessible to receive and/or make frequent business calls outside of working hours. Employee must be readily accessible due to the specific nature of their duties and must be available for emergency responses or time sensitive consultation after normal office hours. The following employees are designated as meeting this requirement: 1. Designated Athletics Staff 2. Designated Advancement Staff 3. Designated ITS Staff 1 Anderson University Mobile Device Policy Modified: 10/24/2014 4. Designated Marketing & Communications Staff 5. Resident Director Staff ii. Category 2: The job requires considerable time outside the office during working hours and it is imperative to the functioning of the University that the employee be immediately accessible to receive and/or make frequent business calls during those times. The following employees are designated as meeting this requirement: 1. Designated Recruiting Staff 2. Designated Advancement Staff 3. Designated Sales Staff 3. University-owned mobile devices for certain University departments a. Departments with employees who are designated as on-call will be provided with business-use only cell phones. These phones may only be used for business and expected to be rotated among those employees designated as on-call. No taxable income will be attributed to employees in this category since there will be no personal use associated with these phones. i. The following departments will be eligible for university-owned business-use only cell phones: 1. Admissions 2. Physical Plant Department 3. Police & Security 4. Other departments, as needed b. Departments with employees who are required to have internet connectivity in the field and need to be immediately accessible will be provided with a business-use only WiFi (hotspot) device. These devices may only be used for business. i. The following departments will be eligible for university-owned business-use only WiFi devices: 1. Advancement 2. Athletics 3. Physical Plant Department ii. Departments are responsible for safeguarding and general maintenance of AU owned WiFi devices used by their employees. iii. Departments are responsible for assuring that usage of the AU owned WiFi devices are in compliance with this policy. iv. The University reserves the right to inspect or withdraw devices at any time for reasonable cause. v. Business & Auxiliary Services will be responsible for the service and account maintenance of University-owned mobile devices. 4. Stipend Allowance a. Stipend is intended to reimburse the employee for the business use of the device. The stipend is not intended to fund the cost of the device nor pay for the entire monthly bill. The assumption is that most employees also use their mobile devices for personal calls and/or data consumption. b. The stipend allowance provided is not an entitlement related to the employee’s position, and it must be applied to an operational need for a cell phone in order to fulfill the particular employee’s duties. c. Stipend allowance amount will be determined as follows: i. Cell phone qualified category 1: $25 ii. Cell phone qualified category 2: $50 2 Anderson University Mobile Device Policy Modified: 10/24/2014 d. Employees eligible for a mobile device stipend must complete the “Mobile Device Stipend Authorization” form. e. Regardless of when they are established, stipend allowances will cease at the end of each fiscal year (May 31). New “Mobile Device Stipend Authorization” forms must be sent to the Business Manager prior to May 31 to continue the allowance, or to establish any new allowances. f. The stipend allowance program will begin January 2015. 5. Conditions of Stipend Allowance a. Stipend allowances will be deemed non-taxable income to the employee provided that the employee annually completes the “Mobile Device Stipend Authorization” form along with a copy of their most recent cell phone statement. The stipend does not increase the employee’s base salary. b. The “Mobile Device Stipend Authorization” form must be completed annually and reviewed for accuracy and relevancy by the employee’s supervisor. c. The dean, director, or departmental head is responsible for an annual review of employee business-related cell-phone use, to determine if existing stipend allowance should be continued as-is, changed, or discontinued, and to determine if any new stipend allowances should be established. d. Employees must retain a cell phone contract for as long as the stipend is provided. e. Employees must notify the Business & Auxiliary Services within 3 business days of a change in stipend eligibility (i.e. if their cell phone contract is cancelled, expires, or due to a change in employment). f. Stipends will not be provided for hardware (i.e. employees must purchase their own phones). Employees are responsible for the maintenance of their phone, both hardware and software. g. Employees are responsible for researching and obtaining a cell phone contract that meets the requirements of the stipend allowance. Employees can purchase services/features beyond the stipend allowance if they choose to, however, the employee will be responsible for the additional charges. h. Employees are individually responsible for all contractual obligations agreed to in their cell phone contract. This includes any termination fees. i. Use of the phone in any manner contrary to local, state, or federal laws will constitute misuse, and will result in immediate termination of the cell phone allowance. The employee must agree to use the phone in a safe manner at all times, and not to use the phone while driving in a manner that endangers people or property. 6. Mobile Devices a. Mobile devices will not be provided to University employees. b. The University will only offer and support mobile devices for those departments that qualify for University-owned business-use only devices. c. University employees (other than those departments listed in section 3) who were provided with the use of a University-owned mobile device will be required to convert to personal plan no later than December 31, 2014. Beginning October 24, 2014, Business & Auxiliary Services staff will be prepared to assist in this conversion. 7. Reimbursement a. If an employee’s job duties do not require the use of a cell phone, then the employee is not eligible for a stipend allowance to cover mobile device expenses. b. Extraordinary business use of the employee’s personal wireless device may be reimbursed with appropriate documentation and approval. i. To be eligible for reimbursement, the expense must 3 Anderson University Mobile Device Policy Modified: 10/24/2014 1. Be in excess of the monthly stipend, or 2. Pre-approved for business use if the employee is not eligible for a stipend allowance. ii. The University will not reimburse the employee for minutes that are covered under the employee’s monthly plan. If the provider’s invoice contains overage charges, the University will reimburse the employee for the business-related minutes included in the overage. iii. Within 30 days of the expense, extraordinary business use should be properly documented and submitted to the respective Vice President for consideration of approval. The employee should make personal payment to the provider, and then should submit a requisition for reimbursement. A copy of the provider’s invoice should be submitted with the requisition and clearly mark business-call charges. The requisition should clearly indicate the person/business called and the business-related purpose of the call. 8. Appeals a. Appeals by employees whose positions are not specifically listed above, but who believe that they are “cell phone qualified," should be made in writing to the respective Vice President for review. Questions? Questions regarding the policy should be directed to the Business Manager in Business & Auxiliary Services. 4