TERMS AND CONDITIONS FOR THE USE OF CPF SAVINGS TO

advertisement

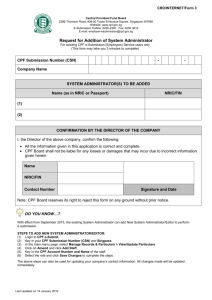

TERMS AND CONDITIONS FOR THE USE OF CPF SAVINGS TO PURCHASE HDB FLATS UNDER THE PUBLIC HOUSING SCHEME (USING HDB CONCESSIONARY LOAN) 1. 2. 2.1 The objective of the Public Housing Scheme (PHS) is to help CPF members buy a flat in Singapore with the use of their CPF savings. Use of CPF Savings A member is allowed to withdraw his Ordinary Account savings under PHS for: a) Direct payment of purchase price of the flat, including cost of common areas, to the HDB, financier and/or sellers. The approved CPF savings will only be released after the member has paid the balance (i.e. purchase price less housing loan and the approved CPF savings that can be used for the flat purchase) in cash. The purchase price that is above the value of the flat has to be paid in cash; b) Repayment of housing loan in part or whole and/or to pay the monthly instalments of the housing loan taken for the purchase of the flat; and c) 2.2 Payment of stamp duty, legal fees, and other related costs incurred related to the purchase or mortgage of the flat. A member aged 55 and above can use his CPF Ordinary Account and Retirement Account savings in excess of his Basic Retirement Sum to buy a Studio Apartment or short-lease 2-room Flexi flat with lease of between 15 years and 45 years. CPF housing limits for flats with remaining lease of at least 60 years 3. 3.1 New HDB Flat The first withdrawal of CPF savings to meet the deposit for the purchase of a new HDB flat shall not exceed 10% of the purchase price or such amount as may be required by HDB. 3.2 The amount withdrawn to meet the deposit with accrued interest shall be refunded to the member's CPF account when the member cancels his agreement to purchase the HDB flat. 3.3 A member who takes up a HDB housing loan to buy a new HDB flat can use all the CPF savings in his Ordinary Account to meet the monthly instalment payment of the housing loan. 4. Resale HDB Flat / Design Build Sell Scheme (DBSS) Flat 4.1 The total CPF savings which a member can withdraw to buy a resale HDB flat / DBSS flat is subject to the Valuation Limit as determined by the Board. The Valuation Limit is the purchase price or the market value of the flat, at the time of purchase, whichever is lower. Page 1 of 4 Last updated on 1 Oct 2015 4.2 A member who takes up a HDB housing loan to buy a resale HDB flat / DBSS flat can use the CPF savings in his Ordinary Account to meet the monthly instalment payment of the housing loan. 4.3 If the HDB housing loan is still outstanding when the total CPF savings withdrawn towards payment of the flat has reached the Valuation Limit and the member is below age 55, he can continue to use his CPF Ordinary Account savings to repay the housing loan after setting aside the current Basic Retirement Sum in his Special Account (including the amount used for investments) and Ordinary Account. 4.4 However, if the member is 55 years and above when the Valuation Limit is reached, he can use his CPF Ordinary Account savings to repay the housing loan after setting aside his Basic Retirement Sum in his Retirement Account, Special Account (including the amount used for investments) and Ordinary Account. CPF housing limits for flats with remaining lease of less than 60 years but at least 30 years (wef 1 July 2013) 5. Additional rules apply to the use of CPF savings for flats with remaining lease of less than 60 years, as follows: a) No CPF can be used if the remaining lease of a flat is less than 30 years. b) A flat owner is eligible to use his CPF savings for the flat only if his age plus the remaining lease of the flat is at least 80 years. c) The maximum amount of CPF savings that can be used is a percentage of the lower of the purchase price or the value of the flat at the time of purchase. The percentage is computed based on the remaining lease of the flat when the youngest eligible member using CPF reaches age 55, as shown below: Remaining lease when the youngest eligible owner using CPF turns 55 Remaining lease at the time of purchase Lower of the purchase price X or the value of the flat at the time of purchase 6. 6.1 Monthly Repayment The amount of CPF savings to be withdrawn each month for instalment payments shall not exceed the amount required for the monthly repayment of the HDB housing loan. 6.2 For a member who has applied to use his CPF savings for the monthly repayment of housing loan, the Board will cease the CPF monthly deduction when there is no CPF contribution for six consecutive months and no CPF savings that can be used for housing. If he wishes to use his CPF savings for the monthly repayment of housing loan subsequently, he can apply again by submitting an application form. Page 2 of 4 Last updated on 1 Oct 2015 7. Use of CPF Savings for Upgrading of HDB Flat 7.1 A member will be allowed to use his CPF savings to pay the cost of upgrading his HDB flat incurred under the HDB Upgrading Programmes and Town Council Lift Upgrading Programme (TCLUP) in part or whole and/or by monthly instalments. However, CPF savings cannot be used for construction works, improvements, repairs and renovations of the flat. 8. Sale/Mortgage/Transfer/Assignment of Flat 8.1 The consent of the CPF Board must be obtained before any HDB flat purchased through the use of CPF savings is sold, mortgaged, transferred or assigned. 8.2 As provided in the CPF (Approved Housing Scheme) Regulations, all CPF savings withdrawn by a member under PHS together with any interest that would have accrued if the withdrawal had not been made have to be refunded to the member’s CPF account on the occurrence of any of the following events: a) if the property or any interest therein is sold, transferred, assigned or otherwise disposed of by the member; b) if the property or any interest therein is sold, transferred, assigned or otherwise disposed of by any other person with or without the consent of the Board; c) if any mortgage or encumbrance is created over the property in favour of a person other than an approved mortgagee without the consent of the Board; or d) if the member has committed a breach of any of the terms and conditions imposed by the Board in connection with the withdrawal of CPF savings under PHS. 9. Application The application form, together with the relevant documents (if any), are to be submitted to the Board one week before the release of CPF savings. 10. Payee/Recipient of CPF Savings Any withdrawal made by a member for the property shall not be paid to the member but shall be paid directly to HDB, Town Councils or such other entity as the Board thinks fit to receive the CPF savings. 11. Other Conditions for Use of CPF Savings 11.1 The Board reserves the right to value the property before releasing CPF savings. The valuation fees shall be paid by the member. 11.2 Monthly service and conservancy charges including all rates, taxes and other charges imposed upon the HDB flat cannot be paid with CPF savings. Page 3 of 4 Last updated on 1 Oct 2015 11.3 Any payments made by the member to HDB out of the member's personal funds in respect of the purchase of a HDB flat cannot be reimbursed with CPF savings. 11.4 Any member who has purchased a property under the PHS by making a false statement or declaration, or furnishing any information or document which he knows to be false in material or who allows such property to be used for any immoral, illegal or unauthorised purposes, or who contravenes any of the conditions under PHS, shall be guilty of an offence under the CPF Act. The Board shall in such circumstances, be entitled to seize the property and sell it to recover the amount of CPF savings that has been withdrawn plus accrued interest. 12. Home Protection Scheme 12.1 A member shall, subject to good health satisfactory to the Board, be covered by the CPF Home Protection Scheme (HPS) if he is below 65 years old and is using his CPF savings to service his HDB housing loan. However, he may apply for exemption if : 13. (i) the outstanding housing loan on the HDB flat is not more than $3,000/and the remaining period of repayment is not more than two years; or (ii) he already has an alternate mortgage or life insurance policy which is sufficient to cover his outstanding housing loan. The member shall furnish to the Board such documentary evidence as is required by the Board. Page 4 of 4 Last updated on 1 Oct 2015