Annual report

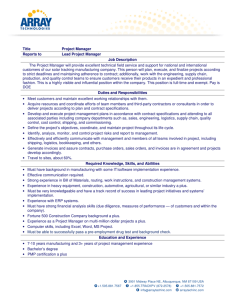

advertisement