The Use and Misuse of Patent Licenses

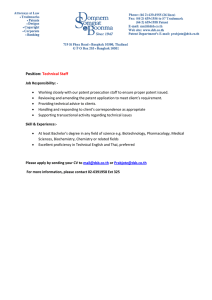

advertisement