If you have any questions regarding your UI rate or LEC, please

advertisement

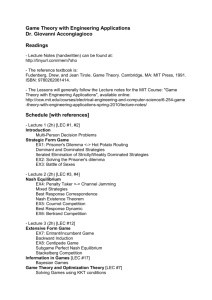

SELF- INSURED SCHOOLS OF CALIFORNIA Schools Helping Schools Aprii 8, 2013 TO: District Superintendents of Kern County School Districts FROM: Nick G. Kouklis, Chief Executive Officer Self- Insured Schools of California SUBJECT: 2013- 2014 Unemployment Insurance ( UI) Contribution Rate and Local Experience Charge ( LEC) Information showing your district's 2013- 2014 Unemployment Insurance Contribution Rate and Local Experience Charge is enclosed. Both the contribution rate and local experience charges are set by Schools Empfoyees Fund which is administered by the Employment Development Department ( EbD). district' s The enclosed information should be used to prepare your 2013- 2014 tentative and final budgets. Rate for the upcomin,g fiscal year has had 0. 05% for the 2013- 2014 fiscal year. We are pleased to report that the UI Tax a significant reduction from 1. 10% of payroll to Although the UI tax rate is identical for all districts, the Local Experience Charge ( LEC rate), which each is similar to an experience modification factor, varies from 0% to 5% according to district' s Unemployment Insurance reserve ratio. The reserve ratio and LEC rate are . shown on your district' s EDD form DE56. The ocal Experience Charge is billed directly from EDD as a separate expense each quarter. If you have any questions regarding your UI rate or LEC, please contact Carmen Gonzales at the SISC office. Carmen Gonzales may be reached at ( 661) 636- 4416 or at caaonzalesC kern. org C: District Business Official DiStrict UI Contact Priscilla Quinn, Director, District inancial Services, Kern County Supt of Schools NGK: cg Enc. Bakersfield, CA 93303- 1 84 7 P. Q Box 1847 1300 17th Street- CITY CENTRE Bakers field, CA ( A Joirrt Pow ers Authority administered by the Kern Courrty Superirrtenderrt of http:// www.kern. org/sisc/ ` 661) 636- 4710' FAX( 661) 636- 4156 Schools OFfice, Christine Lizardi Frazier, Superintendent 1 E EDD Employment Development EDD D e pa r t m e n t Po sox s2ss8o, MIC 13 SACRAMENTO, CA 95814-0001/( 916) 653- 5380 Statof California Letter ID: Issued Date: March 31, 2013 942- Acoount ID: ATTN: SELF- INSURED SCHOOLS OF CA( SISC) SCHOOL DISTRICT Sp.MPLE PO BOX 1808 BAKERSFIELD CA 93303- 1808 IMPORTANT NOTICE Notice Unemployment Insurance( UI) of Contribution Rate This is not a bill. do not oav Lhjs amount. Local Experience Charge artd This is to inform you of yQUC Unemployment Insurance( UI) Contribution Rate and Locai rience Charge( LEC) Rate for the fiscal LEC) Rate Statement for School Employess Fund Participar ts for Fiscal Ysar: 2013/ 2014 Your UI 0.05 6 CoMribution Your LEC Rate 10 0. 5, Alt School Employee' s Wages or are 152) Year shown above. The foliowing is a breakdown of your UI axour f balance and the factors used to calculate your LEC Rate. YOUR UT ACCOUNT BALANCE IS NONREFUNDABLE. Taxable Wages or Unemploymer t Insurance. 1. Cumulative reserve 2. UI Corrtributions balance paid as of from 7/ 1/ 11 3. LEC paid from 7/ 1/ 11 0. 00 6/30/ 11 0. 00 to6/30/ 12 to 6/30/ 12 0. 00 0. 00 by the SEF 4. Interest distributed for positive reserve account employers only) 0. 00 TOTAL CREDITS 5. 6. UI benefitss charged to your accourrt from 7/ 1/ 11 0. 00 to 6/30/ 12 TOTAL CHARGES 7. New UI account balance as of 6/30/ 12 0. 00 8. Reserve ra6o for LEC Ranking/ Rate 0. 00 line 7 divided by line 6) LEC RANKING P ND PERCENTAGE MATRIX Reserve Ratio Rank LEC Pen;entages Negefive to < 1. 00 1 15% 1. 00 to < 2.00 2 p 2. 00 to < 3.00 3 5 3. 00 a 4 0% 4 0 96 more o,r, 0 * Unrated Acoounts- no benefit charges with a positive accourrt balance New SEF Accountsfor the first three compl ed fiscal years. 10° DE 56 Rev. 8( 6- 11) PO BOX 826880, MIC 13, SACRAMENTO, CA 95814-0001 www•edd•ca•9ov EXPLANATION OF THE NOTICE OF UNEMPLOYMENT INSURANCE CONTRIBUTION RATE AND LOCAL EXPERIENCE CHARGE RATE STATEMENT FOR SCHOOL EMPLOYEES FUND PARTICIPANTS ( DE 56) The Notice Unemployment Insurance( UI) Contribution of Participants( DE 56) informs you of contribution rates for a Fiscal Year, 30. It also shows the items your UI July 1 through June and to determine used 1. Cumulative resenre balance- Shows the ending balance in your UI reserve account as of June 30. Rate and Local Experience Charge( LEC) Rate Statement for School Employees Fund( SEF) LEC your LEC 2, UI Contributions paid from- Shows the total of all UI ntributions paid by you from July 1 through June 30. rate and the balance in your UI reserve account as of June 30. 3. LEC paid from- Shows the total of all LEC from July 1 through June 30. MAIL DATE This is the official mail date for this notice. Due to buik some notices are mailed prior mailing, to this date. distribution by the SEF- Shows the amount credited to positive UI reserve accounts for interest earned on the ACCOUNT NUMBER This is the number assigned to you when you registered Department( EDD). This number is assigned to you for UI only. Please refer to your employer account number making inquires about your account. of the California Unemployment Insurance Code( CUIC) mandates the UI contribution rate for the Fiscal Year, July 1 through June have the same UI contribution LOCAL EXPERIENCE CHARGE RATE Local Experience Charge( LEC)- of the GUIC Section 828 mandatesthe LEC rate for the Fiscal Year, July 1 through June 30. All SEF participants are rated annually. Each SEF participant is responsible for a quarterly LEC, costs with any for benefits, associated penames, as well as all and reimbursement for charges shall the noticce. If not paid within the time required, the SEF participant shall be delinquent 30 days from the date pay a penalty interest at the of 10 percerrt of through 4. 6• UI benefits charged to your Account- Shows the amount of UI benefits paid to your former employees from July 1 through June 30. This amount should rate. together 5. TOTAL CREDITS- Shows the total of all the items through June 30. This amount is the total of items 2 UI Contribution Rate- Section 832 participants eamings. added to your Ul reserve account beginning Juy 1 CONTRIBUTION RATE 30. All SEF SEF. Employers with a negative UI reserve account balance do not receive a portion of these interest the Employment Development as an employer with when 4. Section 827 of the CUIC mandates the i terest the of unpaid amount, plus adjusted annual rate established pursuant agree with the amount shown on your School Employee's Fund Employer Statement ofBenefd( DE 428F). These charges may also be as a result of a UI reserve account transfer. For partial transfers, the successor will not receive the DE 428F. TOTAL CHARGES- Shows the total of all the items subtracted from your UI reserve acxount beginning July 1 through June 30. 7• New UI acoount balance- Shows your UI reserve balance as of June 30. to Section 1952 of the Revenue and Taxation Code from and after the date The LEC rate shall of delinquency Previous Reserve Balance Plus Total Credits until paid. complete be 10 percent for the first three fiscal years of participation in the SEF. The LEC rate for the fourth fiscal succeeding fiscal year, shall year, and each be determined by dividing the reserve balance at the end of the fiscal year which began 24 months prior to the fiscal year for which the Line 1 Line 5 Minus Totaf Charqes Line 6 New UT Account Balance Line 7 8. Reserve ratio for LEC Ranking/ Rate- Shows your reserve ratio. Line 7 divided by Line 6. rate is being calculated by the benefits paid ior that same prior fiscal year. Section 828( c) of the CUIC mandates the DE 56 is sent to all SEF participants no later than March 31 of each year. DE 56 Rev. 8( 6- 11) PO BOX 826880, MIC 13, SACRAMENTO, CA 958140001 www.edd. ca.gov