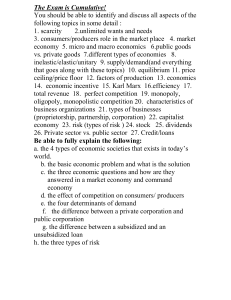

PowerStream Inc.

advertisement