AND International Publishers N.V. Annual report 2014

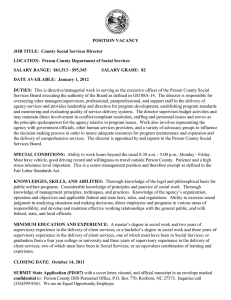

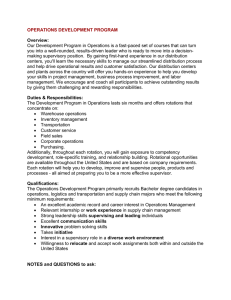

advertisement