Food and Beverage

advertisement

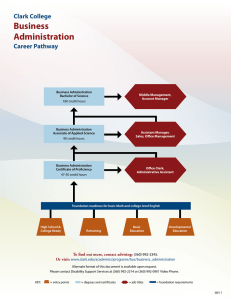

FOOD AND BEVERAGE MANUFACTURING INDUSTRY REPORT A Quantitative Research on Labour Market Demands in the Food and Beverage Manufacturing Industry July, 2015 Research, Planning and Development Department 1 Acknowledgements The Research, Planning and Development Department of the National Training Agency (NTA) would like to express sincere gratitude to all participating organisations for their contribution to this quantitative research. Through their cooperation and candor, a better understanding of the labour market in the food and beverage manufacturing industry was established. Ultimately, this provided a basis through which targeted and strategic policy improvements could be formulated to help bridge the employment gap between the supply of and demand for labour. 2 Contents Acknowledgements ...................................................................................................................................... 2 Executive Summary ...................................................................................................................................... 6 Introduction .................................................................................................................................................. 8 International Perspective......................................................................................................................... 8 Regional Perspective ................................................................................................................................ 9 Local Perspective .................................................................................................................................... 10 Current Status of the Food Processing and Manufacturing Industry ............................................... 11 Economic Review........................................................................................................................................ 12 Contribution to Gross Domestic Product .............................................................................................. 12 Labour Force and Employment .............................................................................................................. 14 Demand for Skilled Persons and Training ............................................................................................. 14 Purpose of Study ........................................................................................................................................ 16 Objectives ............................................................................................................................................... 16 Methodology .............................................................................................................................................. 17 Scope....................................................................................................................................................... 17 Survey Population .................................................................................................................................. 17 Data Collection ....................................................................................................................................... 17 Data Entry ............................................................................................................................................... 18 Limitations of the study ......................................................................................................................... 18 Findings ....................................................................................................................................................... 19 Organisational Profile ............................................................................................................................ 19 Primary Service Offered ..................................................................................................................... 19 Type of Business Offered ................................................................................................................... 20 Number of Years in Operation ........................................................................................................... 20 Number of Employees ........................................................................................................................ 20 Employment Profile................................................................................................................................ 21 Present Employment .......................................................................................................................... 21 Work Permits ...................................................................................................................................... 21 Vacancies ............................................................................................................................................ 21 New and Emerging Skills Sets/Competencies ....................................................................................... 23 Anticipate Demand for Labour .............................................................................................................. 24 Training and Development .................................................................................................................... 24 3 Develop the Industry .............................................................................................................................. 25 Analysis ....................................................................................................................................................... 28 Conclusion and Recommendations ........................................................................................................... 31 Appendices ................................................................................................................................................. 32 Appendix 1: Primary Service Offered ................................................................................................... 32 Appendix 2: Present Employment ......................................................................................................... 34 Appendix 3: Vacancies ........................................................................................................................... 42 Bibliography................................................................................................................................................ 44 4 Tables Table 1: Structure of the Food Processing and Manufacturing Industry…………………………………………………11 Table 2: Exports in TT$ for the Food Processing and Manufacturing Industry for the years 2009 - 2014 by Subsector………………………………………………………………………………………………………………………………………………13 Table 3: Number of Business Establishments for the Food Processors and Drink Industry by Employment Size and Year………………………………………………………………………………………………………………………………………….14 Table 4: Vacancies that are Most Difficult to Source………………………………………………………………………………22 Table 5: List of New & Emerging Skills Set/Competencies within the next 12 months…………………………..23 Figures Figure 1: Key Mega Global Trends within the Food Processing and Manufacturing Industry from 2010 – 2020 ……………………………………………………………………………………………………………………………………………………..8 Figure 2: Percentage of Companies within each Subsector……………………………………………………………………19 Figure 3: Years in Operation………………………………………………………………………………………………………………….20 Figure 4: Number of Employees…………………………………………………………………………………………………………….21 Figure 5: Anticipate Demand for Labour………………………………………………………………………………………………..24 Figure 6: Current Training Providers Meeting your Needs……………………………………………………………………..25 Figure 7: Apprenticeship, Internship and Mentorship Programme…………………………………………………………25 Figure 8: Ways to Develop the Industry…………………………………………………………………………………………………25 5 Executive Summary The National Training Agency (NTA) is the coordinating body for all technical, vocational education and training (TVET) in Trinidad and Tobago. One of its mandate is to continually assess and provide relevant information on TVET and workforce development, which includes the demand for and supply of human resources. In keeping with this mandate the NTA conducts labour market studies in the form of sector surveys to evaluate the labour needs of the country. This report examined the Food and Bevearge Manufacturing industry in Trinidad. This industry is the largest in the non-energy manufacturing sector and is the most appropriate one to be used to diversify the economy. This research was designed as a census of all employers sourced from Central Statistical Office (CSO) listing and Food and Beverage Industry Development Committee (FBIDC) listing. Fifteen subsectors were represented in the Food and Beverage Manufacturing Industry. The study employed both a quantitative and qualitative approach to data collection. A major constraint to data collection was the unwillingness of some employers to participate in the exercise due to staff shortage and busy work schedules. This resulted in a participation rate of 44%. The employers surveyed comprised of a large number of small processors and a small number of large processors. Respondents complained about labour shortage and the poor attitude of the current workforce. The present labour pool were staying away from this industry as it did not seem lucrative like other sectors or industries as noted by several stakeholders. Shortages in the technical skilled areas exist as a result of sectors such as the construction and energy providing better remuneration and benefits unlike Food Processing and Manufacturing Industry. Make work programme such as the Community-Based Environmental Protection and Enhancement Programme (CEPEP) and Unemployment Relief Programme (URP) were also attracting the persons as a result of shorter hours for the same wage as Food Processing and Manufacturing Industry. 6 One industry captain commented that technology has shifted leading to increased automation in the manufacturing process. This shift has brought about a change in the skills set demanded for the manufacturing process from manual labour to skilled machine operators with mandatory computer literacy certification. The top four job vacancies were also the most difficult jobs to source labour and included Factory Worker; Processing Staff; Warehouse Attendant and Delivery Clerk; and Machine Operator. Fifteen percent of employers stated that that there will be new and emerging skills sets/competencies in the industry within the next 12 months. The primary response was for skills required for new product development. A quarter of the employers (31%) anticipated a reduction in the demand for jobs, stating the most common reasons being ‘persons are not interested in working eight hours a day when government make work programmes such as CEPEP and URP exist for shorter hours.’ Three fifths (60%) of the participants stated that their needs were not being met by current training providers, as there is a lack of industry specific courses and whatever training is done is executed in house by the employers. Only 23% of the employers have an apprenticeship, internship or a mentorship programme. Employers stated a number of ways that the industry can develop. Namely, training programmes in skilled areas and lifeskills and the provision of labour. 7 Introduction International Perspective In 2008, the number of workers employed worldwide in the food and beverage (manufacturing) industry amounted to 22 million. Forty percent of the workers comprised of women, who were predominantly clustered in sub sectors such as fish, vegetable and fruit processing. This industry is significantly increasing in emerging and developing economies. For instance, between 2000 and 2008, it grew in Brazil and China by 68 and 178 percent respectively. China’s growth is attributed to the emergence of its middle class and it is seen as a potential export market by large foreign firms. (Rural Development through Decent Work, International Labour Office, ILO 2011, Erick J. Zeballos) Figure 1: Key Mega Global Trends within the Food Processing and Manufacturing Industry from 2010 - 2020 Despite this growth the global industry is faced with a number of challenges such as climate change, changes in supply and demand, food price volatility, food security, changes in food safety 8 regulations and laws. Further, trends also impact this industry, in the ‘2020 Vision Global Food Processing and Manufacturing Industry Outlook’ presentation, key mega trends that have or are likely to affect the industry within the period of 2010 – 2020 were identified (See figure 1). All these challenges and trends have an effect on the dynamics of companies in particular, labour. Therefore, it is essential for workers to be trained and continuously upgrading their skills to meet technological advancement and innovations to ensure greater productivity and prevent unemployment. As mentioned above in the trends, food safety will become an integral function within the industry. Therefore, policies are needed to ensure adherence to prevent negative implications on employment and business operations and survival. It is imperative that workers involved in the food handling process be trained in proper food handling and safe production practices. One such policy that promotes decent working conditions and safe production practices is the ILO Decent Work Agenda policy. Regional Perspective The Caribbean Development Bank (CDB) declared that the region experienced an average economic growth of 1.5% in 2013, and is likely to record an average economic growth by 2.3% in 2014. This growth is on account of the increased production levels in the milled rice subsector in Guyana, the beverage subsector in Dominica and the food production subsector in Barbados. (CDB Annual Report 2013 – Volume One) The Food Processing and Manufacturing Industry contributes significantly to the region’s Gross Domestic Product (GDP). The CDB is also boosting the region’s specialty food industry by supplying US$469,000 to the industry via a supplemental grant to the Caribbean Export Development Agency (Caribbean Export) under the Caribbean Aid for Trade and Regional Integration (CARTFund) Programme, which is funded by Britain’s Department for International Development (DfID). This will bring about growth to an industry that produces high-end processed foods and beverages. (www.stlucianewsonline.com, May 19 2015) 9 The Food Processing and Manufacturing Industry within the region is made up of a small number of large enterprises (for instance especially in subsectors such as bakery and snacks, beverages, oils and fats, sugar, rice and poultry) and a large quantity of micro, small and medium enterprises (for instance preservatives, jams, jellies, condiments, juices, spices, herbs, hot beverages), many of which are family owned, often based at the entrepreneur’s household. A significant number of women manage and work in small and medium enterprises and their related networks. Approximately, 1 – 3 large food processing and manufacturing firms dominate each subsector within the industry and have alliances or ownership intraregional. (SMAE Competitiveness in the Caribbean, 6-8 March 2012) In terms of regional development, US based firm Global Business Innovation Corporation (GBIC) recently launched the ‘Caribbean Food Business Innovation Revolution’ with the objective to revolutionise the Caribbean Food Processing and Manufacturing Industry by moving its products beyond regional exports into US stores such as Walmart and Costco. Several countries within the region have been contacted for involvement. This entails improvement in product quality to meet international standards, significant increases in production levels which will lead to job creation. Local Perspective The Government identified six Strategic Business Clusters1 as part of its diversification drive, one cluster being Food Sustainability. The Food Sustainability cluster consists of four sub-sectors namely, Food and Beverage (Food Processing and Manufacturing), Agriculture Production, Fishing and Farming, and Packaging. From here on, the Food and Beverage (Food Processing and Manufacturing) will be referred as Food Processing and Manufacturing Industry. Building Competitive Advantage – Six Strategic Business Clusters and Enablers page 5, Ministry of Planning and Sustainable Development July 2012 1 10 The Food Processing and Manufacturing Industry not only plays a pivotal role in this diversification thrust but also has the potential to reduce the food import bill2. As suggested by Professor John Spence, with respect to reducing food imports, he commented that "The next step is to assess which of these items (and in what quantities) we can produce locally; or which...we can substitute with an equivalent item that we can produce locally. For example, we cannot grow wheat but we can substitute a certain proportion of cassava flour for wheat flour in our bread without significantly affecting the taste of the bread..." This industry has significant growth and export potential. In order to promote development within this industry the Government of Trinidad and Tobago has introduced several incentives to boost production and exports in addition to luring higher levels of foreign direct investments. Current Status of the Food Processing and Manufacturing Industry The Food Processing and Manufacturing Industry consist of both small and large players. The main features of small players are sole trader type enterprises operating mostly out of homes, with low levels of technology, small number of employees catering to the domestic markets and in some cases now looking to venture into the international scene. The converse holds true for the large players. This is represented in the table below. Table 1: Structure of the Food Processing and Manufacturing Industry Small Processors and Manufacturers Large Processors and Manufacturers Large number Small number Low levels of Technology High levels of technology Greater use of Local Raw materials Large use of imported raw materials Small number of employees within a firm Large number of employees within a firm Owner operated (sole trader type operations) Fewer owner operated and mostly limited liability companies Domestic market focus Both domestic and export market Source: “The Status of the Food Processing and Manufacturing Industry in Trinidad and Tobago and Opportunities for Cluster Development” Presentation, TTMA November, 2011 2 $400m import bill? Can T&T reduce, Trinidad Express, November 8, 2011 11 In addition, some major developments or practices that are happening within the industry include: Consciousness with respect to food safety More small scale processors are entering the export market Improvements in the labelling and packaging of products such as pouch packs. Two known organisations, Caribbean Industrial Research Institute (CARIRI) and exporTT, the National Export Facilitation Organisation of Trinidad and Tobago assist first timers and existing employers with these development or practices. CARIRI’s role in the industry is that of research, product development, quality management, testing of products, packaging and labelling and training. Training offered by CARIRI is both planned as well as customised to suit the needs of manufacturers. Many manufacturers approach CARIRI to provide customised training for their staff. exporTT promotes and builds the export capacity of companies and is seen as the trade policy implementation agency of the Ministry of Trade, Industry, Investment and Communication. The various services offered by exporTT include exporter training programmes, assistance in implementing food safety management systems, international standards certification programmes, co-financing of export related costs, market research. One such programme, Cottage Food and Beverage Export Development Programme (CFBED) has produced graduates from local companies that showcase the local products and taste of our country at international food shows. Economic Review Contribution to Gross Domestic Product Given that the Food, Beverages and Tobacco is the largest sub-sector in the Non-Energy Manufacturing sector, this industry was estimated to have contributed 4.5% of Trinidad and Tobago’s GDP in 2014, as outlined in the Review of the Economy 2014. In 2009, this industry contributed $3,828.0 million to the country’s GDP and has always been increasing with a recorded 12 $5,789.8 million contribution in 2013. However, the industry faced a declined in growth from 22.4% in 2007 to 3.4% in 2011. As illustrated in the table 2 below, exports have increased. An increase in this industry’s exports was recorded during the first half of the year 2011 from TT$104 million, up from $70.3 million for the same period. Table 2: Exports in TT$ for the Food Processing and Manufacturing Industry for the years 2009 - 2014 by Subsector FOOD AND BEVERAGE Edible Preparation Of Meat, Fish And/Or Crustacean, Molluscs Or Other Aquatic Invertebrates Sugars & Sugar Confectionery Cocoa And Cocoa Preparations Preparations Of Cereals, Flour, Starch Or Milk; Pastrycooks' Products Preparations Of Vegetables, Fruit, Nuts Or Other Parts Of Plants Miscellaneous Edible Preparations Beverages, Spirits And Vinegar Residues And Waste From The Food Industries; Prepared Animal Fodder TOTAL FOOD AND BEVERAGE EXPORTS YEAR 2009 2010 2011 2012 2013 2014 TT$27442,970 TT$24810,456 TT$33920,270 TT$37174,784 TT$35606,004 TT$35689,393 TT$35830,100 TT$29082,935 TT$39629,310 TT$51355,696 TT$62141,858 TT$59239,250 TT$55586,566 TT$65707,937 TT$72920,225 TT$74924,799 TT$76828,060 TT$73691,867 TT$292621,012 TT$289776,053 TT$418940,427 TT$419685,161 TT$438064,806 TT$431901,793 TT$184363,487 TT$183475,782 TT$231594,647 TT$233469,393 TT$227597,462 TT$175954,507 TT$106957,541 TT$84810,994 TT$130655,558 TT$143416,534 TT$149389,457 TT$155805,830 TT$701926,522 TT$610140,374 TT$938207,951 TT$917585,463 TT$845995,202 TT$919135,141 TT$22801,126 TT$23267,428 TT$5322,402 TT$7717,782 TT$1980,471 TT$17714,033 TT$1427529,324 TT$1311071,959 TT$1871190,789 TT$1885329,613 TT$1837603,319 TT$1869131,813 13 Labour Force and Employment The Food Processing and Manufacturing Industry is the largest industry in the non-energy manufacturing industry with 430 companies and 11,000 direct employees operating3. Many manufacturers have noted that the biggest challenge facing the local industry is the supply and availability of workers. The table below suggest a decline in the number of business establishment and employees within the industry. Table 3: Number of Business Establishments for the Food Processors and Drink Industry by Employment Size and Year Food Processors and Drink (TTSNA) Employment Size by Group 2005 2006 2007 2008 2009 2010 2011 0-1 2-4 5-9 10-24 25-49 50-99 100-249 250-500 501-999 1000 and Over Branch Not Stated Total 28 42 54 50 26 15 16 12 7 0 1 166 426 26 43 50 53 27 12 13 12 6 0 11 129 382 25 43 41 54 28 13 14 12 6 0 10 100 346 25 48 34 58 20 13 14 13 7 0 9 95 336 23 46 32 52 21 14 13 13 4 3 8 91 320 23 46 32 50 24 14 12 13 6 1 9 87 317 24 41 33 48 25 13 16 12 5 1 9 82 309 Year Source: Central Statistical Office Demand for Skilled Persons and Training In terms of technology, automation has increased in the industry. Several of the manufacturing processes such as filling bottles, washing vegetables and fruits, labelling and sealing have become 3 Trinidad Express, ‘Time to Diversify in Food and Beverage says Minister’ July 17, 2013 14 automated. Therefore the skills sets demanded for these processes have moved from manual labour to that of skilled machine operators. Over the next few years there will be a reduction in the demand for manual labour for these processes particularly by large scale processors. As mentioned above, the biggest challenge facing the local industry is the supply and availability of workers. Despite an increase in the overall graduate output of training institutions and ranking at the top in the category of vocational/skills training in 2014 Global Talent Competitiveness Index Report4, there remains a shortage of skilled, semi-skilled, technical and professional labour in the industry as a result of lack of Food Processing and Manufacturing Industry specific courses. The industry specific courses that do exist are few in number with limited graduates and mostly at semi – skilled level. Additionally, these courses cater to the small scale, sole trader type operations using low levels of automation. Further, there is no training school solely dedicated to the Food Processing and Manufacturing Industry. On May 26th, 2015 the Trinidad and Tobago Manufacturers’ Association (TTMA) along with 10 participating manufacturers signed a Memorandum of Understanding (MOU) with the Ministry of Tertiary Education and Skills Training (MTEST) to address the labour shortage within the industry. This authorised the development of a two-tiered apprentice system, establishment of the OJT Manufacturing within the OJT programme and an Export Manufacturing Apprenticeship Programme (EMAP). This apprenticeship type system takes into account the dual system of education and work-based training utilising the Workforce Assessment Centres and Worker Productivity Schools for the next seven years. 4 ‘MTEST & TTMA Partner on Manufacturing Apprenticeship System’ www.news.gov.tt May 2015 15 Purpose of Study The National Training Agency selected the Food Processing and Manufacturing Industry to be evaluated during the period March – June 2015. This selection was guided by the Government’s plans to reduce its dependency on the energy sector and diversify the economy given that this industry is the largest non-energy manufacturing sector. As a result, the industry will be enhanced and will significantly contribute to the economy to ensure the country’s long term, sustainable growth and development. The main focus of the project was to ascertain the nature and scope of the demand side factors affecting the labour market conditions of the Food Processing and Manufacturing subsector in Trinidad and Tobago. Objectives The broad objective of this survey is to assess the current state of the labour market of the Food Processing and Manufacturing Industry, so as to provide information useful to the development of the country’s human resource capacity. The specific objectives of this survey for the Food Processing and Manufacturing Industry are as follows: to provide the National Training Agency with the required quantitative data and research on the demand side of this subsector; to lay the groundwork, through data collection, for the establishment of an updated training needs analysis; to ensure a comprehensive understanding of the labour market conditions and labour market signalling of this subsector; 16 Methodology Scope The approach taken for this study included both quantitative and qualitative research methods. One qualitative interview was conducted with an industry captain whom provided valuable insight into the industry. Contact was made with other stakeholders however time constraints and busy work schedules did not permit additional meetings. This study examined the subsectors of the Food Processing and Manufacturing Industry as identified by the National Accounts Classification from the Central Statistical Office (CSO). Fifteen out of eighteen subsectors were explored. The subsectors that were excluded were citrus processors, tobacco and ice. Only one organisation belonged to the subsector citrus processors and that company was taken over and merged into the operations of a beverage company and the citrus processor company is now defunct. The other two subsectors do not contribute significantly to the economic productivity. The tobacco subsector is declining not only locally but also internationally which attributes to a growing global health awareness and policies to stimulate a reduction in consumption. Survey Population The list of employers were taken from the CSO’s ‘Business Establishments Operating in Trinidad and Tobago by Industry 2011’ listing and also from the Ministry of Trade, Industry, Investment and Communication, Food Processing and Manufacturing Industry Development Committee ‘Stakeholder’s Listing’. Both listings contained companies operating in Trinidad, were not current and contained some duplication. After cleaning, an updated population was arrived at, amounting to 108 companies. Data Collection A census was undertaken and all 108 companies were contacted via emails which included attachments of a letter requesting participation and a survey instrument (quantitative 17 questionnaire). However, at initial contact, seventeen (17) employers (16%) declared that they were not interested in participating as they were too busy or faced staff shortage and did not see any benefit in completing the questionnaire. The questionnaires were administered via email, fax or telephone interview. Follow-up calls were made to remind employers to submit the questionnaires. Respondents either emailed or faxed the completed questionnaire. A response rate of 44% (47 questionnaires) was obtained. Data Entry The Microsoft Access software was used to enter completed questionnaires. This exercise was done simultaneously with data collection. Limitations of the study This study faced a number of challenges and every effort was made to minimise these challenges to ensure its validity. One challenge was the unwillingness of employers to participate in the survey with the primary reason being heavy or tight work schedules preventing the employer to spare time to complete the form. Another was lack of updated company listings caused longer time to be spent in cleaning up the list. In addition, a lack of legislation for the NTA prevented the company from being taken seriously by employers as they saw no benefit to be gained from this exercise. 18 Findings Organisational Profile Primary Service Offered The total population surveyed were categorised into 15 subsectors / primary service offered. The number of companies per subsector varied. A list of primary service offered can be found in Appendix 1. Respondents stated the primary service offered by their company and the subsector with the most responses were ‘All Other Miscellaneous Processors’ with a total of 23%, Figure 2 below shows this. The primary service offered by these miscellaneous processors within this subsector were as diverse from manufacturing of spices and sauces to flavouring extract used as raw materials for further manufacturing of food products. Figure 2: Percentage of Companies within each subsector Percentage of Companies within each Subsector 23 Percentage 25 20 15 9 10 5 11 2 4 4 13 11 9 2 2 2 2 2 4 0 19 Type of Business Offered The majority of organisations surveyed were ‘Private’ amounting to 98% while only 2% of the organisations were ‘Public’. The sole ‘Public’ business type represented a public limited liability organisation, with a 51% Government ownership. Number of Years in Operation The number of years participating organisations have been in operation varied from one to one hundred years. Thirty percent (30%) of organisations indicated that they had been in operation between 11 to 20 years. Twelve percent (12%) of organisations had been in operation for over fifty years. Figure 3: Years in Operation Percentage of Companies by Years in Operation Number of Years > 50 12 41 - 50 15 31 - 40 6 21 - 30 26 11 - 20 30 1 - 10 11 0 5 10 15 20 Percentage 25 30 35 Number of Employees Respondents stated the number of employees within the organisation and these figures were further categorised into small, medium and large organisations. Three fifths of the respondents (61%) employed between one and fifty employees. Medium firms represented 18% of the respondents employing between fifty-one and one hundred employees while twenty-one percent (21%) employed over one hundred employees and belonged to the large category. 20 Figure 4: Number of Employees Percentage of Employees 80 60 40 20 0 1 - 50 51 - 100 > 100 Number of Employees Employment Profile Present Employment Employers were asked to list the job titles of employees and the number working full time and part time. However, several employers grouped employees by departments or occupational area rather than job titles. The most frequent full time jobs were Factory Worker, Production Staff, Processing Staff, and Packer, with a total of 760, 309, 274 and 160 respectively. This table is shown in Appendix 2. Work Permits The majority of respondents (96%) did not apply for work permits while, the minority (4%), applied for work permits in the skill area of Machine Operator and Technician. Vacancies Employers indicated the vacancies that exist within the organisation as well as specified which ones they have difficulty in sourcing. Additionally, these vacant positions were distinguished by full time or part time. Table 4 demonstrates the vacancies that employers had difficulty sourcing. 21 The top three jobs titles that are most difficult to source comprised of Factory Worker; Warehouse Attendant and Delivery Clerk; and Machine Operator. For a full list of vacancies see Appendix 3. Table 4: Vacancies that are Most Difficult to Source Vacancies that are Most Difficult to Source Job Title Full Time Administrative Assistant 2 Application Support Specialist 1 Assistant Accountant 1 Assistant General Manager - Operations 1 Bread Chef 1 Cake Chef 2 Cleaner 3 Communications Officer 0 Cook 2 Delivery Man 1 Dessert Chef 1 Dispatch Manager 1 Dispatcher 1 Driver 8 Electrical Technician 1 Electrician 1 Factory Worker 105 Field Refrigeration Technician 1 Food Safety and Quality Assurance Officer 1 Forklift Operator 2 Front Counter Clerk 1 Graphic Artist 0 Heavy 'T' Driver 2 Heavy 'T' Driver Salesman 1 Human Resource Assistant 1 Human Resource Officer (Junior & Senior) 2 Inventory Manager / Stockroom Staff 1 Kitchen Assistant 2 Kitchen Staff 2 Lorry man 2 Machine Operator 17 Maintenance Manager 1 Maintenance Staff 6 Marketing Officer (Junior & Senior) 0 Part Time 0 0 0 0 0 0 0 1 0 0 0 0 0 0 0 0 2 0 0 0 0 1 0 0 0 0 0 4 0 0 0 0 0 2 22 Vacancies that are Most Difficult to Source Job Title Full Time Mechanical Technician 1 Merchandiser 2 Office Staff 2 Operations Assistant 1 Oven Operator 1 Pastry Chef 1 Pastry Chef Assistant 1 Process Technician 2 Production Manager 1 Professional Chef 1 Quality Assurance Staff 5 Refrigeration Technician 2 Sales Assistant/Loader 4 Sales Representative 4 Sales Staff 6 Stores Clerk 3 Supervisor 2 Warehouse Attendant , Delivery Clerk 20 Part Time 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 New and Emerging Skills Sets/Competencies Only 15% of participants believed that there will be new and emerging skills/competencies in the industry within the next 12 months. Table 10 indicates a list of the new and emerging skills/competencies as stated by the employers. Table 5: List of New & Emerging Skills Set/Competencies within the next 12 months Knowledge about healthier or organic food options (for e.g. soya free vegie products) Skills required for the development of new products Skills required for the manufacturing / processing of products given new technology Skills required for the packaging of products given new technology 23 Anticipate Demand for Labour Employers were asked if they anticipated a reduction or an increase in the demand for jobs within the industry in the next 12 months and to state the reasons. Almost three quarter (69%) of employers anticipated an increase while, 31% anticipated a reduction in demand for jobs within the industry in the next twelve (12) months. This is illustrated in Figure 5. The majority of respondents stated that the reason for the reduction in demand for jobs was that persons were entering into the government make work programmes such as CEPEP rather than the food processing and manufacturing industry as they preferred working shorter hours. Increased job opportunities within the sector as a result of expansion, in terms of growing market and venturing into exporting was the primary reason for an increase in the demand for jobs as indicated by employers. This is followed by respondents indicating that an increase in graduate output from the secondary and tertiary institutions and persons seeking opportunities to improve their standard of living were the additional reasons for an increase in the demand for jobs. Figure 5: Anticipate Demand for Labour ANTICIPATE DEMAND FOR LABOUR Increase in Demand 69% Reduction in Demand 31% Training and Development Three fifths (60%) of the employers indicated that current training providers were not meeting their need. A minority of employers (23%) had some form of apprenticeship, internship or a mentorship programme. 24 Figure 6: Current Training Providers Meeting your Needs Figure 73: Apprenticeship, Internship and Mentorship Programme Apprenticeship, Internship, Mentorship Programme Current Training Providers Meeting your Needs Yes 23% Yes 40% No 60% No 77% Develop the Industry Employers were asked what more can be done to develop the sector. A significant number of employers (38%) indicated that ‘training’ was most needed to develop the industry. They mentioned that ‘training’ should be looked at from two facets, training in skilled areas and lifeskills training. Another means to develop the industry was the ‘provision of labour’ as expressed by twenty three percent (23%) of respondents by having an adequate labour pool as well as sourcing labour from CARICOM countries. Provision of incentives was another way to develop the industry as stated by seventeen percent (17%) of employers. Incentives such as no import duty on machinery as well as raw materials especially for those labour intensive companies and tax breaks for those companies that hire graduates. Figure 8: Ways to Develop the Industry Ways to Develop the Industry Ways to Develop the Industry Training 38 Infrastructure 6 Labour 23 Policy 6 Incentives 17 Focus on the Agriculture Sector 6 0 10 20 30 40 Percentage 25 A more comprehensive breakdown of the recommendations from the industry captains include: A policy needed to benefit the industry is one that will ease the labour shortage, create change and reduce the dependency on make work programmes. More incentives are needed to boost the industry. Some suggestions include: Incentives to employers to venture into the new apprenticeship programme. The greater number of organisations that come on board will reduce the labour shortage, or skills gap Provision of scholarships for training in Food Microbiology Provisions of tax breaks for those manufacturers that provide training to staff or those that implement quality management systems. Provision of incentives to increase the use of local raw materials Establishment of a Food Processing and Manufacturing Industry Training School Training programmes both at the technical and tertiary level should be offered or developed to meet current as well as future labour needs. Like in other sectors, there are specific training schools catering to the needs of the sector, for instance TTHTI for Tourism and NESC for Energy so too there should be a training institution catering to the needs of the food and beverage and on a large note to the manufacturing sector. A tertiary level Food Microbiologist training programme does not exist. At the University of West Indies (UWI) this course or subject area is offered as a module within another degree. Establishment of a Food Park / Food and Beverage Industrial Estate The presence of a food park or an industrial estate designated wholly to this industry will provide a boost to the industry and the economy. Some of the Industrial Estates in the country like Trincity Industrial Estate, Frederick Settlement Industrial Estate, Diamond Vale Industrial 26 Estate have a few food and beverage manufacturers but none solely devoted to the industry. If one is developed, the Food and Drug administration can be situated there. 27 Analysis The findings of the survey reveal that this industry is primarily comprised of private companies operating both on a small and large scale. All the employers whether small or large, preached the same sermon, which were problems with labour in terms of poor workers’ attitude and a shortage of workers. The Food Processing and Manufacturing Industry encompasses a large number of small scale processors and manufacturers as evidenced by sixty one percent of employers hiring between one and fifty employees. The bulk of the current employees comprised of workers directly involved in the processing or manufacturing activities of the organisation. Additionally, the vacancies within this industry existed primarily with jobs directly associated in the processing and manufacturing activities. The top four job vacancies were also the most difficult jobs to source labour and included Factory Worker; Processing Staff; Warehouse Attendant and Delivery Clerk; and Machine Operator. It is in this area, the processing or manufacturing activities of the organisation that is primarily faced with labour shortage. Furthermore, some of the overall skills that are needed for the development of the industry within the next 3-5 years are Machine Operators; Factory Workers; a large number of unskilled labour and further, in terms of specialised area, Food Microbiologist. Overtime, the production process has become more automated with technology changes. This has implications on the skill sets demanded and the type of training offered both internally and externally. Employers are now demanding skilled machine operators with mandatory computer literacy certification. Machine Operator is one of the skilled areas that 4% of the employers applied for work permits. Although the industry complained of difficulty in sourcing labour or labour shortage, the majority of employers (96%) did not apply for work permits. This was as a result of the respondents unaware of the process to obtain foreign workers. Further, one employer was in the process of applying for work permits and will be actively using this avenue shortly. 28 The majority of respondents stated that the new and emerging skills sets/competencies needed in the industry within the next 12 months are skills required for the development of new products. A number of these employers stated that these new and emerging skills sets/competencies were specifically needed for their organisation. This suggests that greater research and development is needed to bring about innovations and boost the industry further as well as ensuring the organisation’s survival. Employers were asked if they anticipate a reduction or an increase in the demand for jobs within the industry in the next 12 months. A quarter of the employers (31%) anticipated a reduction in demand for jobs, stating the most common reasons being ‘persons not interested in working eight hours a day when government make work programmes such as CEPEP and URP exist for shorter hours.’ To filter this group of workers from the make work programmes, training in proper work ethics as well as in a skilled area should be given. On the other hand, 69% of the participants anticipated an increase in the demand for jobs. An increase in graduate output (both postsecondary and tertiary level) and an expansion of the industry as well as exports were some of the reasons given for this anticipation. Current training providers were not meeting the needs of 60% of the employers. This group of employers indicated that either the training programmes do not exist or that in - house training is done by a member of staff. Training was the most suggested way to develop the industry and were needed in all subsectors with certification. These include programmes for seafood processors, bakery chef, lab technicians in analytical areas, and machine operators among others. Currently, there is no training programme geared towards the Food Processing and Manufacturing industry specifically for the job of Machine Operator and Food Microbiologist. The only training programmes that may be related to this industry are a few semi-skilled level training programmes in agro-processing and bread, cake and pastry making that offer a ‘Certificate of Participation’. Within these training programmes there is no form of assessment to ascertain if the trainee is competent in the skilled area. Therefore, if the industry’s labour demand is to be meet, there needs to be an introduction of industry specific courses as well as offering of higher level courses with some form of assessment. 29 Employers noted that work ethics was lacking in the workplace which have a detrimental effect on the productivity and the survival of the company. Employers recommended that persons be trained in work ethics and lifeskills training which should be introduced at secondary school level or before potential employees enter the workplace. This training is needed to improve responsibility, respect, co-operation, team spirit, manners, dedication and positive attitude as well as managing their finances. A minority of employers (23%) had some form of apprenticeship, internship or a mentorship programme. However, this is soon to be changed with the signing of the MOU between Government and several manufacturers with regards to the development of a two tiered apprenticeship system. It is hoped that these apprenticeship programmes come on board quickly to alleviate the labour shortage. Provision of an adequate labour pool was one the ways to develop the industry as suggested by the employers. One possible means to achieve this is the transfer of CEPEP and URP workers to the manufacturing sector. But for this to be successful, these workers need to be up-skilled and retrained in the skilled area as well as in Lifeskills. The implications of this is a shift in work culture and a change in the mind-set of these workers. Another option is the importation of labour from the CARICOM countries. Agro-processors within the industry highlighted the need for the development of the agriculture sector as their raw materials are derived from this sector. Currently, the large agro-processors are importing the majority of their raw materials. The agro-processor who used local raw materials complained of a lack of a consistent supply. 30 Conclusion and Recommendations The Food Processing and Manufacturing Industry is the largest subsector in the Non-Energy Manufacturing sector. Therefore, this industry should be one of the foremost choice used to diversify the economy. The Government of Trinidad and Tobago needs to recognise that more is needed to develop this industry. Labour shortage is a major crisis in the industry and measures are needed to alleviate this. Such measures include the transfer of workers from the make work programmes, training in industry specific courses and lifeskills. Stakeholders within the industry have to be aware of time-lapse between inception of apprenticeship programme and output of graduates. Therefore, commencement of the programme should be done as soon as possible if the Government as well as employers are to reap its benefits. The agriculture sector is a major supplier to the Food Processing and Manufacturing Industry therefore more is needed to develop the sector in terms of availability and cheaper raw materials for processors. 31 Appendices Appendix 1: Primary Service Offered Subsector Primary Service Offered Manufacture food products and spice blends Manufacture flavouring extracts for soft drinks/ ice cream / baking Manufacture sauces, drinks and condiments Manufacture seasonings, spices, teas, coffee and snacks All Other Miscellaneous Processors Manufacture coffee Manufacturing and distribution of sauces, noodles Manufacturing food flavourings for the beverage, ice cream and baking industries Manufacturing of seasonings and pepper sauce Manufacturing vegie burger and soya free health food products Production of seasonings, pepper sauce and browning Dehydrated spices and seasonings Fruit Processing Manufacture fruit juices and concentrates All Other Processors of Fruit and Vegetable Products Manufacturing and Wholesale of food essence and syrup Processing of root crops into frozen food Processing vegetables and manufacture of pepper sauce Animal Feed Mills Manufacture animal feed Baked goods namely bread, cakes, pastry, desserts Baking bread, pastries and cakes Bakeries [Including Biscuits and Other Dry Bakery Products] Baking of cakes, pastries, bread and catering items French Patisserie - Café Manufacture baked products and food items. (Bakery / Food service) Manufacture biscuits and other baked snacks Breweries [Including Wine Factories] Manufacture wine and food 32 Subsector Primary Service Offered Frying and Packaging of peanuts and channa Manufacture and distribute beverage drinking chocolate Confectionery and Snack Foods Manufacture confectionery / candy Manufacturing and processing of edible items Processing/manufacturing preserved fruits and snacks Processing and sale of seafood (over 150 products) Fish Processors Processing of Seafood Seafood processing and distribution Flour Mills Grain and Other Cereal Mills, N.E.S. [Including Breakfast Foods e.g. Corn Flakes, etc.] Ice Cream Factories Manufacturing of food and feed items Manufacturing of Cereals Manufacturing of ice cream Meat Processors Processing of Burger patties, sales of imported meat and food items Milk and Milk Products Manufacture of milk drink products such as peanut punch Manufacture of yogurt Non-Alcoholic Beverages Manufacture of bottled water Chicken processing Poultry Processors Poultry processing and manufacturing of flour and animal feed Processing and sales of poultry products Processing and sales of poultry products into ready to heat food Vegetable Oils, Animal Oils and Fats Manufacture edible oils, margarine and soaps 33 Appendix 2: Present Employment Present Employment Job Title Accountant Accountant, Administrative Staff, Sales Staff, Manager and Director Accounting Assistant Accounting Officer Accounting Staff Accounts Clerk Accounts Clerk (Clerk I & II) Accounts Staff (Payable & Receivable Staff) Accounting Modules Clerk, Accountant Administrative Assistant Administrative Staff Administrative Staff and Supervisor Analyst Application Support Specialist Area Manager Assistant Accountant Assistant Cold Room Supervisor Assistant General Manager Assistant Manager Assistant Mechanic Assistant Production Analyst Assistant Production Supervisor Assistant Warehouse Supervisor Baker Bakery Assistant Bakery Staff (Bakers and Baking Assistant) Brand Assistant Brand Manager Bread Chef Bread Staff Cake Chef Cake Decorating Staff Cake Staff Cashier Chain Supply Manager Full Time 4 Part Time 0 56 10 1 11 4 8 5 40 22 77 24 2 1 4 2 1 1 1 1 1 1 1 8 5 15 2 2 1 12 2 6 6 14 1 0 0 0 0 1 0 0 0 0 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 3 0 0 0 0 0 34 Present Employment Job Title Chairman Chemist Chief Executive Officer Chief Technology Officer Clerical Accounting Assistant Clerical Staff Clerk/Typist Receptionist Cold Room Attendant Cold Room Forklift Driver Cold Room Supervisor Confidential Secretary Continuous Improvement and Condition Monitoring Engineer Cook Cook II Corporate Secretary Courier Craftsman I Craftsman II Craftsman III Credit Collector Customer Service Manager Customer Service Representative Customs Clerk Data Entry Clerk Deli Assistant Delivery Driver Delivery Staff Dessert Staff Dining Room Host / Hostess Director Dispatcher Driver Driver / Salesman Driver Helper Electrician Engineer Officer Engineering Staff Executive Assistant Export Assistant Full Time 1 1 2 1 1 27 1 1 1 1 1 1 2 1 1 1 7 6 13 1 1 5 8 1 5 6 2 3 6 9 3 30 4 3 1 1 15 3 2 Part Time 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 35 Present Employment Job Title Export Coordinator Export Manager Export Staff Facilities Coordinator Factory Assistant Factory Supervisor Factory Worker Field Sales Officer Financial Accountant Financial Controller Financial Director Fleet and Maintenance Manager Forklift Operator Freezer Staff Front Counter Clerk General Manager General Manager - Business Support Services General Manager - Finance General Manager - Operations General Manager - Sales and Marketing General Technician Group Administrative Officer Group Corporate Services Manager Group Human Resource Assistant - Administration Group Human Resource Specialist - Employee Relations and Development Group Information Technology Specialist Gum Mixer Handyman Hatchery Worker Heads of Production and Supervisory Staff Health and Safety Staff Health, Safety and Environment Assistant Health, Safety and Environment Coordinator Heavy 'T' Driver Help Desk Support Technician Health, Safety, Security and the Environment Officer Human Resource Assistant Human Resource Assistant - Payroll Full Time 3 1 4 1 11 1 760 10 3 4 1 1 5 1 3 2 1 1 1 1 1 1 1 1 Part Time 0 0 0 0 0 0 162 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 1 2 1 6 4 1 1 1 20 1 1 2 1 0 0 0 0 0 0 5 0 0 0 0 0 0 0 36 Present Employment Job Title Human Resource Manager Human Resource Officer Human Resource Officer - Payroll and Administration Human Resource/Safety Staff Industrial Machine Mechanic Information Technology Assistant Information Technology Staff Internal Auditor Inventory Clerk Invoicing Clerk Janitor Junior Production Supervisor Key Account Representative Key Accounts Officer Kitchen Assistant Kitchen Staff (Preparation) Lab Assistant Lab Technician Loader Logistics Clerk Logistics Manager Lorryman Machine Operator Machine Operator / General Labourer Machine Operator I Machine Operator II Machine Technician Maintenance (Welders, Machinist, Electrician, mechanical technician, stores staff) Maintenance Engineer Maintenance Officer Maintenance Staff Maintenance Supervisor Maintenance Technician Management Staff Manager Manager - Carlsen Field Operations Manager - Corporate Security Manager - Feed Milling and Packaging Full Time 2 3 1 3 1 3 2 1 2 1 4 1 1 1 5 10 3 2 7 1 1 18 73 70 7 1 2 Part Time 0 0 0 0 0 0 0 0 0 0 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 13 1 1 28 1 18 15 37 1 1 1 0 0 0 1 0 0 2 0 0 0 0 37 Present Employment Job Title Manager - Feed Sales Manager - Flour Milling and Packaging Manager - Food Sales Manager - Human Resource and Administration Manager - Information, Communication and Technology Services Manager - Maintenance and Facilities Manager - Management Accounting Manager - Procurement and Logistics Manager - Quality, Health, Safety and Environmental Services Manager, Sales Manager, Technical Services Managing Director Marketing Manager Marketing Officer Marketing Staff Meat Room Attendant Mechanic Merchandiser Merchandiser , Salesmen , Promoter Merchandising Manager Messenger Mill Operative Mill Worker Mixer Mobile Equipment Operator I Mobile Equipment Operator II Network Administrator Office Assistant Office Clerk Office Manager Office Sales Helper Office Staff Operations Manager Operations Officer Operations Staff Oven Operator Owner/Manager Full Time 1 1 1 1 Part Time 0 0 0 0 1 1 1 1 0 0 0 0 1 1 1 5 2 1 8 3 3 61 120 1 1 3 32 22 18 2 1 1 2 1 1 14 1 1 13 7 2 0 0 0 0 0 0 0 0 0 25 0 0 0 0 3 0 0 0 0 0 0 0 0 2 0 0 0 0 0 38 Present Employment Job Title Packer Para-Professional Staff Pastry Assistant Pastry Chef Pastry Maker Pastry Staff Payroll Clerk Payroll Officer Planner Plant and Operations Director Plant Maintenance Staff Plant Maintenance Technician Plant Manager Plant Operator I Plant Operator II Plant Operator III Plant Operator IV Plant Production Technician Plant Superintendent Porter Process Operator III Processing Staff Production Analyst Production Manager Production Shift Manager Production Staff Production Supervisor Production Supervisor/Operator Production Trainee Programmer Projects Engineer Promotions Assistant Promotions Supervisor Purchasing Clerk Purchasing Manager Purchasing Officer Quality Assurance Officer Quality Assurance Staff Quality Auditor Full Time 160 38 2 2 2 6 2 1 1 1 16 3 1 2 1 2 2 1 1 11 1 274 1 4 1 309 9 18 3 4 1 1 1 1 1 2 1 33 1 Part Time 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 49 0 7 0 0 0 53 0 0 0 0 0 0 0 0 0 0 0 0 0 39 Present Employment Job Title Quality Control Manager Quality Inspector Quality Management / Quality Control Staff Quality Manager Raw Materials TL Staff Receptionist Refrigeration Technician Research and Development Officer Route Sales Helper Sales and Marketing Officer Sales Clerk Sales Executive Sales Officer Sales Representative Sales Staff Sales Supervisor Salesman / Driver Sanitation Staff Sanitation Team Leader Security Staff Senior Brand Manager Senior Human Resource Officer Shelf Replenisher Shipping and Export Manager Staff (Office Staff and Salesman) Stores Clerk I Stores Staff Supervisor Supervisor / Manager Team Leader - Information Technology Technical / Professional Officers Technical Director Technical Draughtsman Technical Staff Technician / Machine Operator Trade and Marketing Assistant Trade, Sales and Marketing Manager Truck Assistant Utility Attendant I Full Time 1 6 10 1 1 3 1 1 1 1 3 1 7 13 158 2 36 50 1 5 1 1 3 1 12 5 20 105 50 2 29 1 1 55 1 1 1 15 28 Part Time 0 0 0 0 0 0 0 0 0 0 0 0 0 0 19 0 0 5 0 7 0 0 0 0 0 0 5 0 0 0 0 0 0 0 0 0 0 0 0 40 Present Employment Job Title Utility Attendant II Utility Attendant III Utility Driver Van Driver Van Loader Vice President Warehouse Attendant / Dispatcher / Delivery Staff Warehouse Coordinator Warehouse Manager Warehouse Supervisor Welder Workshop Supervisor Full Time 9 5 4 3 1 1 73 1 1 5 3 1 Part Time 0 0 0 0 0 0 5 0 0 0 0 0 41 Appendix 3: Vacancies Vacancies Job Title Accounts Clerk Administrative Assistant Application Support Specialist Assistant Accountant Assistant General Manager - Operations Auditor Bread Chef Cake Chef Cashier Cleaner Cold Storage Labourer Communications Officer Cook Corporate Communications Officer Delivery Man Dessert Chef Dispatch Manager Dispatcher Driver Electrical Technician Electrician Factory Worker Field Refrigeration Technician Food Safety and Quality Assurance Officer Forklift Operator Freezer Attendant Front Counter Clerk Graphic Artist Heavy 'T' Driver Heavy 'T' Driver Salesman Human Resource and Industrial Relations Manager Human Resource Assistant Human Resource Officer Information Communications Technology Coordinator Inventory Manager / Stockroom Staff Kitchen Staff Full Time 1 2 1 1 1 1 1 2 3 3 2 0 2 1 1 1 1 1 12 1 1 106 1 1 2 2 1 0 2 1 0 1 3 1 1 4 Part Time 0 0 0 0 0 0 0 0 0 0 0 1 0 0 0 0 0 0 0 0 0 7 0 0 0 0 0 1 0 0 1 0 0 0 0 4 42 Vacancies Job Title Lorryman Machine Operator Maintenance Manager Maintenance Staff Marketing Manager Marketing Officer Marketing Staff Mechanical Technician Merchandiser Office Staff Operations Assistant Oven Operator Pastry Chef Pastry Chef Assistant Press Plant Operator Process Technician Processing Staff Production Coordinator Production Manager Professional Chef Quality Assurance Staff Quality Management Systems Officer Refinery Operator Refrigeration Technician Sales Assistant/Loader Sales Representative Sales Staff Stores Clerk Supervisor Warehouse Attendant, Delivery Clerk Full Time 8 17 1 6 1 0 1 1 2 2 1 1 1 1 1 2 20 1 1 1 5 1 1 2 4 4 6 3 3 20 Part Time 0 0 0 0 0 2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 43 Bibliography http://investt.co.tt/country-profile/economy Review of the Economy 2014 http://www.foodmanufacturing.com/articles/2015/01/5-food-processing-industry-trends-2015 http://www.ilo.org/global/industries-and-sectors/food-drink-tobacco/lang--en/index.htm http://www.slideshare.net/FrostandSullivan/2020-vision-global-food-beverage-industry-outlook http://www.caribank.org/uploads/2015/02/CDB-2014-Caribbean-Economic-Review-and-Outlook-for2015.pdf 44