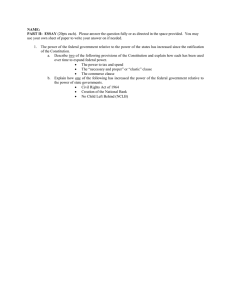

Enterprise Agreement 2011–14

advertisement