Discrete semiconductors - Corporate-ir

advertisement

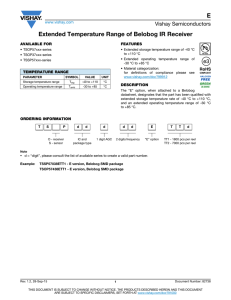

One of the World’s Largest Manufacturers of Discrete Semiconductors and Passive Components Notes on Forward-Looking Statements • Comments in this presentation other than statements of historical fact may constitute forward-looking statements. • Forward-looking statements are based on Vishay management’s estimates and projections and are subject to various risks and uncertainties. • These risks and uncertainties are described in the Company’s annual report on Form 10-K for the year ended December 31, 2003, in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Risk Factors section of the Business Section. • Actual results may differ materially from those projected in the forward-looking statements. 2 Goals Maximize profits by increasing market share and providing technological leadership in discrete components • Broadest line of discrete components: one-stop-shop • Best service • Innovative products 3 Strategy • Increase sales • Decrease costs • Focus on Research and Development 4 Increase Sales • Acquisitions • Market penetration • New products to create new markets • Vertical growth 5 Strategic Acquisitions BCcomponents Transducer Co.’s $2,600 $2,400 $2,200 $2,000 Sales (000s) $1,800 Siliconix, Telefunken $1,600 $1,400 General Semiconductor, Infineon Infrared $1,200 $1,000 Vitramon Roederstein $800 $600 Sprague $400 $200 Dale Draloric $0 85 86 87 88 Sfernice 89 90 91 92 93 94 Year 95 96 97 98 99 ‘00 ‘01 ‘02 ‘03 6 Example of Growth through Acquisition: BCcomponents, formerly Philips • Global manufacturer and supplier of commodity and specialty passive components • Recognized for manufacturing excellence, quality, logistics performance, and sales and marketing strengths • Year 2003 revenues: $258 Million 7 BCcomponents Synergies • SG&A: $25m savings • • • • • • • • Headquarters closed Sales forces merged Sales offices closed Terminated all non-US reps Reduced commissions in US by transferring sales to VSH US reps Terminating external support contracts General & Administrative merged into Vishay organization Manufacturing: $45m savings • • • Restructuring in High Cost Labor countries started (Germany, Belgium, and Netherlands) Plant consolidations planned Moving Vishay production into BCcomponents plants in Asia 8 Broadest Line of Discrete Semiconductors and Passive Components Semiconductors Competitors Diodes Rectifiers Vishay AVX Agilent EPCOS Fairchild Semi HBM International Rectifier Infineon KEMET KOA Maxim Transistors Diodes Selected ICs Passive Components Opto Capacitors MOSFETs Analog IRDC IR Small Switches Comp- Sensors Signal Power ICs onents Couplers LEDs X X O X X X X X X X X O X X X X X X Magnetics Film Foil WW Rchips Sensors Variable Non linear Inductors Transformers X X X X O O X X X O X X X O X X X X O X X X Murata On Semi Philips Rohm Sharp STMicroelectronics TDK Texas Instruments Toshiba Yageo Power Alumin. Tantalum Film MLCC Resistors X X X X X X X X O O X O X X O O O X X X X X X X Source: Company estimates X X X O X O X X = Major Position X O = Minor Position 9 Passive Components Manufactured by Vishay • • Resistors and inductors • #1 in wirewound and other power resistors • #1 in foil resistors • #1 in thin film resistors Capacitors • • #1 in wet tantalum and conformal coated capacitors Stress measurement systems • #1 in strain gage sensors and load cells 10 Vishay in Discrete and Optical Semiconductors Worldwide Ranking of Companies that Manufacture Both Discrete and Optical Semiconductors: 1. Toshiba 2. Rohm 3. Vishay Source: Gartner, Company estimates 11 Semiconductor Components Manufactured by Vishay • • Discrete semiconductors (power MOSFETs, diodes, transistors) • #1 in low-voltage power MOSFETs • #1 in rectifiers • #1 in glass diodes Optoelectronics (IRDC, sensors, modules, visibles) • #1 in IR receivers 12 Vishay Revenue by Product Group: 2004 Measurements Group 5% Siliconix 19% Capacitors 22% Resistors/ Inductors 23% Vishay Semiconductors 31% 13 Leverage Broad Product Line to Increase Market Share • How to increase number of Requests for Quotation (RFQs)? • Get onto existing Bills of Materials (BOMs) • Present rate of conversion into Vishay BOMs is about 1,000 line items per day. 14 Increasing Global Presence Revenue by Geographic Location 1997 Asia 10% 2004 SEA 22% North America Americas 28% Asia 36% Americas 25% 48% Europe 42% Europe 39% 15 Vishay’s Participation in Multiple End Markets: 2004 Computer 18% Consumer 13% Medical 2% Automotive 16% Military/Aero 5% Telecom 11% Industrial 35% 16 Major Markets 17 Component Content in Cell Phones LED Potential Vishay Bill of Materials Resistors 161 Power MOSFETs 3 MLCCs 226 Power ICs 8 Tantalum Capacitors 13 Diodes, rectifiers 18 ESD/TVS 8 (HF Inductors, Power Inductors) Crystals Total Passive Components 1 419 HF Inductor 17 (Polymer Tantalum, Coated Tantalum) Inductors Resistor LEDs 21 Total Semiconductors 57 Total Passive Components and Semiconductors 476 Power IC Polymer Tantalum Capacitor MLCC Coated Tantalum Capacitor Shown to the right are the exterior and one side of an internal printed circuit board of the Samsung SCH-E300, a W-CDMA cellular telephone. Crystal Identified and highlighted on the printed circuit board (and listed in the text table on this page) are types of components manufactured by Vishay. List contains only types of components manufactured by Vishay. ESD Diode Power MOSFET Power Inductor* *Inside the phone but not located on this board 18 N u m b e r o f C o m p o n e n ts p e r M o th e rb o a rd (1 ) Passive Component Usage in Computers 1000 Passive Components around Intel Processors 900 900 800 700 600 600 500 440 400 345 300 200 252 124 100 0 ® 486 Pentium Pentium II Pentium III Pentium 4 P5 (2) Intel® Motherboards (1) Source: Vishay estimates; will vary depending upon end-product application. (2) Source: Estimated 800-1,000 passive components for P5 to be released in 2008, ©Paumanok Publications, Inc. 2003 19 Average Passive Component Content Per Vehicle Circuit Protection 2% Inductors 2% Tantalum Chip 1% Aluminum etc. 1% Chip Resistor 46% entertainment center airbags engine lighting suspension comfort accessories Global Posit. Sys. steering MLCC 48% Source: ©Paumanok Publications, Inc. 2003 security system diagnostics brakes transmission 20 Market Penetration No single customer has over 6% of sales 21 Decrease Costs • Reduce labor cost • • • Reduce material costs • • Leverage purchasing synergies between divisions Reduce taxes • • Move production to low cost labor countries such as China, Israel, India and Czech Republic Goal: only 20-25% of production in high cost labor countries (as of Q3 2004 28.7%) Down to 20% by producing in low tax locations (China, Israel) Equipment grants from Israel • Deferred income of $21m as of October 2, 2004 22 Growth and Maintaining Leadership Through R&D • Reduce size • Increase performance • Reduce cost 23 Percent of New Products New Products Vishay 2003 70 60 50 40 30 20 10 0 Vishay (incl. Siliconix) 3 10 Years 24 R&D: Surface-Mount RF Capacitor 9 Reduce size z z z z Industry’s first silicon based capacitor 0.6 pF-180 pF, 1% tolerance 0402 capacitor Extremely stable capacitance from 1 MHz to several GHz Reduces board size by as much as 45% 9 Increase performance 9 Reduce cost 25 R&D: Chipscale Devices MICROFOOT® Chipscale MICROFOOT power MOSFETs eliminate the package 9 Reduce size 9 Increase performance 9 Reduce cost z z MICROFOOT reduces footprint by 70% and profile by 40% for the same power performance as industrystandard TSOP-6 Lower inductance, lower resistance TSOP-6 MICRO FOOT 26 Growth Through Vertical Integration: Measurements Group World Market: $1.5 billion (Company estimate) 27 Innovation Through High Tech Start Ups • Set up program of investments in start up companies • R&D in addition to Vishay’s internal R&D 28 FINANCIALS 29 Q3 2004 Highlights • Sales for Q3 2004 were $584 million • +10% year over year • -10% quarter over quarter sales of $647 million • Diluted EPS of $0.13 in Q3 2004 compared to $0.04 in Q2 2003 • Bookings for Q3 2004 were $491 million • Book-to-Bill for Q3 2004 of 0.84 – Actives was 0.79, Passives was 0.89 • Backlog at end of Q3 2004 $474 million • Cash balance at end of quarter of $640 million 30 Strong Financial Position (In Millions) December 31, 1999 2000 2001 October 2, 2002 2003 2004 Long-Term Debt $ 656.9 $ 140.5 $ 605.0 $ 706.3 $ 836.6 $ 740.2 Stockholders’ Equity $1,013.6 $1,833.9 $2,366.5 $2,358.8 $2,514.0 $2,731.0 Total Capitalization $1,670.5 $1,974.4 $2,971.5 $3,065.1 $3,350.6 $3,471.2 Debt / Equity Ratio Cash Balance 65% 8% 26% 30% 33% 27% $ 105.2 $ 337.2 $ 367.1 $ 340.0 $ 555.5 $ 640.0 31 One of the World’s Largest Manufacturers of Discrete Semiconductors and Passive Components