39-cent per pack federal excise tax - Campaign for Tobacco

THE FEDERAL CIGARETTE TAX IS MUCH LOWER THAN HISTORICAL LEVELS

The federal excise tax on cigarettes is currently 39 cents per pack. Congress last voted to raise the federal cigarette tax in 1997, when it passed a two-stage increase of 10 cents that went into effect

January 2000 and another five cents that went into effect January 2002. The resulting 39-cent rate has failed to keep up with either inflation or the ongoing increases in the wholesale and retail prices of cigarettes. In fact, the federal cigarette tax rate is currently significantly lower in real terms and as a percentage of cigarette prices than the federal cigarette tax levels that existed before the first Surgeon

General's report on smoking in 1964, when the federal government and the public first began to understand the enormous harms and costs caused by smoking. Bringing the federal cigarette tax up to historical levels would require significant increases to the current tax per pack.

*

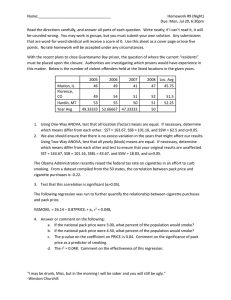

Maintaining the Federal Tax Rate As Percentage of Retail Cigarette Prices

The 1960 federal cigarette tax of 8 cents per pack accounted for almost a third of the average total retail price charged to smokers (26 cents per pack). Now, the average retail price for cigarettes is more than

$4.00 per pack, and the federal tax of 39 cents per pack accounts for less than 10 percent of the average retail price. Raising federal cigarette tax rates back to the 1960 level of 31 percent of the average retail price would require an increase to the federal rate of 95 cents per pack.

Maintaining the Federal Tax Rate As Percentage of Manufacturer Cigarette Prices

The 1960 federal cigarette tax of 8 cents per pack equaled almost half of the pre-tax price charged by the major cigarette manufacturers when they sell to wholesalers and distributors. Now, the prices charged by the cigarette manufacturers is $2.47 per pack, and the current federal tax of 39 cents per pack equals

*

Because it was so small and was phased in over multiple years, the last increase to the federal cigarette tax did not significantly reduce smoking rates or produce any significant related public health benefits or smoking-caused cost reductions. Larger increases in the federal cigarette tax rate, implemented in a single year lump-sum would, in contrast, not only produce large amounts of new revenue but would also significantly reduce smoking rates, nationwide, and produce substantial related reductions in federal smoking-caused expenditures.

1400 I Street NW - Suite 1200 - Washington, DC 20005

Phone (202) 296-5469 · Fax (202) 296-5427 · www.tobaccofreekids.org

The Current Federal Cigarette Tax Rate Is Much Lower Than Historical Levels / 2 only 15 percent of that amount. Raising the federal cigarette tax rate to the 1960 level of 47 percent of the manufacturers’ price would require a federal rate increase of more than 78 cents per pack.

Correcting the Federal Cigarette Tax for Inflation

As shown below, the federal cigarette tax rate has failed to keep up with the Consumer Price Index for all tobacco products since 1960, as well. If the federal rate had kept up with the CPI for Tobacco Products, it would now stand at $1.52 per pack. To catch up, the current federal rate would have to be increased by

$1.13 cents per pack.

†

†

There was no CPI just for cigarettes until 1997, but the CPI for all tobacco products and the CPI for cigarettes have tracked each other very closely since then.

The Current Federal Cigarette Tax Rate Is Much Lower Than Historical Levels / 3

The graph below shows federal tobacco tax revenues in constant 2007 dollars to adjust for inflation.

In 1960, the federal cigarette tax was 8 cents per pack, which equals 56 cents in current dollars. A 17cent per pack increase would bring the federal cigarette tax rate back to its inflation-adjusted 1960 level.

The federal cigarette tax rate is also falling behind state cigarette taxes.

The average state tax on cigarettes has gone up from five cents per pack (or less than two-thirds the size of the federal tax) in 1960 to $1.19 per pack (or more than 305% of the federal tax) in 2008. To keep up with the states, the federal cigarette tax would have to be raised by at least 80 cents per pack.

Taxes on cigarettes in the USA are also much lower than those in other countries.

Taxes on cigarettes among the European Union nations range from more than $2.00 to almost $10.00 per pack.

Other federal tobacco tax rates are also below historical levels.

To maximize revenue, tax fairness, and public health benefits, any increase to the federal cigarette tax rate should be complemented with parallel increases to the other federal tobacco tax rates – which have, over time, also failed to keep up with inflation or with manufacturer or retailer price increases.

Most recent federal cigarette tax rate increases.

The 1983 federal cigarette tax rate increase (from 8 to 16 cents per pack) passed in the Tax Equity and Fiscal Responsibility Act, PL 97-248 signed in 1982 by President Ronald Reagan. The 1991 and 1993 rate increases (from 16 to 20 and then 24 cents) both passed at same time via Revenue Reconciliation Act, PL 101-508, signed in 1990 by President George

The Current Federal Cigarette Tax Rate Is Much Lower Than Historical Levels / 4

H.W. Bush. The 2000 and 2002 rate increases (from 24 to 34 and then 39 cents) both passed at same time in the Balanced Budget Act of 1997, P.L. 105-33, signed by President Bill Clinton.

Campaign for Tobacco-Free Kids, January 13, 2009 / Eric Lindblom & Ann Boonn

Sources: Orzechowski & Walker, Tax Burden on Tobacco , 2007; U.S. Department of Agriculture Economic

Research Service, Tobacco Briefing Room, www.ers.usda.gov/Briefing/tobacco ; Bureau of Labor Statistics, U.S.

Department of Labor. Tobacco Reporter , March 2004.

More information on federal tobacco taxes is available at http://tobaccofreekids.org/research/factsheets/index.php?CategoryID=11 .