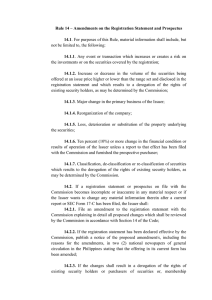

Form 44-101F1 Short Form Prospectus

advertisement