TV in the mobile or TV for the mobile: challenges and changing

advertisement

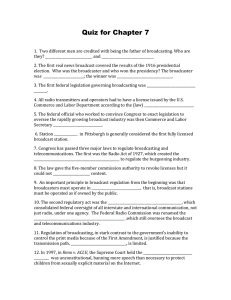

The 18th Annual IEEE International Symposium on Personal, Indoor and Mobile Radio Communications (PIMRC'07) TV IN THE MOBILE OR TV FOR THE MOBILE: CHALLENGES AND CHANGING VALUE CHAINS Aurelian Bria Royal Institute of Technology Stockholm, Sweden Patrik Kärrberg London School of Economics and Political Science London, UK . ABSTRACT This paper intends to provide a techno-economic overview of the Mobile TV business and its business models. Recent trials have shown that a large number of people would like to consume mobile TV and few people doubt that this service will eventually be offered in the majority of wireless networks around the world. However, this service is not a simple add-on to the voice and data, but comes with totally new dimensions that challenge the present markets. The aim of this paper is to identify and describe these challenges in the technology, market behaviour, and industry strategy domains. I. INTRODUCTION Several business models deployed when providing mobile services are vertically integrated setups focusing on delivering generic content to consumer mass markets. However, mobile TV is not yet a clearly defined media, and it has ambiguous connotations, which leaves us with many questions regarding what kind of services could be delivered, and how actors will interact in that process. Mobile TV could replace traditional television when users lack access to a television set, but we expect it to complement traditional TV rather than replace it. Initially, as current cases in Japan and Europe show, retransmissions of existing channels and programmes will be common, but eventually it will develop into something more than just “television on the move”. It will be part of a multimedia device, which emphasises interactivity and enables users to produce and personalize content [1]. Mobile TV is not an isolated phenomena, but one of several distribution channels for IP TV; broadcast to TV-sets, via the Internet when stationary (desktop), via the Internet when on the move/nomadic use (laptop) and finally in the mobile phone. As mobile and fixed Internet formats increasingly converge, technical service delivery layers become standardized. “TV in the mobile” is foremost a technical challenge already solved by several carriers through streaming solutions (and acquiring of related programme rights). However, we expect “TV for mobile” (content customised and broadcast for the mobile format) to alter the traditional value network around TV content. Most notably mobile carriers take an active role in both production and distribution. In this paper we define mobile TV content as “any video played on a mobile device”. 1-4244-1144-0/07/$25.00 ©2007 IEEE. Per Andersson Stockholm School of Economics Stockholm, Sweden The following research questions will be addressed throughout the paper: a) How business models delivering “TV for mobile” depends on the underlying delivery technology and b) How interaction and power relations in the value network for mobile TV will change from traditional TV? The expansion of the digital domain consists largely of the reformatting and translation of content to increase availability. The digital version of previously analogue media is characterized by a higher level of “liquidity”, as digital content is more adaptive, transferable, and accessible to new platforms. This increased liquidity is one of the main driving forces behind an increasing mobility of media. Mobile TV usage will be an integrated part of this media consumption. The activity areas of actors could be summarized as below: Content generation Content aggregation Digital distribution Customer relation mgmt Mobile network operator Cable TV company Newspaper Terrestrial broadcaster Production company End-user as content creator Media Web sites & portals Content generation Content aggregation Digital distribution Customer relation management & billing Figure 1 Actor involvement in mobile TV content distribution Despite the high expectations regarding market demand and business growth in the coming years, little data is available on user behaviour. Trials in Finland, England, Spain, France, Italy, and Norway, have indicated some commonalities: consumers generally prefer simplicity and high usability, mobile TV services should show high technical functionality and accessibility, content should be adapted to short periods of viewing time, and complementary mobile services (e.g. voice calls) should not be negatively affected by the TV services. Several studies indicate that consumers expect services featuring ease of use and familiar content (e.g from the traditional TV at home). The overall experience must be appealing, easy to access wherever the user is and not too expensive. Furthermore, the market, consisting of content providers, aggregators, distributors etc, requires a standard The 18th Annual IEEE International Symposium on Personal, Indoor and Mobile Radio Communications (PIMRC'07) interface towards the distribution channels implemented by the mobile network operators or broadcasting operators. Distribution service needs to support effective content protection, billing of the customer, access control and tracking functionality for advertisers. As the boundaries between different media are getting fuzzier, so are the consumers’ media habits. New patterns of media consumption are forming. Traditional TV media are today being sidestepped in favour of browsing the web. According to the 2006 report by the Swedish Media Committee, wherein the media habits of 2000 children, young adults and parents were measured, the time spent on surfing the internet surpassed that of TV viewing. Therefore, we can expect that users want to access the same content in different ways depending on the context, eventually looking for a bundled service that cover different distribution channels. For example, the content of a TV program can be viewed via terrestrial broadcasting while relaxing in a camping site, through the Internet when connected in a WLAN hotspot at the airport, or in the mobile when sitting in a bus. There are multiple technologies for delivering Mobile TV services, but due to the scope of this paper we focus on the 3G and DVB-H system, as they are expected to dominate in Europe. We already know that the bit rate performance as a function of the spectrum allocated for use is almost the same regardless the radio technology utilized today, and close to the Shannon bound. There will be no breakthrough by improving modulation or coding, but spectrum allocation for the future systems may give competitive advantages to one technology or another. DVB-H operators might have high hopes regarding the digital TV switchover freeing up spectrum in the old UHF band (presently utilized for analogue TV broadcasting). However, the digital switchover might not free up any spectrum at all, as the offer of the terrestrial digital TV systems not only includes more channels, but also better quality (e.g. HDTV). DVB-H (Digital Video Broadcasting-Handheld) is expected among analysts to have the highest percentage share amongst broadcast technologies in the West: a larger backing of influential actors, greater degree of activity in terms of trials and rollouts, and it being supported over the UHF frequency, which gives it an advantage over DAB/DMB in terms of performance. Several countries could be expected to have more than one Mobile TV broadcast standard including France, Germany, India, Netherlands, UK, US and Japan. Most notable amongst these is the UK, which is expected to comprise all the major broadcast technologies: DVB-H, DAB/DMB and MediaFLO (Juniper Research, 2007). In Finland, and in the rest of Europe, Nokia has been one of the main actors pushing forward DVB-H. There are presently many uncertainties concerning the future market positions and strategies of: technology suppliers, mobile service operators, TV broadcasters, service content providers and others, all aiming for a stable position in the new, emerging constellations of firms involved in developing and distributing mobile TV services. Figure 2 Interactive mobile TV (Source: NTT DoCoMo) II. WHAT IS MOBILE TV As mentioned in previous section, there are two ways to relate to the term and concept of mobile TV: TV in the mobile or TV for the mobile. TV in the mobile simply implies that traditional TV content is re-broadcast in the mobile phone. The content is not produced with the mobile platform in mind, but rather just compressed and perhaps shortened versions of traditional TV content as news, sports, music videos etc. In early trails and launches this has been the clearly dominating form of service. In the US, for example, the mobile TV service MobiTV streams over 25 traditional TV channels over the cellular network. Swedish pilot studies have also replicated regular TV programming, but it soon became clear that the content is simply not adapted to the usage situations of an outside-of-the-home, mobile viewer. Produced for big screens and long viewing time, the majority of the content in traditional TV channels cannot be presented on small screen devices with limited battery life, resulting in poor value and convenience for the consumer. TV for the mobile is an alternative view to mobile TV, namely that content is produced and optimized for the mobile platform and the mobile user situation. This means content that can be clearly reproduced on the small screen (e.g. mobile phone size), it is enhanced with interactivity features, and its length is adapted to the consumption pattern of the mobile users. The main trends that justify this broader definition of Mobile TV are mainly: • The user experience when watching TV is changing from a synchronized and scheduled pattern to a more personalized experience thanks to technologies as Personal Video Recorders (PVR) and IPTV that allows recording of content and time shifting. • Video on Demand (VOD) is more and more popular, exactly because it allows personalization of the service. • Mobile TV presently grows independently from the technologies for distribution (cellular, broadcasting, IPTV). III. TECHNOLOGY CHOICE The technologies can be categorized into two groups: the ones that use the cellular network for delivery (e.g. HSDPA and MBMS), and a separate broadcast network for mobile TV (e.g. DVB-H [5]). In the case of delivery over the cellular network, unicast and broadcast mobile TV traffic would be The 18th Annual IEEE International Symposium on Personal, Indoor and Mobile Radio Communications (PIMRC'07) shared with voice and data traffic in the existing networks. Providing TV by streaming over dedicated cellular connections (e.g. HSDPA) has a big limitation: a rapid consumer adoption could rapidly exhaust the available spectrum for 3G systems. A separate broadcast network would require a terrestrial transmitting network especially designed for broadcasting. The five main network operators in the UK (3UK, O2 Orange, T-Mobile and Vodafone) favour the open DVB-H broadcasting standard, even if the UHF spectrum, currently used for analogue television, will not be available for other uses on a national scale until 2012 [3]. The adoption of mobile broadcast technologies is dependent on the availability of spectrum, gradually opening up in Europe and the US after 2010. Meanwhile an opportunity window exists for Western carriers to further trial and launch streamed TV services on their 3G networks. Approximately 30% of operators in OECD countries provide an option for 3G unlimited flat rate data services. Almost all operators provide both capacity-based and flat rate tariff plans in parallel. For data centric operators in Japan and Korea, flat fees have already disseminated well in the market, with more than 50% of subscribers in Japan utilizing this option [4]. However, streamed TV services (based on progressive download mechanisms) never became a notable revenue source for Japanese operators, and broadcast technologies are currently the total focus for these operators. In the UK, several trials have taken place of DVB-H and Qualcomm’s MediaFLO. Additionally a commercial launch of DAB/DMB based services took p lace by Virgin Mobile in October 2006. Virgin Mobile utilizes a DMB based solution and BT Movio’s broadcast technology. Streamed TV, offered by all UK carriers, have shown better user penetration, even if high fees keep it from reaching high volumes. Figure 3 Features of distribution technologies IV. VALUE CHAINS IN MOBILE TV As mobile TV becomes a reality it will change how and when we watch TV. But how will it affect the current players in the TV market? The main actors in the value chain of TV are content creators, broadcasters and distributors. As aggregators of content the broadcasters are the central players of this value chain. However, there certainly are revenue streams from outside parties at all instances of the value chain as there is a sliding scale of how viewers pay for content; Figure 4 Users pay with time and money for content At one end we have traditional advertising, product placements and advertiser funded programming, where the viewer pays by being exposed to such messages. On the other end of the scale there are pay-per-view, subscription and carriage fees, where the viewers pay the bill by themselves. Content creators, for example studios and production companies, receive an increasing part of revenue from advertising end of the scale. Distributors, for example cable networks, get their cut mainly from subscription fees and PayPer-View end of the scale. Broadcasters tend to generate revenue from the whole scale. A. Impact of new technology on industry structure How will a new technology like mobile TV affect the current market structure? As in all commercial undertakings there is one dominant question; who will control the revenue streams? As mobile network operators are used to having control over their customers’ behaviour they are likely to represent a new breed of distributors. Traditionally, the broadcasters have had revenue streams from all parts of the value chain, while the distributors’ revenue streams have mainly come from subscription fees and the like. Most of the traditional distributors’ revenue can be allocated to the technical service of providing the signal and not the content per se. As mobile network operators currently tend to operate as gatekeepers for access to Internet content outside their own system there is also a very real possibility that they will try to extend their control over mobile TV services as well. This opportunity is enabled by the need for interactivity features in mobile TV, interactivity that will most probably be provided using the uplink of the cellular networks. Traditionally, TV has largely been defined by the linearity of the scheduled content. Scheduling at specific timeslots has had tremendous effects on society at large as it has had a scheduling effect on how people plan and live their lives. Primetime series has been a way to gather the family. News broadcasts at specific times has been must see TV for decades. However, this linearity has been disrupted by the appearance of digital video recorders as they have brought with them the ability to time shift on the fly. Thus have the traditional way of consuming TV started to change. Mobile TV can therefore be seen as a way of extending the traditional way of watching TV as it to some extent lessens the need to time shift contents. With the emergence of mobile TV there The 18th Annual IEEE International Symposium on Personal, Indoor and Mobile Radio Communications (PIMRC'07) will be disruptions in the traditional value chain. The broadcasters’ role as aggregators of content could be said to be constant, but the mobile network operators will be a new type of distributor. When it comes to content mobile TV can be seen as an extension of traditional TV, but due to different viewing patterns there seems to be a need for a new type of content. The notion of brand must also be taken into account. Mobile TV is a potential playing field for any number of new media actors. In all the trials, however, the same channels that are popular for regular TV are popular for mobile TV. Viewers seem to prefer the strong brands, built up with regular TV. Two variables seem to control the future market development: the flexibility in content delivery demanded by consumers and the level of cooperation between companies. As converging media landscape changes consumer behaviour and leads to a reorganization of the industry, companies will attempt to either prevent the media convergence or adapt their business models accordingly. The increased liquidity of information enables consumer’s constant access to information through several channels. Cooperation of market actors is crucial for delivering services of high quality with the minimum of resources. For example, NTT DoCoMo and Nippon Television Network (NTV), the terrestrial TV operator, have agreed to a business tie-up to develop content and related services that will combine mobile communications and conventional TV programmes. Currently only broadcasting companies with existing licenses for terrestrial broadcasting can provide content, but in 2008 it is expected that also carriers and other media companies will be allowed to broadcast. In particular, these two companies will jointly study new business opportunities such as a service that will combine One-Seg and i-mode services [3]. It is currently possible to watch TV and access the mobile Internet. A football game and simultaneously access to interactive content, such as voting and in-depth information about the teams, is shown in fig. 2. It is not enough that carriers and content providers cooperate, but for example, also manufacturers of mobile phones have to be involved. It is reasonable to think that this kind of cooperation can be achieved when a “win-winsituation” is not only talked about, but actually practiced among players in the industry. B. Charging for mobile TV Another important aspect is the fact that consumers accept that they will be charged for services provided through their mobile phones. This acceptance gives the mobile network operators a power advantage over the broadcasters, as they have the power to grant access to a customer base that are expecting and willing to pay for a service like mobile TV. If they wield their power right, mobile network operators may take hold of all revenue streams that are not related to advertising. As the number of mobile network operators are very low in comparison to the number of broadcasters there is a very real risk that they will only open up their network to broadcasters that will abide to their rules. However, as the current structure of intertwined relationships between content creators and broadcasters are very strong and complicated it seems unlikely that the mobile network operators will be able to circumvent this structure by starting their own mobile TV channel (if the regulator allows this). The content will be the main focus for the customers, but it may happen that the need for service personalization goes so far so the majority of users require from mobile operators only a bit pipe to the wanted content source (e.g. similar to Internet radio/TV today). Consumers gaining cheap access to Internet content using the mobile networks will determine the operator loosing control over the distribution channels. Already the mobile operators are concerned about bandwidth consumption as a result of technological innovations which allow users to produce and access their own mobile TV services. For example, software as Windows Media Encoder or devices such as the Slingbox allow users to stream video from their home (PVR, TV, DVD,etc.) over the Internet and mobile networks. C. Regulation for user choice important Another important factor is to what extent the regulator will allow for new distributors to broadcast to end-users. Taking into account that mobile TV is a relatively new and innovative service type (enabling new value network constellations) the regulator is a very important actor. Their role in regulating e.g. the protection of the public, and the promotion of cultural diversity and pluralism of the media, will affect the introduction and success of mobile TV service. Content creation has up till now not been the strength of carriers. This leaves room for new actors (such as production companies or even advertisers) to side-step the traditional TV distribution companies. It would however depend on the regulatory framework and the network operator (DVB-H or 3G) policy. There is also a real possibility that the legislative power will be in favour of increased competition. One way is force the network operators to open up to the service providers. Another way is to push for virtual network operators (VNO) for mobile TV. A virtual network operator would be more inclined to compete by offering a wide range of services and content, as they would have no other revenue that could subsidize their operations. The success of 3G in the mobile TV arena (regardless if is implemented with point-to-point HSDPA or cell broadcasting MBMS) is heavily dependent on the future regulator policy in allocating spectrum. Most operators have 2 classes of frequency, paired and unpaired, with the paired being reserved for 2-way services such as voice and interactive data. The unpaired part is supposed to be used for asymmetrical services such as data, but is mostly unused. In most countries, the unpaired spectrum is sold together with the 3G spectrum. For firms, new technological developments such as fixedmobile convergence may create new incentives for vertical The 18th Annual IEEE International Symposium on Personal, Indoor and Mobile Radio Communications (PIMRC'07) and horizontal integration and disintegration. Regulatory oversight may remain necessary to monitor for anticompetitive behaviour at all levels of the value chain, including access to content and to networks. models and services are adapted to the mobile use case, in order to provide and preserve user value. D. Actors to support user acceptance of “TV for Mobile” Another way of increasing the likelihood of a successful subscription business is to try to expand the traditional way of watching TV. One way to do this for the mobile networks operators is to cooperate with pay-tv broadcasters or distributors as those customers who already have these kinds of subscriptions are quite likely to be interested in accessing their premium channel on mobile TV as well. As this would be an add-on channel package that are linked to their regular home subscription the payment would most likely go through the none-mobile TV distributor. Hence, would the power over the revenue stream once again be in the hands of the broadcaster. Mobile TV is a new service that has the potential to change the present market for mobile services. The main challenges are not related to the quality or capacity of the available technologies, but rather the complex question of who will pay for, use, own and control a mobile TV network. At present there are many issues to resolve in order to make the actor network invest together and develop a complete service package that consumers are willing to pay for. Two future paths and scenarios are clear, one where mobile TV is broadcasted mainly over a dedicated broadcast network similar to traditional TV today. The other is a solution that uses the existing mobile networks that with some upgrades could support a “broadcast-like” service. DVB-H might provide options for broadcasters and carriers to collaborate on technical hybrid solutions with broadcast streams being synchronised with mobile Internet usage (as in the Japanese case). We argue that mobile TV is a complement to traditional TV but reconfigurations of existing value chains don’t happen without friction. There is a real opportunity for the regulator to bring clarity regarding standards and interoperability. Powerful actors, such as carriers and the media industry’s content providers must agree on business models that support this new ecosystem. To successfully create “TV for mobile” adapted to mobile users real needs, incentives for all actors in this ecosystem must be clear. E. Value Chain Integration Case: Commerce and TV Going Mobile Together in Japan A saturated market for mobile services and voice calls is a major reason for mobile carriers in Japan to focus their future efforts on mobile transactions. NTT DoCoMo even took a 20% stake in leading credit card company Mitsui Sumitomo in 2005. Mobile commerce was estimated to exceed Euro 2.8 billion in Japan in 2005 and more than an estimated 40% of users shop by ordering items through their mobile phone and women more so than men [4]. In Europe it has been seen as important to enable subscription fees to capitalize on mobile TV and recoup infrastructure investment. However, in Japan with an expected 10 million mobile TV enabled handsets being shipped up to the summer of 2007, the focus lies on advertising and potentially mobile commerce. Mobile wallet owners are expected to have nearly tripled from 2005 to some 37% of all users in 2006 (Impress, 2006), and continue to grow. Keeping in mind that 40% of mobile users already shop with their mobile phone, analysts and industry organizations expect that mobile TV and its synchronized mobile sites (by the EPG), could boost mobile commerce further. The focus of mobile applications in Japan are said to change from “whenever and anywhere” (DoCoMo in NTT DoCoMo plays with the Japanese word for “anywhere”) to “immediately and on the spot”. Adaptation of PC services for the mobile phone has for a long time not being seen as meaningful in Japan by content providers, where the focus instead is on developing services suited to the mobile user’s specific needs. So even if value and service integration are key to mobile service innovation, it is crucial that business V. SUMMARY AND CONCLUSIONS ACKNOWLEDGEMENTS We would like to thank our thesis students Guan Wang and Johan Englund for their help with data collection and organization, interviews and the valuable discussions. REFERENCES [1] Orgad, S,“This Box Was Made For Walking… - How will mobile television transform viewers’ experience and change advertising?”, London School of Economics and Political Science, London: Enterprise LSE, 2006 [2] TREFZGER, J. 2005. Mobile TV-Launch in Germany – Challenges and Implications, Nov. 2005. [3] “Mobile multiple play: new service pricing and policy implications (2nd edition)”, Working Party on Telecommunication and Information Services Policies, OECD, 2007 [4] Japan Mobile Phone White Paper 2007 (2006), Tokyo: Impress [5] G. Faria, J. A. Henriksson, E. Stare, and P. Talmola, “DVB-H: Digital broadcast services to handheld devices,” Proceedings of the IEEE, vol. 94, no. 1, pp. 194-209, January 2006.