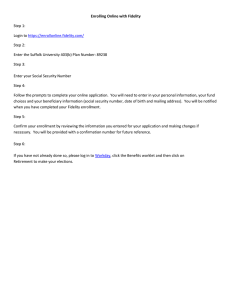

Fidelity Investments 403(b)

advertisement