Best Practices for Dealing With

An Account Compromise

You’ve just received an e-mail from Visa’s Compromised Account Management System (CAMS) alerting you that

some of your accounts may be at risk. Now what? This is a common problem for today’s issuer. The good news

is there are a variety of ways to address account compromises that can minimize the impact to your customers

and still protect against fraudulent activity. The following are considered industry best practices for responding to

these events:

1. Prioritize the exposed accounts.

Determine how many of the exposed accounts are still

active, and if any of the accounts have been closed due

to fraudulent activity.

n

n

n

If you have closed accounts that were involved

in fraud, compare the fraud pattern on the closed

accounts with the circumstances or fraud pattern

described in the CAMS alert message. For example,

if the CAMS alert describes a fraud pattern of full

magnetic-stripe counterfeit taking place, you should

determine if your fraud patterns are similar.

If the CAMS alert describes a compromise involving

only account numbers and expiration dates, you

may be looking for card-not-present fraud patterns.

If you detect similar fraud patterns you may want

to consider blocking and reissuing cards for the

affected “active” accounts. Fraud patterns matching

the data elements compromised are often tell-tale

signs that someone has already obtained some of

your accounts and has used them. This indicates

that the other accounts may have also been exposed.

Continue to monitor the compromised accounts for

card present activity with invalid or missing Card

Verification Values (CVV) as these may be signs of

potentially counterfeit cards.

If you haven’t seen any signs of fraud that you

believe could be linked to the reported account

compromise incident, continue to monitor your

accounts in accordance with best practices. It is

often difficult to determine with certainty if the

hacker was able to retrieve all of the exposed

account numbers, including those from your

institution. In this situation, it is recommended that

these accounts continue to be monitored closely and

placed in authorization strategies with heightened

controls. It is not uncommon for criminals to store

account data up until the expiry date of the card.

2. Comprehensively evaluate the exposure.

Monitor the fraud rates on the group of exposed

accounts and compare to the portfolio average. Take

into consideration the number of cards affected, daily

spending limits on cards, and the likelihood that fraud

may occur. Also, assess the likelihood that the fraud

will take place in the card-not-present environment,

which may allow for chargeback rights on fraudulent

transactions.

3. Narrow down the high-risk possibilities.

For incidents involving the compromise of full track

data, the accounts that were reissued after the

compromise date are not likely to be “high-risk”

because the reissued account will have a new Card

Verification Value (CVV, CCV2) and expiration date.

4. Check for upcoming expirations.

Determine how many of the exposed accounts will be

expiring in the next 30 to 180 days. Consider moving up

the reissue on those accounts. Note that changing the

card account number may not be necessary; issuing the

same card account number with a different expiration

date will create a new CVV and CVV2 thereby

protecting against future counterfeit, card present fraud,

and this may help reduce the impact to cardholders.

Also consider applying atypical expiration lengths (e.g., 26 months versus 24). These procedures can help to minimize impact to the customer

particularly with regard to recurring payments. If you participate in Visa Account Updater, make sure to provide new card information to minimize cardholder declines for bill pay or other recurring transactions.

Best Practices for Dealing With An Account Compromise [continued]

Additional Information

5. Apply effective risk decisioning tools.

Establish authorization strategies that use the Visa

Advanced Authorization risk score and risk condition

code. Utilize the Compromised Event Reference ID

for real-time recognition of compromised accounts

to filter at-risk accounts and optimize fraud detection

at the point of sale. Combine the Visa Advanced

Authorization risk score and compromised risk condition codes with Visa’s rule-based decisioning

solutions to stop fraud at an exceptional false positive

ratio to ensure minimal customer impact. For more

information please contact your Visa Account

Representative or e-mail VAA_VRM@visa.com.

Promptly Notify Visa of Suspected Compromises

By doing so, Visa can take action to investigate and determine

the validity of the potential compromise. In the early stages of an

investigation, Visa may issue a CAMS Proactive Alert which is

designed to notify Visa clients as quickly as possible of a potential

compromised event and its related accounts. If the compromised

event is confirmed, a follow-up CAMS alert will be distributed to all

affected financial institutions.

Reporting a Suspected Compromise

6. Notify your dispute area of the compromise.

This ensures that appropriate action can be taken

immediately. The disputes team also can help to detect

emerging fraud patterns in the group of exposed

accounts.

7. Know your insurance rights and liabilities.

If your financial institution has counterfeit fraud

insurance coverage, you may need to review your

coverage with your carrier and discuss the impact of not

blocking and reissuing new cards.

8. Report fraud.

Make sure you or your processor properly reports fraud

to Visa through the Fraud Reporting System, Visa’s

centralized clearing house that helps you to report, track

and analyze fraudulent transactions.

Visa has developed a Common Point of Purchase (CPP)

identification form for issuers to complete when reporting a

possible data compromise. This form, available at Visa Online,

must be completed and submitted to Visa via Visa Online’s secure

e-mail in order for a fraud investigation to be considered. Issuers are

reminded that the CPP identification form is not a replacement for

reporting fraud through the Fraud Reporting System (FRS) and is to

be used solely for investigative and tracking purposes.

About Visa Account Updater

The Visa Account Updater provides a platform for issuers to

communicate through acquirers current changes to cardholder

account information to merchants whose business models support

electronic maintenance of customer account data. Participating

merchants use this updated account information to support

account-on-file functions, such as recurring payments, preferred

customer programs, and express payment options. For more

information please contact your Visa Account Representative.

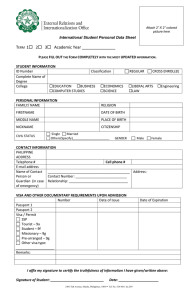

About Visa Advanced Authorization

Authorization

Request

VisaNet

Authorization

Message Stream

In-Flight

Scoring Engine

• Visa Global Profiles

• Global Transaction & Fraud Data

• Neural Networks

• Statistical Models

Approve/

Decline

Authorization

Request

• Issuer Authorization

Strategies

• Visa Risk Manager

• Falcon Fraud Manager

Visa Advanced Authorization is part of a

comprehensive suite of fraud management solutions

that extends the power of Visa Global Processing

by helping issuers optimize loss prevention and

better manage risk through effective risk decisioning

capabilities. It evaluates 100% of transactions

using the comprehensive global data available

only through VisaNet to deliver outstanding fraud

protection accuracy without burdening your internal

systems. The real-time nature of the product also

enables faster response to emerging fraud schemes.

Visa also offers additional risk solutions that provide another layer of decisioning intelligence

to Visa Advanced Authorization that allows you

to decline the highest risk transactions while

optimizing approval rates at the point of purchase.

This means reduced risk exposure for you and the

freedom for your customers to use their Visa cards

in more places. For more information please contact

your Visa Account Representative or e-mail VAA_VRM@visa.com.

© 2010 Visa Inc. All Rights Reserved. VRM 10.28.10