tweeter home entertainment group, inc. - Corporate-ir

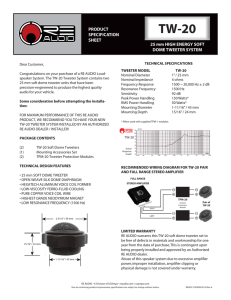

advertisement