Financial Tear Sheet

advertisement

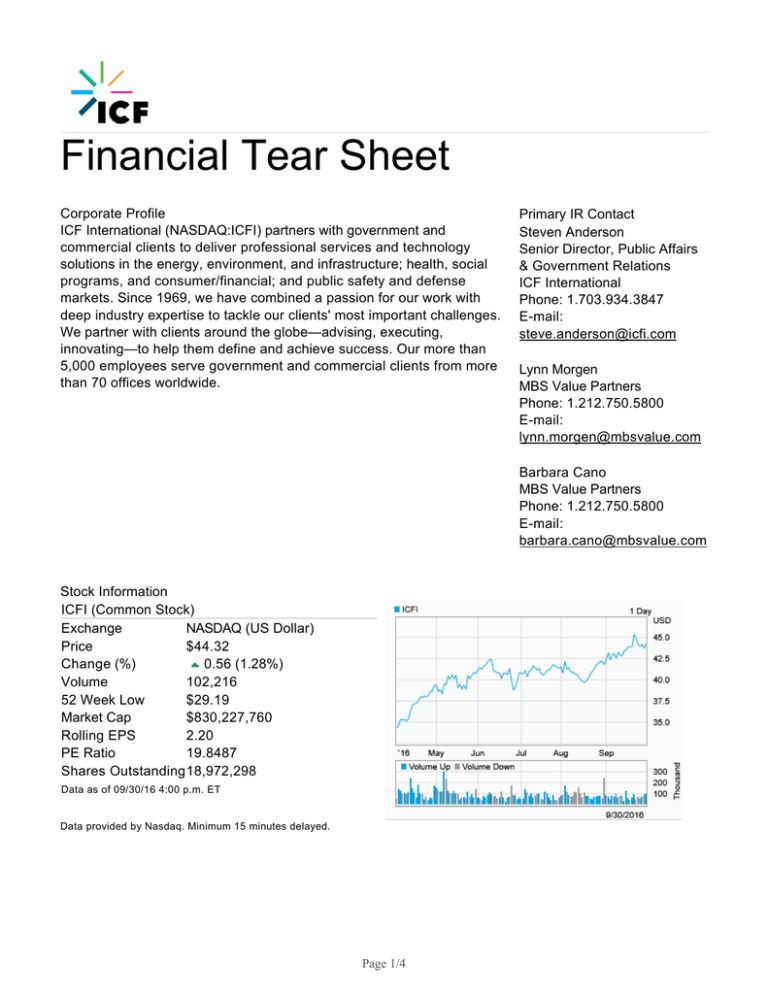

Financial Tear Sheet Corporate Profile ICF International (NASDAQ:ICFI) partners with government and commercial clients to deliver professional services and technology solutions in the energy, environment, and infrastructure; health, social programs, and consumer/financial; and public safety and defense markets. Since 1969, we have combined a passion for our work with deep industry expertise to tackle our clients' most important challenges. We partner with clients around the globe—advising, executing, innovating—to help them define and achieve success. Our more than 5,000 employees serve government and commercial clients from more than 70 offices worldwide. Primary IR Contact Steven Anderson Senior Director, Public Affairs & Government Relations ICF International Phone: 1.703.934.3847 E-mail: steve.anderson@icfi.com Lynn Morgen MBS Value Partners Phone: 1.212.750.5800 E-mail: lynn.morgen@mbsvalue.com Barbara Cano MBS Value Partners Phone: 1.212.750.5800 E-mail: barbara.cano@mbsvalue.com Stock Information ICFI (Common Stock) Exchange NASDAQ (US Dollar) Price $44.32 Change (%) 0.56 (1.28%) Volume 102,216 52 Week Low $29.19 Market Cap $830,227,760 Rolling EPS 2.20 PE Ratio 19.8487 Shares Outstanding18,972,298 Data as of 09/30/16 4:00 p.m. ET Data provided by Nasdaq. Minimum 15 minutes delayed. Page 1/4 Recent Press Releases & Upcoming Events 09/16/16 ICF International to Host Investor Day on September 20, 2016 09/13/16 ICF International Awarded $34 Million Contract to Support the Defense Critical Infrastructure Program by Conducting Infrastructure Risk Assessments Worldwide 08/02/16 ICF International Reports Second Quarter 2016 Results Analyst Estimates / Ratings Mean Recommendation: 1.7 There are currently no events scheduled. EPS Trend Current 30 Days Ago 90 Days Ago Sell SEC Filings Filing Date 09/22/16 09/22/16 09/20/16 09/16/16 Strong Buy Form 4 4 8-K 4 QTR Sep 16 0.81 0.81 0.82 QTR Dec 16 0.78 0.78 0.78 QTR Mar 17 0.67 0.67 0.67 QTR Jun 17 0.78 0.78 0.76 FY Dec 16 2.88 2.88 2.87 FY Dec 17 3.18 3.18 3.17 Corporate Governance Sudhakar KesavanChairman & Chief Executive Officer John Wasson President & Chief Operating Officer James C. Morgan Executive Vice President & Chief Financial Officer Andrea Baier Senior Vice President Louise Clements Executive Vice President Gene Costa Senior Vice President James E. Daniel Senior Vice President & General Counsel John George Senior Vice President & Chief Information Officer Ellen Glover Executive Vice President Page 2/4 John Guda Senior Vice President, Healthcare Colette LaForce Senior Vice President & Chief Marketing Officer Jim Lawler Executive Vice President & Chief Human Resources Officer Philip Mihlmester Executive Vice President Sergio Ostria Executive Vice President Dr. Barbara Rudin Executive Vice President Dr. David Speiser Executive Vice President of Strategy Robert Toth Page 3/4 Senior Vice President Ownership Summary Shareholders Holders Value ($MM) % O/S Shares Institution 213 766.94 98.9 18,768,707 Mutual Fund 282 381.63 49.4 9,362,505 15 .00 4.5 861,505 Insider * *Insider values reflect direct beneficial ownership. Top Holders Shares Held % O/S Share Change Filing Date Fidelity Management & Research Company 1,601,332 8.4 -491,162 06/30/16 Dimensional Fund Advisors, L.P. 1,361,756 7.2 136,516 06/30/16 Vaughan Nelson Investment Management, L.P. 1,335,209 7.0 23,500 06/30/16 Fidelity Institutional Asset Management 1,008,392 5.3 256,230 06/30/16 BlackRock Institutional Trust Company, N.A. 908,117 4.8 -37,801 06/30/16 Boston Partners 819,033 4.3 -162,259 06/30/16 The Vanguard Group, Inc. 687,192 3.6 16,408 06/30/16 TimesSquare Capital Management, LLC 632,914 3.3 -13,600 06/30/16 Skyline Asset Management, L.P. 611,800 3.2 -45,200 06/30/16 Columbia Wanger Asset Management, LLC 518,615 2.7 518,615 06/30/16 Page 4/4