An Investigation of the Average Bid Mechanism for

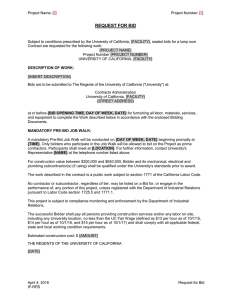

advertisement