Julia A. Peloso, CFP,® ADPA,® CRPC

advertisement

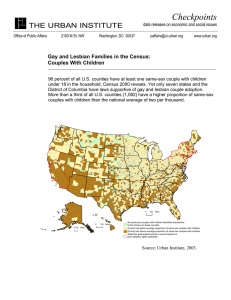

Julia A. Peloso, CFP, ADPA, CRPC ® ® Senior Portfolio Manager Vice President Wealth Advisor Accredited Domestic Partnership Advisor SM ® 2000 Westchester Avenue 1NC Purchase, New York 10577 914-225-6391 / Main 888-499-8544 / Toll- F ree 914-225-6770 / fa x www.morganstanleyfa.com/julia.peloso Julia.Peloso@morganstanley.com Julia Peloso, CFP, ADPA, CRPC ® ® ® Senior Portfolio Manager Vice President Wealth Advisor As an Accredited Domestic Partnership Advisor, I have the knowledge and SM experience to help make a difference in your life. Simplifying complexity through collaborative problem-solving and education Couples and families seek to live life on their own terms, but same-sex couples face additional challenges. The world, never a simple place, seems to get more complex every day. When you have a question about the impact of the latest news on you and your family, where do you turn for help? Julia’s clients often turn to her to help decipher news and events around the world. They know that she will take the time to help them understand how the global becomes the local and the personal. Particularly in the financial area, samesex couples’ decisions require deeper analysis and more careful planning as they work together to achieve many of life’s more important goals. What do you need to know to make sound financial decisions? What factors are likely to affect your family’s finances and long term planning? The more you know, the better able you and your family will be to live life on your terms. We have ample evidence that even the most sophisticated technology cannot accurately predict human behavior. Julia’s focus on her clients’ emotional needs as well as their financial goals and aspirations means a more conservative approach to risk management. Strategies are framed in the context of trade-offs. Julia works with her clients to help them prioritize the financial and emotional trade-offs that have the most value to them. J U LI A A . PELOSO, CF P ®, A DPA®, CRPC® 3 My background Julia Peloso, cfP®, aDPa®, cRPc® Senior Portfolio Manager Vice President Wealth Advisor Since 1984, I have been helping people transform their financial dreams into realities. With my first love being teaching, I have a passion for breaking things down in order to understand how they work, and then educating others about what I have learned. A key part of that process is figuring out how changes to components affect the whole, mostly in order to focus on the few pieces that can have the most impact on changing the outcome. LGBT people have many of the same dreams held by everyone else. For us, and for many reasons, it can be more difficult to make those dreams into realities. I believe that education and professional training are critical, but not the most valuable tool I offer my clients. I am a student of human nature, and never underestimate the impact our emotional needs have on our behavior. Through my own personal experiences of more than 30 years and my technical knowledge and experience I have an appreciation of our capacity to be irrational and act against our best interests. I value my technical knowledge, and have continued to pursue it, earning certifications targeted at improving my skills. I am a CERTIFIED FINANCIAL PLANNERTM, a CHARTERED RETIREMENT PLANNING COUNSELORSM and an Accredited Domestic Partnership AdvisorSM. Each of these designations requires annual or bi-annual continuing education, including both technical skills and ethics. I bring my full self to work every day, and harness my knowledge and experience to help my clients plan for and secure their financial futures. J U LI A A . PELOSO, CF P ®, A DPA®, CRPC® 5 On your terms. Couples and families across America seek to live life on their own terms, but same-sex couples face additional challenges. Particularly in the financial area, couples’ decisions require deeper analysis and more careful planning as they work together to achieve many of life’s most important goals. What do you need to know to make sound financial decisions? What factors are likely to affect your family’s finances and long term planning? The more you know, the better able you and your family will be to live life on your terms. 6 Morga n S ta n le y 8 12 knowing the law / p8 / The more you know about laws in your state and across the country — and about how they are changing — the more control you can have over your life. same-sex family finances / p12 / With health care expenses, employee benefits, income taxes and the treatment of dependents — building a workable financial strategy requires navigating the special considerations that apply to LGBT families. planning your retirement / p16 / Achieving the flexibility and financial independence you want in retirement will require a careful analysis of the benefits that are — and aren’t — available to same-sex couples. 16 controlling your legacy / p20 / 20 Your legacy is the opportunity to pass on the material rewards of your life in the way that best fulfills your goals and reflects your values. 7 The laws of your state will have an effect on your life with your partner — on your family structure, shared finances and long term plans. Do you want to marry or have a less formal relationship? Do you plan to have children or adopt? Are you already married? Do you already have children? 88 Morga n S ta n le y Are you happy where you live? Are the laws in your state LGBT-friendly? kNOWINg the LaW The MORe YOu kNOW AbOuT lAWS IN YOuR sTaTe and aCross The CounTry — and abouT hoW They are Changing — The more ConTrol YOu CAN hAVe OVeR YOuR lIFe. If you are planning for the future with a same-sex partner, your decisions and strategies will necessarily be affected by the legal environment in which you make them. Begin with the big picture by considering your answers to the following questions: How formal do you want your relationship to be? Where do you want to live? What about children? There are legal dimensions to each of these questions, and to many others that you will need to address — a situation made more complex by the rapid evolution of state laws across the country. J U LI A A . PELOSO, CF P ®, A DPA®, CRPC® 9 The laws of the land Depending on where you choose to live, current federal and state laws differ widely, creating a complex planning environment for LGBT couples. Federal law. Depending on their state of residence, same-sex couples have various legal scenarios to work with. At the federal level, however, the Defense of Marriage Act defines marriage as between one man and one woman. Under this law, the federal government does not recognize same-sex marriage. This means that you and your partner cannot file joint income tax returns, you cannot claim the estate tax marital deduction and your retirement assets will not automatically roll over to your spouse. In addition, same-sex couples are not entitled to their partner’s Social Security benefits. State laws. States can make their own determination about same-sex marriage. If you live in a state that allows same-sex marriages, you are treated in the same way as a heterosexual couple with regard to state income taxes. You also enjoy spousal inheritance rights, as well as spousal election at death. That means a surviving partner has the right to claim what the state deems is a fair share of the deceased spouse’s estate, rather than what is specified in a will. Other states are not required to recognize an existing same-sex marriage, so if you and your partner move, you will need to educate yourself about the laws of your new home state. What is included in a cohabitation agreement? This legal contract between you and your partner formally defines the financial status and obligations in your relationship — and can be particularly important if you split up. recitals Helps to ensure clarity by stating when you began living together and providing a brief history of your relationship disclosure of assets and liabilities A balance sheet listing the value of each asset and liability along with ownership, an important financial baseline distributing property in case of death or breakup of relationship May reduce conflict and cost by detailing what will happen to assets in the event of death or a breakup obligating financial support Defines expectations and responsibilities for ongoing support when one partner is the main breadwinner in a relationship that dissolves; similar in concept to alimony handling the payment of debts Details who will be responsible for the payment of debts both during the relationship and if it dissolves dividing a principal residence upon breakup or at death Lessens the likelihood of a battle over the family home if you break up defining how children will be taken care of in the event of dissolution of the relationship Provides guidance in the case of a breakup involving children by spelling out child support, custody and visitation rights; binding in marital situations only, but valuable in nonmarital situations as well choice of law Helps to ensure that the cohabitation agreement can be carried out by specifying a mutually agreed upon state that recognizes such agreements 10 Morga n S ta n le y Legal tools that can help protect you Despite differences in law, there are many financial and legal tools you can use to protect yourself and those you love. Creating a Cohabitation Agreement. A cohabitation agreement is a legal contract between two individuals who are living together in an intimate relationship. It is designed to simulate, as close as possible, the obligations and rights that married people have toward each other. The agreement typically details the length of the relationship, includes a statement of both partners’ assets and liabilities and specifies whether their assets and income should be treated as separate or joint property. You and your partner can also make specific provisions that cover the distribution of assets in the event of death or separation, financial support if one of you is the primary breadwinner, responsibility for repayment of debts and support and custody arrangements for your children. Titling assets. Same-sex partners should give careful consideration to how their property is titled. If the home you and your partner share is in your name only, it will pass to the inheritors named in your will or, if you have no will, state law will govern who gets the property. In the case of a will, others may contest the will in its entirety, or some of its provisions. One way to avoid this problem is to share ownership as “joint tenants with rights of survivorship” (JTWROS). A JTWROS title allows a surviving partner to inherit property outright, regardless of the terms of the will or state law. Before creating a JTWROS, you and your partner should consult with a tax specialist to decide if this is a good choice given your specific situation. Designating beneficiaries. Naming your partner as the beneficiary of an individual retirement account (IRA), an annuity or a life insurance contract is a simple way to make sure these assets end up where you want them in the event of your death. Same-sex couples are not entitled to their partner’s Social Security benefits or, generally speaking, their pension benefits. However, some companies now offer pension benefits to domestic partners. Drafting a will. A will specifies to what person, persons or charities everything you own goes upon your death. It is essential to have one. In your will, you can also name a guardian for your children. This is important for samesex couples, particularly if you are the biological or adoptive parent. Without a will, the courts may choose a guardian you did not intend, and your partner may not be able to even visit your child should something happen to you. Ask for Advice Given the complexity of the legal backdrop and the long term implications of your decisions, it is wise to seek professional advice. Lawyers, Financial Advisors and tax professionals are all good sources of objective guidance. You may want to find a Financial Advisor with the Accredited Domestic Partnership designation. These individuals have studied the specific issues domestic partners face with regard to wealth transfer, retirement planning and federal taxation, among other concerns. As with any professional service, choose someone you trust who communicates clearly and is responsive to your needs. same-sex marriage and state law States have made provision for same-sex couples in several different ways. Many still limit marriage to relationships between a man and a woman, as federal law does. Others allow same-sex couples to legally marry in the state and enjoy the same rights as married heterosexual couples. Still other states allow partnerships with full or limited rights, including civil unions, domestic partnerships, designated beneficiaries and reciprocal beneficiaries. J U LI A A . PELOSO, CF P ®, A DPA®, CRPC® 11 2010 646,476 same-sex families4 313,599 male 332,877 female 2000 601,209 same-sex families5 304,148 male 297,061 female 1990 145,130 same-sex families5 81,343 male 63,787 female 12 MORgA n S tA n LE y same-sex family finances with Health care expenses, employee benefits, income taxes and the treatment of dependents — b uilding a workable financial strategy requires navigating the special considerations that apply to LGBT families. As you and your spouse or partner deal with the practical aspects of life together, you will quickly encounter issues related to taxes, health care, insurance and, if offered to you, employee benefits. Then, if you have or adopt children, other questions will emerge. Every family must deal with these issues to some degree but, as a same-sex family, you will face additional considerations. The decisions you make can have a real and immediate dollars-and-cents impact. It’s important to understand all your opportunities, as well as the attendant responsibilities. J U LI A A . PELOSO, CF P ®, A DPA®, CRPC® 13 Shared resources and taxes Under US law, almost any asset can be jointly owned by two persons, with the exception of retirement accounts. That means you have the opportunity to decide whether to commingle your assets with your spouse or partner, or keep your assets separate. Allocating ownership for tax purposes. Income and expenses associated Setting up Accounts Some couples choose to completely integrate bank accounts and elect one partner to be in charge of the finances. Others opt to maintain separate checking or cash-management accounts — divvying up the expenses and assigning each partner specific financial responsibilities. Another idea is to create three bank accounts — yours, mine and ours. With the first two accounts, each partner pays personal expenses and any other responsibilities. With the shared account, you pay for the expenses and investments you make as a couple and for your family. are paid directly to the service provider. Your tax advisor can help you evaluate whether you may be subject to gift taxes and what you can do about it. with your holdings can be allocated in whole or in part to either of your tax returns. How Joint versus Your tax advisor can help you divide them individual redepends on your turns. When you evaluate whether you filing federal respective tax may be subject to gift situations; the returns, sametaxes and what you can person with sex partners can do about it. the higher tax rarely be depenburden might dents of each want to claim other and cannot deductions for such things as mortgage file jointly. Each partner must file indiinterest and capital losses. vidually — which can add substantially to The gifting issues. Keep in mind that the combined tax burden of the couple. the IRS considers some asset transfers Plus, in those states where a same-sex between same-sex couples as taxable gifts. couple is entitled to file a married state Gift taxes may be levied if one partner return, they must also file a “dummy” gives more than $14,000 to the other married federal return with the state in partner, unless the money is for certain order for their state taxes to be calculated medical and educational expenses that properly and to appear correct. Taxes and children While you and your same-sex spouse or partner will not be able to file a joint federal tax return, you can take advantage of tax deductions available to all families with children. For example: •If you and your partner have a child •If one of you claims a dependent and both of you qualify as legal parents, either biological or adoptive, you can decide which of you claims the child as a dependent on your federal income tax return. One of you may also be able to file as “head of household,” which may help to reduce taxes. If you have two children, you each may be able to claim this status. Be sure to discuss your options with a qualified tax professional. 14 Morga n S ta n le y child age 16 or younger on your return, you may be eligible for a tax credit of $1,000 per child. The credit is reduced as income increases. If you adopt children, one of you may be able to claim an adoption credit of up to $12,650 for qualified adoption expenses for each eligible child in the year that child is adopted. There are income based limits and phaseouts, so consult your tax professional. • what if you couldn’t work? If you are the primary breadwinner, it may be wise to consider what could happen if you became ill or disabled. 1 2 Could you replace your income? Can your partner make up the difference? 3 How long would you be able to pay your bills on one (or no) income? 4 Disability insurance could potentially replace a portion of your income. Factoring in the cost of health care All families need to set aside money for major goals such as buying a home, sending a child to college or retiring comfortably. Same-sex couples may also need to make specific provisions for health care expenses. To begin with, not every employer will extend coverage to a same-sex partner. According to the Human Rights Cam- sure you understand your company’s paign’s 2012 Corporate Equality Index, specific policies. 89% of Fortune 500 employers extend Coverage for children. Health domestic-partner coverage to employees coverage for children often depends on with same-sex partners. If your partner’s the relationship of the child to the ememployer does not provide coverage for ployee. If the employee is the biological you, you can research whether or not or adoptive parent, then most employyou can purchase ers will treat the health insurance child as they would from your own emfor any other famHealth coverage for ployer. You can also ily. If your son or children often depends investigate the cost daughter is your of an individual partner’s biological on the relationship of plan or one offered or adoptive child, the child to through a group or coverage will dethe employee. association, which pend on the terms may be more cost of your company’s effective than an policy. individual plan. COBRA coverage. The Consolidated Coverage and taxes. Even if your Omnibus Budget Reconciliation Act employer’s coverage does extend to (COBRA) gives former employees the your partner, the value of the benefit right to temporary continuation of health is counted as income paid to you and coverage at group rates. However, if is included in your gross income by your company provides health insurfederal law. Some companies are now ance for both of you and you change paying the added taxes or reimbursing jobs, your partner will not be eligible employees for the added tax burden, for benefits under the federal governbut the practice is not yet universal. Be ment’s COBRA program. Keeping current Decisions regarding retirement assets (and many other financial matters) can be complex and technical. Make sure you seek the guidance of a qualified advisor, particularly a tax attorney or certified public accountant, as you consider various courses of action. That’s especially important at a time when both state and federal laws are in flux. If you also want to monitor legislative developments and planning strategies on your own, online resources available to you include: • Lambda Legal — www.lambdalegal.org. They offer a range of updates and publications that may help you in planning. • The Williams Institute — www.williamsinstitute .law.ucla.edu. Part of the University of California, Los Angeles Law School, the institute tracks demographic trends and legal developments across the US. J U LI A A . PELOSO, CF P ®, A DPA®, CRPC® 15 PlANNINg your ReTiReMenT AChIeVINg The FlexIbIlITY AND FINANCIAl INDePeNDeNCe YOu WANT IN ReTIReMeNT WIll RequIRe a Careful analysis of The benefiTs ThaT are — and aren’T — aVailable To same-sex CouPles. Successful retirement planning takes place on several levels. At the macro level, your plan needs to take account of inflation, which can significantly erode the purchasing power of your savings. Then there are all the issues that are unique to you and your family, including 16 MORgA n S tA n LE y where you want to live, what you plan to do and how much income you can plan for. For many same-sex couples, the support system presumed in retirement and disability planning may not exist, so ensuring financial independence is essential. your generation is likely to live longer in retirement than any before it. that creates more opportunities for enjoyment — and more years to incur substantial costs. 70 after age 65, about 70% of all individuals will need some type of long term health care, and more than 40% will need nursing home care.7 2x 80s On average, if you are a 65-year-old man, you will live to be 82; if you are a 65-year-old woman, 85.8 Gay and lesbian individuals age 60 to 90 are more than twice as likely to live alone.6 J U LI A A . PELOSO, CF P ®, A DPA®, CRPC® 17 The realities of retirement assets Retirement planning for same-sex couples is complicated by the fact that your spouse or domestic partner will be considered a nonspouse beneficiary under federal law in almost every circumstance. The differences between spouse and nonspouse can be mitigated somewhat by proper beneficiary designation on accounts like 401(k) plans but, under current laws, you need to take differences in distribution and taxation rules into account in your planning. LGBT Retirement Communities Currently there are about 25 existing or planned gay and lesbian retirement communities. Many adults over 50 choose these communities because they desire: To be independent from their families To increase social opportunities To be in a community of people with similar lifestyles and interests Beneficiary designation. If you have a 401(k) and 403(b) plan or an IRA, assets in the account at your death will pass to the beneficiary you designate in the account documents. If you do not designate a beneficiary, unless the plan or IRA documents provide differently, the assets will become part of your estate and distributed according to your will. If you have no will, the state will determine who receives the assets, which may well not be your partner. In either case, assets will be subject to the probate process. Be sure to review your beneficiary designations regularly, and make adjustments whenever required by changes in your family situation. IRAs. Rules regarding the rollover of inherited IRA assets were liberalized in 2007 but still provide less flexibility than that accorded under spousal rules. For example, your same-sex spouse or partner may roll over assets that pass to him or her as beneficiary to another IRA, helping to protect the tax-advantaged status of the assets. However, distributions cannot be delayed until the beneficiary reaches age 70½ as is the case of a federally recognized spouse. Your beneficiary will have to begin receiving distributions immediately. 401(k) assets. Assets in 401(k) plans are now governed by rules similar to those covering IRAs. As of 2010, a same-sex spouse or partner, while still considered a nonspouse beneficiary under federal tax law, can protect the tax-deferred status of plan assets by rolling them over into an IRA. Still, just as with assets rolled over from an IRA, your beneficiary must begin taking distributions immediately, without the option of waiting until age 70½. Social Security. Your same-sex spouse or domestic partner will not qualify as a spouse under current federal law. That means your Social Security benefits will cease upon your death. Likewise, should your partner die first, you will no longer receive benefits as you would if spousalcontinuation rules applied. how inflation erodes retirement savings. Here’s what happens to the purchasing power of $1 million, assuming the historical 3.5% inflation rate, over 10, 20 and 30 years. Put another way, you would need $2.81 in 30 years for every $1.00 of purchasing power held today.9 2012 $1 Million 18 Morga n S ta n le y 2022 $708,918.81 2032 $502,565.88 2042 $356,278.41 The long term care (LTC) question. Long term care includes services provided to anyone with a chronic disease, disability or sudden illness who requires assistance with “activities of daily living” (ADLs) such as eating, bathing, dressing or moving from a bed to a chair. It also includes supervision of individuals with Alzheimer’s disease and other mental illnesses usually associated with aging. LTC is expensive, and getting higher every year, as this table shows: years of care today 10 years 20 years 1 $77,745 $120,608 $196,458 2 $245,091 $380,217 $619,333 3 $429,590 $666,425 $1,085,553 Figures in the table were computed by Genworth based on information from the 2011 Cost of Care Survey and represent room costs for an individual. Conducted by CareScout(R) 04/11. These costs can rapidly erode even well funded retirement plans, leaving you, your partner or your children facing major, unexpected expenses. Given the magnitude of the potential costs, an increasing number of people are making LTC insurance a part of their retirement plan, and it is clearly something that same-sex couples may want to consider. HIV, LTC and insurance An HIV-positive status complicates LTC and other insurance coverage. If either you or your partner is HIV-positive, you should be aware that: When your business partner is your life partner If you have a family business, you may want to consider a partnership agreement that protects you and your partner legally. Your Financial Advisor can work with your attorney to help maximize the benefits to which gay and lesbian business partners are entitled. For business owners whose gifts or estate plans might be challenged by other family members, the business partnership may also provide a recognized relationship to strengthen those plans. It is illegal for an LTC services provider coverage as part of their group benefits to discriminate against an HIV-positive plans. In such situations, the coverage is person, denying care solely because of usually available on an open-enrollment, HIV. Only when speno-underwriting basis cific circumstances to all applicants. If you Increasingly, are met — conditions are HIV-positive and employers are offering that apply to all pawork for such a comLTC coverage as part tients — can the right pany, you may want to of their group benefits. to care be denied. consider this option. It is legal for an Questions regarding insurance company, unlawful discriminaunder preexisting-condition rules, to tion, insurance coverage and employee decline the application for LTC insur- benefits are complex and vary from inance by an HIV-positive person, making dividual to individual. Be sure to discuss this insurance difficult to purchase for with a qualified legal advisor if you have many individuals. questions about the rules or believe you Increasingly, employers are offering LTC have been discriminated against. J U LI A A . PELOSO, CF P ®, A DPA®, CRPC® 19 CONTROllINg your LeGacY YOuR legACY IS The OPPORTuNITY TO PASS ON The MATeRIAl ReWARDS OF YOuR lIFe IN The WAY ThAT beST FulFIllS YOuR gOAlS AND ReFleCTS YOuR VAlueS. There are many reasons to create an estate plan. The most common is to help ensure that your property passes to the people you wish to benefit in the way you desire. The same is true for gay and lesbian couples, but the complex and evolving legal environment sometimes presents added challenges. Proper planning can’t reconcile all the differences between federal and state laws, but significant opportunities exist to enhance control and minimize taxes, conflicts and costs. 20 MORgA n S tA n LE y Many of the traditional estate planning tools and strategies take on a new dimension of importance for same-sex couples. For example, trusts and gifting can add a level of certainty to your planning, helping to minimize family issues by providing clarity while greatly reducing the risk of potential legal disputes. By defining your goals and working with a qualified lawyer, accountant and Financial Advisor, you can achieve a high degree of confidence that your wishes will be carried out. Estate planning holds many benefits, including comfort for you because you can have confidence that your assets will go to the people and causes you intend. 4. 1. Lessening tax burdens Fulfilling charitable and other goals 5. Avoiding family conflict 2. Avoiding potential reductions in your net worth 6. Retaining control over your wealth 3. Speeding up settlement of your estate J U LI A A . PELOSO, CF P ®, A DPA®, CRPC® 21 A fundamental tool: The revocable living trust The revocable living trust is the most popular trust vehicle used today and probably the most basic. As the name suggests, it’s a legal arrangement made during your life for the purpose of managing and passing on assets. You can use it to involve your partner or spouse in the management of your finances and investments should you become incapacitated, and to ensure that your assets pass to your partner or spouse upon your death. The key word in revocable living trust is revocable. As grantor, you can make changes to or terminate a revocable living trust at any time. At your death, the trust becomes irrevocable and the instructions you indicated in the trust document are carried out by the trustee. Those instructions can include distributing the assets to your partner, spouse or others. Even though assets funding your revocable living trust are now owned by the trust, you, as grantor, retain control. This includes amending the terms and provisions of the trust and changing the trustee, beneficiaries and asset management approach. Assets you place in the trust are managed by the trustee you choose. Many people who have revocable living trusts name themselves as trustee. This is perfectly legal and appropriate for many situations. Alternatively, a third-party trustee can manage the assets with input from you for the benefit of the beneficiaries. It is very important that you choose a qualified and capable current or successor trustee to ensure that the trust provisions are carried out properly. Assets in a revocable living trust avoid the public disclosures of probate — a major reason why individuals establish revocable living trusts — a nd are often distributed more quickly and on a confidential basis. A sampling of what trusts can do your goal consider benefit reduce estate taxes Charitable trust Supports charitable organizations while offering tax benefits and estate planning advantages Qualified personal residence trust (QPRT) May remove the value of your home from your estate while you continue to live in it provide support for children Minor’s trusts Allows greater flexibility and control than direct gifts, and possible tax savings solidify financial support for surviving spouse in complex family situations Qualified terminable interest property trust (QTIP) Provides for lifetime support for surviving spouse while allowing control of ultimate distribution of assets. May be applicable for state tax deduction. Contact your tax advisor for more information. “freeze” the value of appreciating assets for estate tax purposes Grantor retained annuity trust (GRAT) Locks in asset value on date of transfer to trust, and appreciation is passed to beneficiary free of estate taxes 22 Morga n S ta n le y The basic documents Lesbian and gay couples may need to be more aggressive than other couples in planning for the management and disposition of assets, both during their lifetimes and at death. As a result, certain strategies and documents may take on greater importance for you, and you should discuss the following with an attorney: your will. Discuss a “no contest” clause to prevent challenges from family members. living will. This legal document instructs health care professionals about your wishes regarding life-sustaining procedures in the event you become terminally ill. medical durable power of attorney. Also known as a health care proxy, this document allows you to name a person to act as your representative to make health care decisions on your behalf if you become seriously ill and are unable to make these decisions for yourself. In the absence of a health care proxy, the closest blood relative will generally be given the authority to make these decisions. Without this document your partner can be left standing on the sidelines while medical decisions are made. financial durable power of attorney. Like a health care proxy, a financial durable power of attorney authorizes another person to act as your representative to make financial decisions on your behalf. guardianship appointment. Appointing a guardian helps ensure that the person you prefer assumes responsibility for a child upon your death. Keep in mind that guardianship does not override the rights of a biological parent. Six questions that can help you plan effectively 1 Who should benefit from your estate? 2 Is your partner or spouse financially dependent on you? 3 If children are involved, who has custody? Who will be the guardian? 4 Do you wish to treat all the children equally? 5 Do you have specific goals for certain beneficiaries? 6 Do you wish to leave any portion of your estate to a charitable organization? domestic-partnership agreement. As a useful planning alterna- tive, this agreement is a legal contract outlining the distribution of assets upon termination of the relationship prior to death. Beneficiary Designations. As described earlier, review any retirement, insurance or other beneficiary elections to make sure wishes are respected. The power and satisfaction of gifting One way — perhaps the best way — to ensure that your assets are transferred as you intend is to make a lifetime gift. Making full use of the available estate and gift tax exemptions and exclusions is especially important for domestic partners or married gay or lesbian couples, who do not receive the same benefits under the law as do married heterosexual couples. When you consider gifting, keep in mind that: You can make annual gifts to your partner, spouse and/or children directly or in trust for their benefit — up to $14,000 per year ($28,000 for a married couple) to each of as many beneficiaries as you wish. Gifts greater than $14,000 ($28,000 for married couples) will be subtracted from the individual or couple’s lifetime gift tax exemption and subject to tax. Under the American Tax Payer Relief Act of 2012, the federal estate and gift tax exemption is $5 million for an individual and $10 million for a married couple. These amounts are indexed for inflation making the exemption for individuals $5.25 million and $10.5 million for married couples in 2013. In 2013, you could give your partner or spouse a tax-free gift of up to $5 million, and you and your spouse could transfer up to $10 million to children or a trust. Additionally, there is an exclusion for gifts made under the medical and educational expense provision of the Internal Revenue Code. These transfers must be for medical expenses or tuition and must be made directly to the health care provider or educational institution. There is no dollar limit for this exclusion. J U LI A A . PELOSO, CF P ®, A DPA®, CRPC® 23 Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. Morgan Stanley Financial Advisors do not provide tax or legal advice. This material was not intended or written to be used for the purpose of avoiding tax penalties that may be imposed on the taxpayer. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters. Morgan Stanley Smith Barney LLC offers a wide array of brokerage and advisory services to its clients, each of which may create a different type of relationship with different obligations to you. Please contact us to understand these differences. Morgan Stanley Smith Barney LLC is a registered brokerdealer, not a bank. Where appropriate, Morgan Stanley Smith Barney LLC has entered into arrangements with banks and other third parties to assist in offering certain banking-related products and services. Unless otherwise specifically disclosed to you in writing, investments and services offered through Morgan Stanley are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks and involve investment risks, including possible loss of principal amount invested. Asset allocation and diversification do not guarantee a profit or protect against loss. Tax laws are complex and subject to change. This information is based on current federal tax laws in effect at the time this was written. Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors do not render advice on tax and tax accounting matters to clients and are not “fiduciaries” (under ERISA, the Internal Revenue Code or otherwise) with respect to the services or activities described herein. This material was not intended or written to be used, and it cannot be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer under U.S. federal income tax laws. Clients should consult their own legal, tax, investment or other advisors, at both the onset of any transaction and on an ongoing basis to determine the laws and analyses applicable to their specific circumstances. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trusts, estate planning, charitable giving, philanthropic planning or other legal matters and before establishing a © 2013 Morgan Stanley Smith Barney LLC. Member SIPC. retirement plan or to understand the tax, ERISA and related consequences of any investments made under such plan. This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The securities discussed in this material may not be suitable for all investors. Morgan Stanley recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial adviser. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. Insurance products are offered in conjunction with Morgan Stanley’s licensed insurance agency affiliates. http://www.lambdalegal.org/publications/nationwide-status-same-sexrelationships 2 Same-sex couples who married in 2008 remain married; same-sex marriages halted by Proposition 8 in November 2008. Broad domestic partnership law still in effect. 3 Same-sex marriage subject to voter referendum in November 2012. Earlier laws remain in effect. 4 http://williamsinstitute.law.ucla.edu/wp-content/uploads/Census2010Snapshot-US-v2.pdf 5 “Gay and Lesbian Families in the United States,” Tax Policy Center, Urban Institute and Brookings Institution. August 22, 2001. http://www.taxpolicycenter.org/publications/urlprint.cfm?ID=1000491 6 “Aging as Ourselves: LGBT Aging Health Issues for Health Care Providers,” page 21. Loree Cook-Daniels, 2008. http://www.dvsacmiami.org/Resources/ Complete%20curricula%20text%20with%20references.pdf 7 National Clearing House for Long Term Care Information, http://www.longtermcare.gov/LTC/Main_Site/Understanding/Definition/Know.aspx 8 Social Security Actuarial Life Table 9 Morgan Stanley, Financial Planning Group 1 CRC625294 (03/2013) 7491981 04/2013 CA Ins Lic #0F46909 CS 7472485 04/13

![-----Original Message----- From: Elizabeth H. Maury, Ph.D. [ ]](http://s2.studylib.net/store/data/015587840_1-99e1c0d77ec14fce523cbff8ea4fb89d-300x300.png)