Industrial Estate Sector

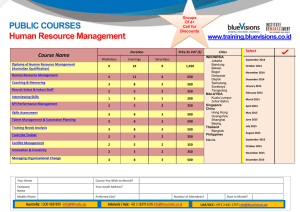

advertisement

Research & Forecast Report Jakarta | Industrial Q4 2015 Ferry Salanto | Associate Director - Research Industrial Estate Sector Industrial Land Supply During the year, one industrial estate in Bekasi introduced several parcels of industrial land totaling almost 20 hectares. In line with sluggish economy activity this year, developers seemed to slow down land preparation activities. On the other hand, several industrial estates are still rushing to finish construction work to meet the delivery commitment for presales transactions they made. There is generally limited new land that can be made available as industrial lots, particularly in the Bekasi area. Although there are certain industrial estates with expansion plans, the number would not be significant in the short term. Industrial Land Stock Status in Some Active and Future Industrial Estates 4,000 3,500 3,000 2,500 Hectares “During 2015, only one industrial estate in Bekasi added to the supply of industrial land with 20 additional hectares. Nevertheless, a large amount of additional industrial land is expected to be available over the next two years in Jabodetabek, Serang and Karawang. Total land sales for the whole of 2015 were 347.51 ha or about 79% of the total sales in 2014. Of this, almost 50% of industrial land sales was underpinned by substantial sales concluded at Modern Cikande Industrial Estate. None of the operating industrial estates made price adjustments this quarter. Quite a few developers said that their sales targets for 2015 were unachievable and thus they preferred to maintain the current prices.” Accelerating success. 2,000 1,500 1,000 500 0 Bogor Existing Stock Tangerang Karawang Remaining Unsold Land Source: Colliers International Indonesia - Research Bekasi Serang Potential Land To Be Developed Karawang seemed to have a large industrial land expansion in the future, not only from the development of several future industrial estates in the Trans Hexa Karawang consortium, but also from the expansion plans of existing industrial estates. In line with the growing number of companies operating in industrial locations in the eastern part of the Greater Jakarta area and the growing middle-class population, land in Bekasi and Karawang is becoming commercially valuable. In some cases, vacant land allocated for industrial use could be transformed into more expensive land for commercial or residential uses. A few industrial estates have already started commercial development benefitting from the increasing number of operating companies. Land Sales Activities The last quarter of 2015 saw a low for the industrial market after having a dismal year. During 2015, the industrial market, in general, weakened and only looked almost as good as 2014’s full year performance. Total land sales for the whole of 2015 was 347.51 ha or about 79% lower than the total sales in 2014. Of this, almost 50% of industrial land sales in the Greater Jakarta area was underpinned by remarkable sales concluded at Modern Cikande Industrial Estate. This quarter, the greatest number of transactions occurred at the end of 2015 at Bekasi Fajar Industrial Estate (BFIE) with a total of almost 10 ha of land mainly concluded by automotive related companies, and the building material and food industries.On the contrary, other active industrial estates in the Bekasi region revealed that they had zero sales this quarter including industrial estates with regular sales like Greenland (GIIC) at Kota Deltamas Land Absorption During 4Q 2015 and MM2100. Other active industrial estates, like Delta Silicon at Lippo Cikarang only sold 0.1 ha this quarter for warehouse use. Despite this, Bekasi was the second most active region in selling industrial land during 2015 with a total of 141.49 ha, representing 65% of the total sales in 2014. Despite the smaller number of transaction, the Serang region still had the most upbeat performance with two prominent industrial estates registering middling sales. Krakatau Industrial Estate Cilegon (KIEC) saw the expansion of a chemical related company of 5,000 sq m and Pertamina, the national oil company for the gas retailer business, took around 7,000 sq m. Nevertheless, this quarter was an anticlimactic period for Modern Cikande Industrial Estate that recorded the lowest amount of land sales throughout 2015. From one Japanese company in the material recycling business taking 2 ha and a local food processing company, total sales in this reviewed quarter was only 2.42 ha, far less than the total sales in the previous quarters. Nonetheless, total sales at Modern Cikande during 2015 were tremendous, at more than 165 ha. Total industrial land being transacted in Serang during 2015 was registered at 182.73 ha, higher by 13.3% compared to the total sales in 2014. For the last two years, the amount of land sold in Karawang was relatively low, an average of 4.3 ha land quarterly. This quarter was the second worst quarter after 3Q 2014 (when none of the industrial estates reported sales) with only KIIC registering a marginal 0.4 ha sale to a new Japanese industrial gas company. Thus far only Millennium continued to sell land and warehouse buildings in Tangerang. Millennium reported sales of three warehouse units and one parcel of land totaling 1.24 ha. Land Absorption During 2015 Modern Cikande Bekasi Fajar Greenland International Industrial … Delta Silicon Modern Cikande Bekasi Fajar Krakatau Industrial Estate Cilegon Jababeka Jababeka Millenium Suryacipta KIIC Krakatau Industrial Estate Cilegon Millenium MM2100 Industrial Town KIIC CCIE Delta Silicon Kota Bukit Indah (Besland Pertiwi) 0 2 4 6 8 10 0 12 40 2 120 160 hectares hectares Source: Colliers International Indonesia - Research 80 Source: Colliers International Indonesia - Research Research & Forecast Report | Q4 2015 | Industrial Estate | Colliers International 200 Types of Activities Industries During 2015 Land Price Logistics/ Packaging Chemicals Oil & Gas Warehousing 0.95% Metal Heavy Electronics 2.89% 5.76% Equipment Related 7.17% 0.58% 4.81% 0.32% Steel-related Machinery Clothing 0.40% 3.15% 0.05% Plastics Building 0.29% Material Consumer 7.26% Goods 6.62% Medical 0.29% Others 1.53% Corresponding to the sluggish industrial market in 2015, none of the operating industrial estate made price adjustments this quarter. The weakening of the local currency against the US dollar has been a challenging issue in the pricing of land apart from the main cause, the slowing economy. In general, industrial developers have been much focused on achieving sales targets as buyers become less active during the year. In fact, quite a few developers said that sales targets for 2015 were unachievable and thus they preferred to maintain prices. Greater Jakarta Industrial Land Prices USD240.00 USD210.00 Automotive 26.56% USD/sq m USD180.00 USD120.00 USD90.00 USD60.00 USD30.00 Bogor Tangerang Karawang Bekasi 2015 2014 2013 2012 2011 2010 2009 USD0.00 2008 For the last three years, the industrial trend has been shifting from the automotive industry to food, logistics and consumer goods. Until the end of 2013, the industrial market had been dominated by the automotive sector. In 2013, the domination of this sector reached 55% of the total industrial transactions for the year. The automotive industry then shared about the same percentage as other sectors like food industry and logistics in 2014. Again in 2015, the food industry dominated most of the transactions, surpassing the amount of land being absorbed by the automotive industry. USD150.00 2006 Source: Colliers International Indonesia - Research 2007 Food & Beverage 31.39% Serang Source: Colliers International Indonesia - Research Annual Industrial Land Absorption 1,400 Industrial land quoted in US dollars will be converted to Indonesian rupiah when a transaction occurs. This has been implemented by most industrial estates with pricing in US dollars in complying with the Central Bank regulation to use rupiah in any transaction in Indonesia. 1,200 1,000 Hectares 800 600 Industrial Land Prices and Maintenance Costs* 400 region 200 Jakarta Bogor Bekasi Tangerang Source: Colliers International Indonesia - Research 3 Karawang 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 0 Serang Land price (in USD/sq m) maintenance costs (in usd/sq m/month) lowest highest average lowest highest average Bogor 120.00 203.30 161.60 0.06 0.06 0.06 Bekasi 195.00 254.10 221.10 0.06 0.08 0.07 Tangerang 138.00 145.20 141.60 0.03 0.08 0.06 Karawang 170.00 200.00 185.00 0.05 0.10 0.06 Serang 123.40 138.00 130.70 0.03 0.05 0.04 *1USD = Rp 13,773 Source: Colliers International Indonesia - Research Research & Forecast Report | Q4 2015 | Industrial Estate | Colliers International Minimum Wages in Jakarta Maintenance Costs Of all the industrial estates in our coverage, only CCIE introduced a new maintenance tariff, a 6.3% increase to IDR850/sq m/ month. Most industrial estates preferred to keep their tariffs as they were. For the last two years, maintenance costs in all regions in the Greater Jakarta area have been stable. In compliance with the Bank Indonesia regulation, several industrial estates are anticipating converting their maintenance charges from US dollars to rupiah. IDR3,500,000 IDR3,000,000 IDR2,500,000 IDR2,000,000 IDR1,500,000 Greater Jakarta Industrial Maintenance Costs IDR1,000,000 USD0.10 IDR500,000 USD0.08 IDR0 2009 2010 2011 2012 2013 2014 USD/sq m/month USD0.06 1Q 2015 4Q 2015 Source: Colliers International Indonesia - Research USD0.04 Jakarta Province saw a 27% YoY increase in the minimum wage to IDR3,100,000. USD0.02 Minimum Wages in Western Greater Jakarta Bogor Bekasi Tangerang Karawang 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 USD0.00 Serang Source: Colliers International Indonesia - Research Minimum Wages Another issue noted by investors was the new minimum wage policy. The new formula was introduced to calculate wage increases using each province’s inflation rate and economic growth, therefore enabling businesses to better approximate the costs they are expected to incur. Government Regulation (PP) No. 78/2015 concerning wages stipulates a measured annual wage increase that takes into account the current fiscal year’s inflation and Gross Domestic Product (GDP) growth rates. The PP states that minimum wages that were multiplied by the inflation rate would ensure steady purchasing power, while multiplication by GDP rates would guarantee increases in overall productivity. IDR 3,500,000 IDR 3,000,000 IDR 2,500,000 IDR 2,000,000 IDR 1,500,000 IDR 1,000,000 IDR 500,000 IDR 0 2009 2010 2011 2012 2013 2014 1Q 4Q 2015 2015 Kota Serang Kabupaten Serang Kota Tangerang Kabupaten Tangerang Source: Colliers International Indonesia - Research In general, the four regencies in the western part of the Greater Jakarta area registered an average 24.8% increase compared to the same period last year. 4 Research & Forecast Report | Q4 2015 | Industrial Estate | Colliers International Minimum Wages in Eastern Greater Jakarta Minimum Wages in Central Java and East Java IDR 3,500,000 IDR3,500,000 IDR 3,000,000 IDR3,000,000 IDR 2,500,000 IDR2,500,000 IDR 2,000,000 IDR2,000,000 IDR 1,500,000 IDR1,500,000 IDR 1,000,000 IDR 500,000 IDR1,000,000 IDR 0 IDR500,000 2009 2010 2011 2012 2013 2014 IDR0 2009 2010 2011 2012 2013 2014 1Q 4Q 2015 2015 1Q 4Q 2015 2015 Kota Semarang Kota Surabaya Kabupaten Gresik Kabupaten Sidoarjo Kota Bekasi Kabupaten Bekasi Kota Pasuruan Kabupaten Pasuruan Kabupaten Karawang Kabupaten Purwakarta Kota Mojokerto Kabupaten Mojokerto Source: Colliers International Indonesia - Research Source: Colliers International Indonesia - Research The most expensive wages are mainly found in the eastern Greater Jakarta areas, such as Bekasi and Karawang. These locations have the highest increase compared to the other areas at 36.3% YoY. In several cities located in Central Java and East Java Provinces, the minimum wages increase significantly YoY by 37.1%. Minimum Wages in Southern Greater Jakarta IDR 3,500,000 IDR 3,000,000 IDR 2,500,000 IDR 2,000,000 IDR 1,500,000 IDR 1,000,000 IDR 500,000 IDR 0 2009 2010 2011 2012 Kota Bogor 2013 2014 1Q 4Q 2015 2015 Kabupaten Bogor Source: Colliers International Indonesia - Research With only two regencies in the Bogor area, the minimum wage increase was registered at 30.3%. 5 Concluding Thought In an attempt to spread industrial development across the archipelago, the government is preparing a number of fiscal incentives, aiming to attract investment and speed up the construction of industrial estates in these regions. At least 14 industrial estates outside the main island of Java, that cover an area of 22,484 ha, will be prepared in the five years to spur economic growth in all parts of the country. The Ministry of Industry is currently revising Government Regulation No. 24/2009 concerning industrial estates in assisting investors who intend to develop industrial estates to be able to receive tax reductions both from the central government and local administrations. Power supply is one of the main issues concerning most industrial investors. Other than preparing fiscal incentives, the government will also ease the procedures and requirements for obtaining electricity. Indonesia’s competitiveness in doing business has been challenged by other ASEAN countries that have been more successful at attracting foreign investors. Indonesia is now improving efficiency by reducing the number of licenses and the time to issue permits in order to become competitive and a more appealing country in which to do business. In order to cope with such issues and to spur more industrial investment into the country, the government recently announced a series of economic policy stimulus packages incorporating aspects of industrial estate development like the availability of a threehour licensing policy for investors intending to start projects that are worth at least IDR100 billion, employ a minimum of 1,000 employees and are located inside industrial estates designated by the Investment Coordinating Board (BKPM). Research & Forecast Report | Q4 2015 | Industrial Estate | Colliers International 502 offices in 67 countries on 6 continents Primary Authors: Ferry Salanto Associate Director | Jakarta 62 21 3043 6730 Ferry.Salanto@colliers.com United States: 140 Canada: 31 Latin America: 24 Asia: 39 ANZ: 160 EMEA: 108 $2.3 billion in annual revenue Colliers International Indonesia World Trade Centre 10th & 14th Floors Jalan Jenderal Sudirman Kav. 29 - 31 Jakarta 12920 Indonesia TEL 62 21 3043 6888 158 million square meters managed 16,300 professionals and staff About Colliers International Group Inc. Colliers International Group Inc. (NASDAQ: CIGI; TSX: CIG) is a global leader in commercial real estate services with more than 16,300 professionals operating from 502 offices in 67 countries. With an enterprising culture and significant insider ownership, Colliers professionals provide a full range of services to real estate occupiers, owners and investors worldwide. Services include brokerage, global corporate solutions, investment sales and capital markets, project management and workplace solutions, property and asset management, consulting, valuation and appraisal services, and customized research and thought leadership. Colliers International has been ranked among the top 100 outsourcing firms by the International Association of Outsourcing Professionals’ Global Outsourcing for 10 consecutive years, more than any other real estate services firm. colliers.com/indonesia Copyright © 2013 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Accelerating success.