500CR - Maryland Tax Forms and Instructions

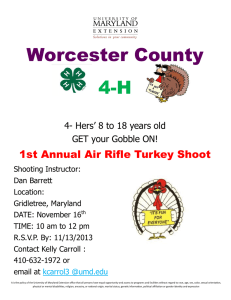

advertisement