The Changing World of Graphics

advertisement

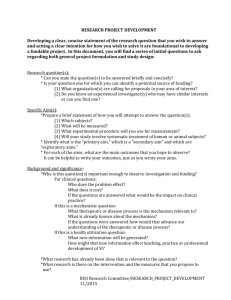

The Changing World of Graphics Alejandro Mata Economist, European Forest Products November 2015 1 © Copyright 2015 RISI, Inc. | Proprietary Information Alejandro Mata, Economist European Forest Products • Bachelor’s degree in Engineering, MBA degree earned in 2007 • Worked in business and market intelligence functions for one of Europe’s leading paper producers • Have been analyzing and forecasting the industry since 2009 • Author of the Paper Trader and Paper Packaging Monitor Europe, the European Graphic and Packaging Paper 5-Year and 15-Year Forecasts 2 © Copyright 2015 RISI, Inc. | Proprietary Information • Europe has averted Grexit • But challenges remain • Brexit is next…. • How will all of this impact the graphics industry? 3 © Copyright 2015 RISI, Inc. | Proprietary Information European Graphic Paper Demand… Is the Market in Decline? 15% 50.0 10% Million Tonnes 40.0 5% 30.0 0% 20.0 -5% 10.0 -10% Volume (L) Percent Change (R) - -15% 97 4 99 01 03 05 07 09 © Copyright 2015 RISI, Inc. | Proprietary Information 11 13 15 The Decline Is Mainly in Western Europe 15% 50.0 10% Million Tonnes 40.0 5% 30.0 0% 20.0 -5% 10.0 -10% Western Europe Emerging Europe Percent Change (R) - -15% 97 5 99 01 03 05 07 09 © Copyright 2015 RISI, Inc. | Proprietary Information 11 13 15 Newsprint Is Declining Everywhere Western Europe Emerging Europe 3.5 10 3.0 Millions 12 2.5 8 2.0 6 1.5 4 2 UWF Umec CWF Cmec Newsprint 1.0 0.5 0 0.0 97 99 01 03 05 07 09 11 13 15 6 97 99 01 03 05 07 09 11 13 15 17 © Copyright 2015 RISI, Inc. | Proprietary Information Current Conditions Demand Newsprint Uncoated Woodfree Uncoated Mechanical Trade S&D Balance Profitability 7 Coated Mechanical Coated Woodfree © Copyright 2015 RISI, Inc. | Proprietary Information • US duties • Industry cost curve • Cut size study Capacity Demand Production Newsprint – Western Europe 11,000 10,000 9,000 8,000 7,000 6,000 5,000 4,000 2010 8 2011 2012 2013 © Copyright 2015 RISI, Inc. | Proprietary Information 2014 2015 2016 2017 Production Cost Operating Rate 100% Newsprint – Western Europe € 700 90% € 500 85% € 400 80% € 300 € 200 2010 9 95% € 600 75% 70% 2011 2012 2013 2014 © Copyright 2015 RISI, Inc. | Proprietary Information 2015 2016 2017 Newsprint – Western Europe • Worse than originally thought; significantly down this year (-8%), and not expected to improve in the near future • Exports rising (strong US dollar impacting North America) • Flat during the next two years due to capacity closures and anemic demand in the world • Strong demand drops and fewer capacity closures • Flat exports not helping to offset EU market • Profitability at historical lows 10 © Copyright 2015 RISI, Inc. | Proprietary Information Newsprint – Europe Major Expansions in European Newsprint Industry, 2014-2016 Company Mill Country Capacity Year Comments Stora Enso Kvarnsveden Sweden -200,000 2014 Shift to uncoated mechanical SCA Ortviken Sweden -140,000 2015 Shut PM2 Martland Holdings Aylesford UK -400,000 2015 Mill closure UPM Shotton UK -215,000 2015 PM1 shut Norske Skog Bruck Austria -125,000 2016 Shift to tissue Volga Balakhna Russia -295,000 2015 11 © Copyright 2015 RISI, Inc. | Proprietary Information Uncoated Mechanical – Western Europe 12 Capacity Demand Production 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2010 2011 2012 2013 © Copyright 2015 RISI, Inc. | Proprietary Information 2014 2015 2016 2017 Uncoated Mechanical – Western Europe 13 Production Cost Operating Rate 100% € 700 95% € 600 90% € 500 85% € 400 80% € 300 € 200 2010 75% 70% 2011 2012 2013 2014 © Copyright 2015 RISI, Inc. | Proprietary Information 2015 2016 2017 Uncoated Mechanical – Western Europe • Demand still dropping, although each year by a smaller amount (except 2017) 14 • Fewer conversions to LWC going forward • Although relatively flat from a year ago, exports to North America are expected to start rising soon due to the large price difference and relatively low operating rates; US tariffs to Canada also helping • Operating rates recovering from 3-4 years of relatively low levels; recovery mainly driven by exports • Closures of PMs at Chapelle and Jamsankoski helping • Margins also at historical lows, although they are predicted to start increasing, driven by the recovery in operating rates © Copyright 2015 RISI, Inc. | Proprietary Information Uncoated Mechanical – Europe Major Expansions in European Uncoated Mechanical Industry, 2014-2016 15 Company Mill Country Capacity Year Comments Kama Krasnokamsk Russia -29,000 2014 Shut PM1 Stora Enso Kvarnsveden Sweden 200,000 2014 Shift to uncoated mechanical UPM Jamsankoski Finland -235,000 2015 Shut PM5 UPM Chapelle France -130,000 2015 Shut PM3 Arctic Paper Mochenwangen Germany -40,000 2015-2016 Heinzel Laakirchen Austria -260,000 2017 © Copyright 2015 RISI, Inc. | Proprietary Information PM3 shift to packaging Shift PM10 to packaging Coated Mechanical – Western Europe Capacity Production 11,000 10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2010 16 Demand 2011 2012 2013 © Copyright 2015 RISI, Inc. | Proprietary Information 2014 2015 2016 2017 Coated Mechanical – Western Europe 17 Production Cost Operating Rate 100% € 700 95% € 600 90% 85% € 500 80% € 400 75% € 300 2010 70% 2011 2012 2013 2014 © Copyright 2015 RISI, Inc. | Proprietary Information 2015 2016 2017 Coated Mechanical – Western Europe 18 • Demand dropping fast due to grade’s exposure to magazines (general interest and popular magazines) • Improving due to weak euro and demand dropping less in North America • Net exports to flatten out during the last two years due partly to conversions in Europe • Improving thanks to the recovery in net exports and capacity changes observed throughout the year • Conversions to packaging will help keep rates high • Margins have started to improve © Copyright 2015 RISI, Inc. | Proprietary Information Coated Mechanical – Europe Major Expansions in European Coated Mechanical Industry, 2013-2016 19 Company Mill Country Capacity Year Metsa-Board Husum Sweden -120,000 2013-2014 Stora Enso Corbehem France -330,000 2014 Mill closure Stora Enso Veitsiluoto Finland -190,000 2014 PM1 closure UPM Kaukas Finland -225,000 2015 PM2 closure Metsa-Board Husum Sweden -200,000 2015 Shift to packaging Kotkamills Kotka Finland -180,000 2016 Shift to packaging Burgo Duino & Verzuolo Italy -200,000 2015 Shift reduction (Verzuolo) Shut PM2 (Duino) © Copyright 2015 RISI, Inc. | Proprietary Information Comments Shift to packaging grades Coated Woodfree – Western Europe Capacity Production 11,000 10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2010 20 Demand 2011 2012 2013 © Copyright 2015 RISI, Inc. | Proprietary Information 2014 2015 2016 2017 Coated Woodfree – Western Europe 21 Production Cost Operating Rate 100% € 700 95% € 600 90% 85% € 500 80% € 400 75% € 300 2010 70% 2011 2012 2013 2014 © Copyright 2015 RISI, Inc. | Proprietary Information 2015 2016 2017 Coated Woodfree – Western Europe 22 • Demand dropping twice as fast as last year. However, demand drivers not showing a significant deterioration. • Overall net exports stable. Gains in North America and Latin America offset by fewer exports to Emerging Europe. • Increased competition from Asian producers • Still rising due to previous closures (Avezzano, Nijmegen, Lenningen, etc.) • Lack of further closures and stagnating demand will bring operating rates down in 2017 • Margins are recovering thanks to the improved market supply and demand balances © Copyright 2015 RISI, Inc. | Proprietary Information Coated Woodfree – Europe Major Expansions in European Coated Woodfree Industry, 2014-2016 23 Company Mill Country Capacity Year Lecta Zaragoza/Motril Spain -100,000 2014-2015 Burgo Avezzano Italy -180,000 2014 Mill stop SAPPI Nijmegen Netherlands -240,000 2014 Mill sold, shift to packaging Paper Excellence Lenningen Germany -160,000 2014 Shut PM6 Arjowiggins Wizernes (AA) France -170,000 2015 Mill sale or closure Metsa-Board Husum Sweden -60,000 2015 Shift to packaging © Copyright 2015 RISI, Inc. | Proprietary Information Comments Shit to packaging Uncoated Woodfree – Western Europe Capacity Production 10,000 9,000 8,000 7,000 6,000 2010 24 Demand 2011 2012 2013 © Copyright 2015 RISI, Inc. | Proprietary Information 2014 2015 2016 2017 Uncoated Woodfree – Western Europe 25 Production Cost Operating Rate 100% € 800 95% € 700 90% € 600 85% € 500 80% € 400 € 300 2010 75% 70% 2011 2012 2013 2014 © Copyright 2015 RISI, Inc. | Proprietary Information 2015 2016 2017 Uncoated Woodfree – Western Europe • Demand dropping again after a surprisingly strong 2014. 26 • High unemployment and next economical downturn in 2017 bringing demand down • Exports booming, mainly to North America due to capacity closures and positive exchange rate effects • Net exports to come down again with the conversion of Husum and Varkaus during the next two years • Operating rates high due to healthy demand • Conversions to packaging to push operating rates further up next year • Profitability improving © Copyright 2015 RISI, Inc. | Proprietary Information Uncoated Woodfree – Europe Major Expansions in European Uncoated Woodfree Industry, 2014-2016 27 Company Mill Country Capacity Year Comments Lecta Several Spain 15,000 2014 New PM7 & some mill closures Radece Papir Radece Slovenia 36,000 2014 Mill restart Pabianicka Pabianicka Poland 53,000 2014 Start second-hand PM UPM Docelles France -160,000 2014 Mill closure Meerssen Meerssen NL -32,000 2015 Mill closure Papeteries des Chatelles Raon France -45,000 2015 Mill closure Tullis Russell Markinich UK -60,000 2015 Mill closure Stora Enso Varkaus Finland -285,000 2015 Shift to containerboard Metsa-Board Husum Sweden -420,000 2015-2016 © Copyright 2015 RISI, Inc. | Proprietary Information Shift to packaging Import Duties in North America Offshore imports to the USA declining • To almost zero from China and Hong Kong • Less than 90% from Indonesia Imports from Europe increase • Except Portugal USA remains a very attractive market… • For overseas suppliers, due to strong US dollar 28 © Copyright 2015 RISI, Inc. | Proprietary Information European exports at risk due to displaced Asian exports • Emerging Europe, Africa, Middle East North America Capacity Demand • North America became a net importer in 2014 Production 11,000 10,000 9,000 • Latin America also runs a trade deficit 8,000 7,000 2010 2011 2012 2013 2014 2015 2016 2017 Asia Capacity Demand • China remains the largest threat to European exports due to: Production 36,000 34,000 32,000 30,000 Asian Overcapacity 28,000 26,000 Cost positioning 24,000 22,000 US ADD duties 20,000 2010 29 2011 2012 2013 2014 2015 2016 2017 © Copyright 2015 RISI, Inc. | Proprietary Information Conversions 30 © Copyright 2015 RISI, Inc. | Proprietary Information Packaging vs. Graphics Profitability: Prices/Total Cost 1.75 Kraftliner Testliner Boxboard CWF Newsprint 1.50 1.25 1.00 0.75 2001 31 2003 2005 2007 2009 2011 © Copyright 2015 RISI, Inc. | Proprietary Information 2013 2015 “Significant overcapacity in the newsprint market” 400,000 tonnes of newsprint • Demand in secular decline • Margins at historically low levels • Despite capacity closures, supply and demand balances are not improving 32 UK, Benelux and Austrian operations down Issues with liquidity and credit risks © Copyright 2015 RISI, Inc. | Proprietary Information Is the Grass Greener on the Other Side? • Margins are higher • Demand for packaging grades is still growing • Capacity management is important in packaging too • That is why virgin grades have higher margins • Global markets are more competitive • Conversions need to be done properly 33 © Copyright 2015 RISI, Inc. | Proprietary Information Questions 34 © Copyright 2015 RISI, Inc. | Proprietary Information Thank you for your attention! For more information: World Graphic Paper 5-Year Forecast www.risi.com/worldgraphic Global Woodfree Risk of Closure Study www.risi.com/woodfreerisk China’s Influence on World Graphic Paper Markets in the Coming Decade www.risi.com/chinagraphic 35 © Copyright 2015 RISI, Inc. | Proprietary Information