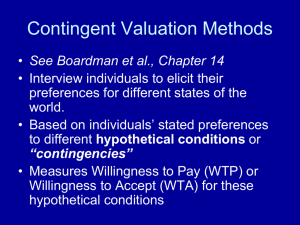

Willingness to Pay vs. Willingness to Accept

advertisement