Check List for Modification of details in existing IEC Number

advertisement

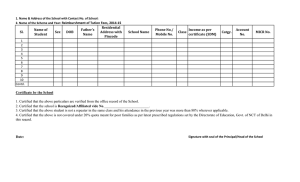

Check List for Modification of details in existing IEC Number (Companies) (Para 2.12 of FTP & Para 2.8, 2.9, 2.9.1, 2.9.2, 2.9.5 & 9.1 of HBP) (Prepared by Addl. DGFT, Mumbai) Whether following documents have been submitted I 1 2 3 4 5 6 7 8 9 10 Documents Covering letter in applicant’s letter head duly signed by authorized signatory ANF 2A (Part A, C and D) with each individual page duly signed by authorized signatory Original IEC Certificate Documentary evidence for Date of Incorporation, by way of self certified copy of Certificate of Incorporation issued by ROC (Registrar of Companies) As proof of change in name and/or constitution of the company: Self certified copy of Certificate of ROC indicating the change of name. In case of change in Directors, copy of Form 32 and Receipt of payment made to ROC. As proof of change in the address of the company, a self certified copy of Form 18 filed with ROC, copy of Receipt of payment made to ROC and the self certified downloaded copy of page of Ministry of Corporate Affairs website indicating the change of address of company For proof of addition of branch/factory, etc., documentary evidence like (any one): Shop & Establishment Certificate/Excise Registration Certificate/ Sales Tax Registration Certificate/Electricity Bill/Landline Telephone Bill, etc. In case there is change in PAN number of the company due to change in constitution/ownership of company (for example, from Private Limited Company to Public Limited Company, etc.): Self certified copy of new PAN card In case the applicant requests modification in name/address/ constitution after 90 days of such change: Application for condonation of delay If, in case condonation of delay as per point ‘9’ above is accepted, Demand Draft of Rs.1000/- in favour of Addl. DGFT, Mumbai. Notes: Total number of pages in the relevant document 1. The proof of person authorised by the company/firm should be enclosed by way of valid documentary evidence in nature of a Board Resolution/ Government Order/ Partnership Deed/ Power of Attorney, etc. as may be relevant. 2. All above documents may be kept secured in a file cover. 3. An Authorised signatory would include Proprietor/ Partner/Karta/Trustee/ Director/Power of Attorney holder by way of Board Resolution in case of Public Limited Company/ person authorized by Govt. order in case of PSU. 4. The above documents may be sent by post or hand delivered at the Office of Addl. Director General of Foreign Trade, Nishtha Bhavan, 48, Sir Vithaldas Thakersey Marg, Churchgate, Mumbai-400 020. 5. Kindly tick mark the relevant options given in point 5 of part ‘D’ in ANF 2A.