What Consumers Think, Business Impact, and Recommended Actions

advertisement

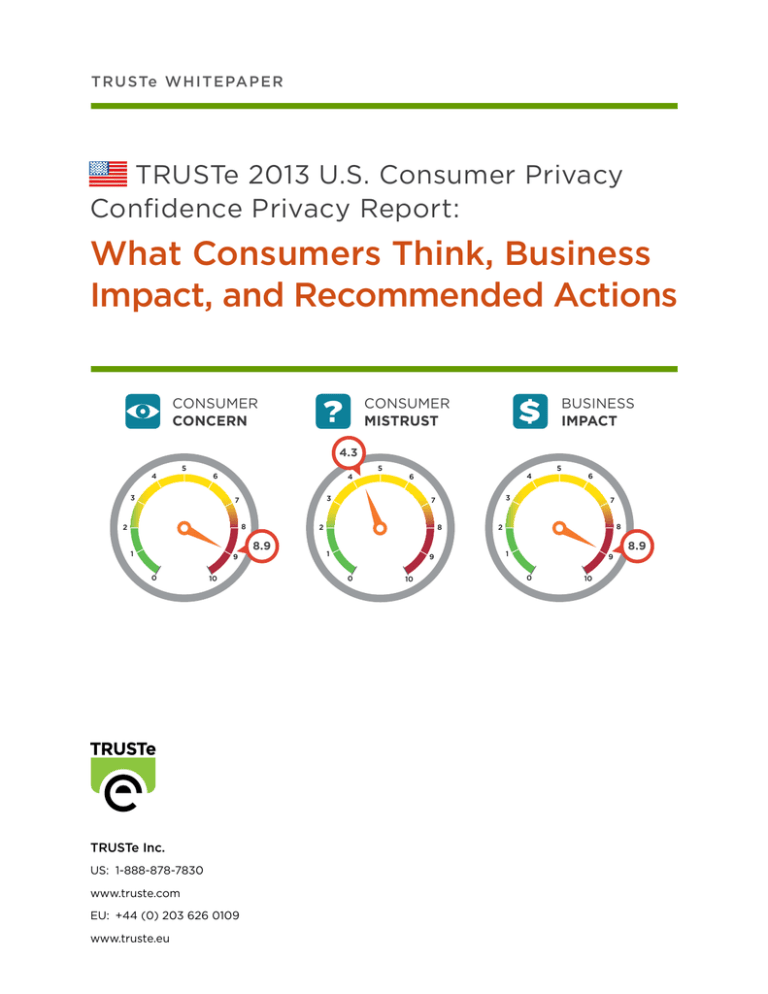

T R U STe W HITE PA P E R TRUSTe 2013 U.S. Consumer Privacy Confidence Privacy Report: What Consumers Think, Business Impact, and Recommended Actions CONSUMER CONCERN $ ? $ CONSUMER MISTRUST BUSINESS IMPACT 4.3 4 5 6 3 4 8 1 9 0 10 TRUSTe Inc. US:1-888-878-7830 www.truste.com EU: +44 (0) 203 626 0109 www.truste.eu 4 6 3 7 2 5 8.9 8 1 9 0 10 6 3 7 2 5 7 8 2 1 9 0 10 8.9 201 3 U. S. Cons umer Con fide n ce P rivacy Re por t: What Con s u m e rs Think, Busine ss I m p a ct, a nd Re co mme n d e d Ac t i o n s 2 This TRUSTe Research Report will help you to: • Understand consumer concerns, consumer trust, and business impact related to online privacy of adults in the U.S. • Provide insight on how customers are responding to privacy issues related to websites, mobile apps, e-commerce, social networks and email • Provide legal, marketing and product development professionals with tips on managing data privacy to ensure compliance and build trust 201 3 U. S. Cons umer Con fide n ce P rivacy Re por t: What Con s u m e rs Think, Busine ss I m p a ct, a nd Re co mme n d e d Ac t i o n s 3 In a data-driven economy the relationships that businesses develop with consumers become highly valuable as the exchange of relevant customer information powers commerce through online services. Businesses need to maintain strong relationships with customers to be able leverage this highly valuable information. Heightening awareness, and understanding the importance of consumer concerns, consumer trust and business impact related to online privacy is critical to business and the long-term vitality of online services. In this research report, we look at survey results from the 2013 U.S. Consumer Privacy Confidence Privacy Research and provide an analysis for three key insights: (i) Consumer Concerns, (ii) Consumer Trust and (iii) Business Impact. A series of visual and easy-to-understand meters – designed to show ongoing trends – accompany each insight. Executive Summary The TRUSTe 2013 U.S. Consumer Privacy Confidence Report provides a comprehensive analysis of current consumer thoughts about online privacy and its impact on business practices across the U.S. The extensive study surveyed 2,166 online U.S. adults and was conducted by Harris Interactive on behalf of TRUSTe in January 2013. This research is part of the ongoing TRUSTe Consumer Research Program that highlights the trust gap that exists between consumers and businesses and reinforces the urgent need for businesses to develop and maintain a comprehensive and robust data privacy management program. Recent research also touches upon pressing privacy-related consumer concerns, including behavioral advertising, mobile privacy and social networks. For more research, please go to www.truste.com/resources. This research reveals: • Mobile privacy concerns increased sharply over the last year – 72% of smartphone users are more concerned about privacy on their smartphones than they were a year ago. • Consumer mistrust and the potential impact on business is growing – 43% do not trust companies with their personal information, 89% avoid doing business with companies where they have privacy concerns, and 81% of smartphone users avoid using applications they do not believe protect their privacy. • Online shopping and using social networks top the list of U.S. online privacy concerns – 89% worry about their privacy when shopping online and 87% worry about their privacy when using social networks. • 94% of U.S. consumers want control over who can collect their personal information and who can track them online. 201 3 U. S. Cons umer Con fide n ce P rivacy Re por t: What Con s u m e rs Think, Busine ss I m p a ct, a nd Re co mme n d e d Ac t i o n s 4 Detailed findings SECTION 1: Consumer Concern Respondents were asked “How often, if at all, do you worry about your privacy online in general when using the internet?” CONSUMER CONCERN 4 5 6 3 “How often do you worry about your privacy online?” 22% 11% 7 89% WORRY 8 2 1 9 0 8.9 23% 44% 10 Never Sometimes Frequently Always U.S. consumer online privacy concerns continue to remain high but reduced slightly compared to 2012 findings. 89% of consumers worried about their privacy online when using the internet versus 90% in 2012. 22% of online adults ‘always’ worry about online privacy (down 1% from 2012); 23% worry about it ‘frequently’ (up 2% from 2012); and 44% worry about it ‘sometimes’ (down 2% from 2012) Taking a further look at online activities that concern consumers the most reveals interesting information. Online Activity % With Privacy Concerns When shopping online 89% When using social networks 87% When banking online 86% When using e-mail 82% When using mobile apps 77% Depth of privacy concern: Of the 89% who worry about their privacy when shopping online, 30% ‘always’ worry about online privacy; 25% worry about it ‘frequently;’ and 34% worry about it ‘sometimes.’ Of the 87% who worry about their privacy when using social networks, 28% ‘always’ worry; 26% worry about it ‘frequently;’ and 33% worry about it ‘sometimes. This research was conducted in early January, just after one of the busiest ever periods for e-commerce over the holiday season. Some of this retail concern may be due to the fact that consumers visit a wide range of sites for online holiday shopping - frequently for single transactions. 201 3 U. S. Cons umer Con fide n ce P rivacy Re por t: What Con s u m e rs Think, Busine ss I m p a ct, a nd Re co mme n d e d Ac t i o n s 5 The survey also found that 35% were always concerned when banking online and 30% were always concerned when shopping online. The depth of privacy concern rises when the stakes are higher, so even though overall concerns about online banking may be lower than for online shopping or using social networks, the people who are concerned about online banking are very concerned. Gender – Women were slightly more likely to worry about their online privacy with 46% of women worrying frequently or always, compared with 44% of men. Region – 27% of adults in the Northeast were always worried compared with 18% in the Midwest. Age – Privacy concerns are equally high across all age groups although younger respondents (18-34) were slightly more concerned about their privacy. Age Frequently or Always Worry 16-24 25-34 35-44 45-54 55-75 47% 42% 44% 44% 90% Education – Education appeared to make little difference; 46% of those with some college level education were frequently or always worried about their privacy as were 47% of those with high school level of education or less. The level of concern remains high despite the fact that many companies are proactively addressing how they manage data privacy – the problem is consumer awareness of how their data is being collected and used is also increasing, raising the bar for what companies need to do to stay ahead of the game. Section 2: Consumer Mistrust Respondents were asked to what extent they agreed with the statement “I trust most companies with my personal information online”. ? CONSUMER MISTRUST “I trust most companies with my personal information online.” 9% 4.3 4 5 15% 6 3 7 47% 8 2 1 43% DISAGREE 28% 9 0 10 Strongly Disagree Somewhat Disagree Somewhat Agree Strongly Agree Consumer mistrust increased to 43%, up by 2% compared to 41% in 2012. Of the 43% of online adults who do not trust most companies with their personal information online, 15% of respondents strongly disagreed (up 3% from 2012), 28% tended to disagree (down 1 % from 2012), 47% tended to agree (down 3% from 2012) and 9% strongly agreed (no change from 2012). 201 3 U. S. Cons umer Con fide n ce P rivacy Re por t: What Con s u m e rs Think, Busine ss I m p a ct, a nd Re co mme n d e d Ac t i o n s 6 Men mis-trust companies with their personal information more than women; 47% of men and 39% of women report they do not trust companies with their personal information online. One of the more interesting views is based on geographic region – the chart below shows the level of mistrust is highest in the West and lowest in the Midwest. Level of mistrust with personal information by region* *Strongly/Somewhat Disagreed 42% 44% Northeast South 36% Midwest 52% West Who is responsible for protecting privacy online? 94% of consumers believe that companies have a responsibility to protect their privacy online, compared with the same figure of 94% in 2012. However research conducted by Harris Interactive on behalf of TRUSTe in July 2012 showed consumers thought that they themselves were best placed to protect their privacy and personal information online. So although consumers believe that companies have a responsibility to protect them, they are not prepared to trust them to do this. Additionally, 94% of online adults reported that they want the ability to control who can collect their personal information and who can track their activities online. SECTION 3: Business Impact Respondents were asked to what extent they agreed with the statement “I avoid doing business with companies who I do not believe protect my privacy online”. $ BUSINESS IMPACT 4 5 “I avoid doing business with companies who I do not believe protect my privacy online.” 4% 7% 6 3 7 55% 8 2 1 9 0 34% 89% AGREEE 8.9 10 Strongly Disagree Somewhat Disagree Somewhat Agree Strongly Agree 201 3 U. S. Cons umer Con fide n ce P rivacy Re por t: What Con s u m e rs Think, Busine ss I m p a ct, a nd Re co mme n d e d Ac t i o n s 7 Consumer mistrust and the potential impact on business is growing – 89% of online adults avoid doing business with companies who they believe do not protect their privacy - this is an increase of 1% compared to 88% in 2012. 55% of consumers strongly agreed (up 2% from 2012), 34% tended to agree (down 1% from 2012); 7% tended to disagree (down 1% from 2012) and 4% strongly disagreed (no change from 2012). Who worries the most? Gender – There is a slight difference between men and women when it comes to the potential business impact. 87% of men and 91% of women would avoid doing business with companies that they did not believe protected their privacy online. Education – The tendency for adults to avoid companies with bad privacy practices is higher among online adults with higher levels of education. 84% of adults with a high school education compared to 92% with some college education and 92% with a college degree or higher level of education reported that they would avoid doing business with companies who they do not believe protect their privacy online. SECTION 4: Spotlight on Mobile Privacy Concerns Following the significant shift towards accessing the internet through mobile and tablet devices additional questions on mobile privacy were included in the 2013 survey. Amongst smartphone users, 77% had privacy concerns Activities where consumers have privacy concerns* worried, 22% frequently worried, 34% worried sometimes and 23% worried never. 89% SHOPPING ONLINE 87% USING SOCIAL NETWORKS 86% when using mobile apps. Of these 21% were always Who worries the most? Gender – 79% of women had privacy concerns when using mobile apps compared with 75% of men. Age – A higher proportion of those aged 45-54 worried BANKING ONLINE about privacy on mobile apps than in the other age groups. 82% 77% USING E-MAIL USING MOBILE APPS *Always, frequently, sometimes worry Age Privacy Concerns 16-24 25-34 35-44 45-54 55-75 77% 80% 83% 67% 80% 201 3 U. S. Cons umer Con fide n ce P rivacy Re por t: What Con s u m e rs Think, Busine ss I m p a ct, a nd Re co mme n d e d Ac t i o n s 8 Respondents were asked to what extent they agreed with 72% of smartphone users are more concerned about their privacy on smartphones than one year ago the statement “I am more concerned about my privacy on my smartphone than I was one year ago.” 72% of smartphone users are more concerned about privacy on their smartphone than one year ago. Of the 72%, – the higher the level of education, the higher the concerns; 69% of adults with a high school education compared to 72% with some college education, and 74% with a college degree or higher level of education. 72% “I am more concerned about privacy on my smartphone than I was a year ago.” High School or Less Strongly/ somewhat agree 69% Some College College Grad 72% 74% Respondents were asked if they avoided using smartphone 81% of smartphone users avoid using smartphone apps that they don’t believe protect their privacy online apps they did not trust. 81% of smartphone users avoid using applications they do not believe protect their privacy. Of the 81%, a trend exists among smartphone users who avoid using applications – the higher the level of education, the higher percentage of online adults avoid using mobile apps; 76% of adults with a high school education compared to 81% with some college education and 85% with a college degree or higher level of education. “I avoid using smartphone apps that I do not believe protect my privacy.” High School or Less Strongly/ somewhat agree 76% Some College College Grad 81% 85% Why Businesses Should Address Consumer Privacy Concerns Consumers are highly concerned about their privacy, whether it is shopping online, using social networks, or using mobile apps - they want to know how their data is being collected, used and stored. It is evident from the aforementioned research that privacy concerns impact consumer trust and consumers avoid doing business with companies who do not have a good data privacy management program in place. 201 3 U. S. Cons umer Con fide n ce P rivacy Re por t: What Con s u m e rs Think, Busine ss I m p a ct, a nd Re co mme n d e d Ac t i o n s 9 Companies need to take critical steps to ensure valuable customer relationships are protected and address and alleviate their privacy concerns. By implementing good privacy data management practices, businesses can build a trusted exchange with customers. Information is currency in a world where data is used to power new products like mobile apps and cloud services as well as enable innovative marketing programs like behavioral advertising. Therefore, businesses need to secure long-term customer relationships to ensure that they can continuously build and develop different sources of information exchange with these same customers. For businesses to stay relevant, they need to adapt to the ongoing changes within the privacy industry. They need to build a comprehensive data privacy management strategy and implement solutions that addresses address both compliance requirements and customer concerns. Good data privacy management starts with incorporating a privacy-centric approach to managing data beyond merely posting a privacy policy on your company website. Privacy needs to be designed into your approach with customers to ensure that your business properly manages data privacy and addresses consumer concerns. If your business is global, then you need to address both your non-US online properties, as well as how international regulations could impact your US online properties. Good data privacy management helps ensure that your business is compliant and builds trust with your customers so they feel confident sharing their personal information with you. Three Steps to Building a Comprehensive Data Privacy Management Strategy As with any important business initiative, the key to success is developing a framework to assess the issues and designing a plan of attack. The chart below outlines a proven three-step process for putting a comprehensive data privacy management strategy in place. 3. Control 1. CERTIFY • Preference & opt-out management • Data collection, usage, & sharing practices • Tracker database • Industry & legal compliance requirements • Compliance reporting • Tracker detection • Ongoing monitoring & analysis • Disclosure review & testing 2. Monitor • Disclosure & tracking changes • Privacy seals • Real time authentication • Certification letters 201 3 U. S. Cons umer Con fide n ce P rivacy Re por t: What Con s u m e rs Think, Busine ss I m p a ct, a nd Re co mme n d e d Ac t i o n s 10 Step 1 Perform a thorough audit and assessment of your current privacy practices and certify them vs. applicable regulations and best practices. This includes asking questions like: • What data do you collect? How long do you keep it? Who do you share it with? • What channels do you use to collect data? (web, mobile web, mobile apps, etc.) • Do you market to children? • Are you marketing outside the U.S.? • Are there industry or legal data privacy compliance requirements that impact your business? • Who owns privacy decisions at your organization? • When did you last update your privacy policy? • Has your policy been reviewed by in-house or outside legal resources? In order to ensure you are compliant with all relevant legal requirements and best practices, as well as able to demonstrate your strong privacy commitment to customers, partners, and key industry constituents, you should consider pursuing a third party privacy certification. Privacy certification help reassure consumers, businesses, and government agencies that you can be trusted. Also, working with independent experts enables you to focus more resources on your business. Step 2 Monitor your privacy program continuously to ensure it remains current with both evolving regulations as well as changes in your data management programs. You can do this by establishing a cross-functional / crosscompany committee as well as implementing tools like the TRUSTe Tracker Audit Service to ensure you can monitor both the presence and type of trackers on your site as well as the reputation of the companies who you enable to access your site and customer data. These tools can also provide important insights into the performance impact of the trackers on your site as well as help manage and prevent accidental data leakage. Step 3 Put controls in place to manage key privacy processes on an ongoing basis. This includes managing customer preferences for opt-outs tied to both web and mobile app behavioral advertising (DAA and eDAA online behavioral advertising program) as well as for managing cookie consent preferences tied to the EU Cookie Directive. A comprehensive data privacy management u Tr st • E ng agement • Co mp lia nc e program enables you to address privacy using multiple channels (web, cloud, mobile, behavioral CLOUD MOBILE ads, etc.) across all geographies, on an ongoing basis – to build trust, drive engagement, and ensure compliance. WEB DATA ADS Data Privacy Management Strategy CERTIFY MONITOR CONTROL Data Privacy Management Platform 201 3 U. S. Cons umer Con fide n ce P rivacy Re por t: What Con s u m e rs Think, Busine ss I m p a ct, a nd Re co mme n d e d Ac t i o n s 11 About TRUSTe TRUSTe is the leading data privacy management solutions provider and offers a suite of software and services enabling companies to safely collect and use customer data to power their digital businesses around the world – enabling them to unlock the full value of their data while building trust, driving engagement, and ensuring compliance. TRUSTe solutions, which include privacy by design consulting, privacy certifications, website monitoring tools, and preference management controls ensure companies can safely use data across all their digital business channels, including websites, mobile apps, cloud services, social networks, email, and advertising. All TRUSTe solutions are engineered to enable businesses to continuously develop new and innovative products and marketing programs while building trust and driving engagement by adhering to best practices for providing customers with transparency, choice and accountability regarding the collection and use of personal information. The TRUSTe Certified Privacy Seal is recognised and trusted by millions of consumers as a sign of responsible privacy practices. More than 5,000 companies like Apple, AT&T, Disney, eBay, HP and Microsoft rely on TRUSTe to ensure compliance with evolving and complex privacy requirements. For more information, call us at 888-878-7830 or visit one of the following resources. • Additional research and white papers www.truste.com/resources • Upcoming educational webinars www.truste.com/events • Key privacy industry news and alerts www.truste.com/blog • Privacy Certifications, Monitoring Services, and Control Platforms www.truste.com/products-and-services If you have questions about this research, please email Dave Deasy at ddeasy@truste.com. CONTACT US US: 1-888-878-7830 www.truste.com | EU: +44 (0) 203 626 0109 www.truste.eu