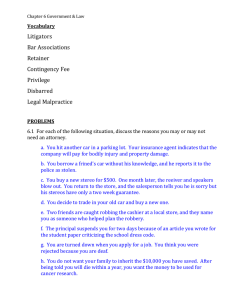

Nonrefundable Retainers - The Fordham Law Archive of

advertisement