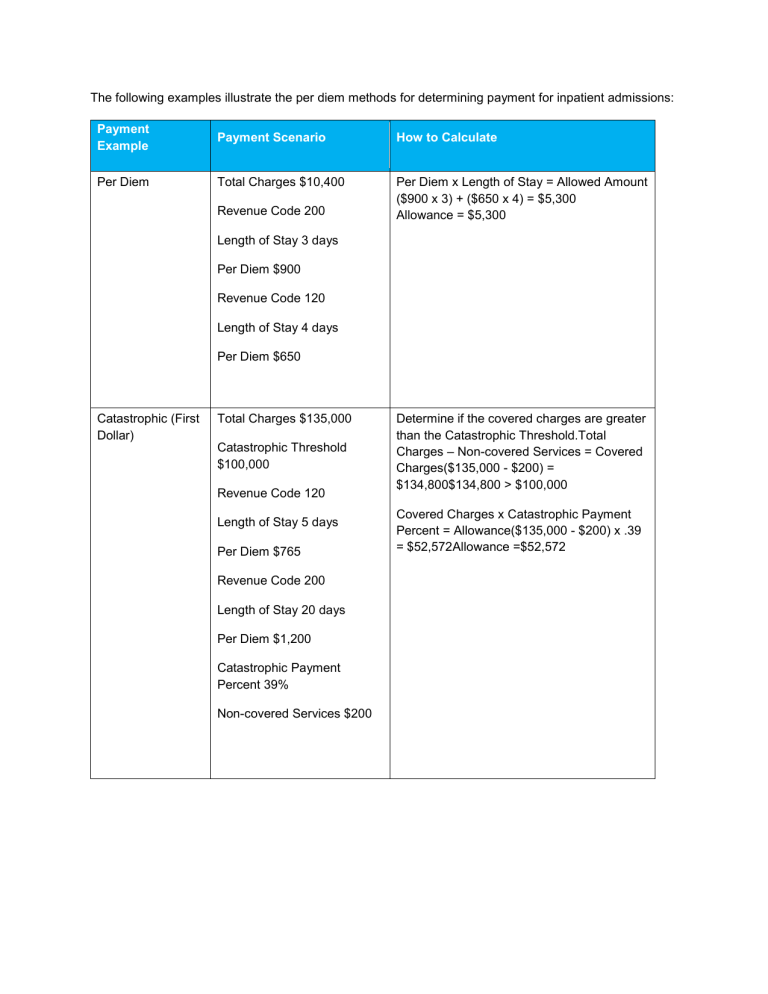

The following examples illustrate the per diem methods for

advertisement

The following examples illustrate the per diem methods for determining payment for inpatient admissions: Payment Example Payment Scenario How to Calculate Per Diem Total Charges $10,400 Per Diem x Length of Stay = Allowed Amount ($900 x 3) + ($650 x 4) = $5,300 Allowance = $5,300 Revenue Code 200 Length of Stay 3 days Per Diem $900 Revenue Code 120 Length of Stay 4 days Per Diem $650 Catastrophic (First Dollar) Total Charges $135,000 Catastrophic Threshold $100,000 Revenue Code 120 Length of Stay 5 days Per Diem $765 Revenue Code 200 Length of Stay 20 days Per Diem $1,200 Catastrophic Payment Percent 39% Non-covered Services $200 Determine if the covered charges are greater than the Catastrophic Threshold.Total Charges – Non-covered Services = Covered Charges($135,000 - $200) = $134,800$134,800 > $100,000 Covered Charges x Catastrophic Payment Percent = Allowance($135,000 - $200) x .39 = $52,572Allowance =$52,572 Payment Example Case Rate (Cardiac) Payment Scenario How to Calculate DRG 218 Multiply additional days by the per diem amount 12 x $800 = $9,600 Total Charges $80,000 Catastrophic Threshold $100,000 Length of Stay 20 days (Admission date 03/1/10, Discharge date 03/20/10) Days 1-8 Length of Stay $15,500 Fixed Case Rate Days 9 and Beyond Length of Stay $800 Med/Surg Per Diem Non-covered = $200 Add the sum in the previous step to the Fixed Case Rate $9,600 + $15,500 = $25,100 Allowance = $25,100 Payment Example Payment Scenario How to Calculate Second Dollar Catastrophic with an Implant DRG 218 Determine if the adjusted total covered charges exceed the catastrophic threshold. Length of Stay 10 days 8 ICU days 2 Med/Surg days ICU rate $1000 Med/Surg rate $850 DRG 104 Days 1-8 Length of Stay $18,000 Fixed Case Rate Additional days at the Med/Surg rate An adjusted total covered charge does not include the implant charges since they are reimbursed in addition to inliers and outliers. $90,000 - $15,000 = $75,000 $75,000 > $60,000 Determine the inlier allowance. For this example, the case rate of: $18,000 + (2 x 850) = $18,000 + $1,700 = $19,700 Determine the implant allowance. Implant billed charges x Negotiated Implant Percent of charges $15,000 x 50% = $7,500 Total Charges $90,000 Total Implant Charges $15,000 Negotiated Threshold $60,000 Negotiated Catastrophic Percent 45% Negotiated Implant Percent 50% Determine the applicable catastrophic reimbursement. In this case, take the total adjusted charges – the negotiated charge threshold and multiply the difference by the catastrophic percent. [($90,000 - $15,000) - $60,000] x 45% = $15,000 x 45% = $6,750 Add the inlier amount, the implant amount and the catastrophic amount together for the total claim allowance. $19,700 + $7,500 + $6,750 = $33,950 Payment Example Payment Scenario How to Calculate First Dollar Catastrophic with an Implant DRG 218 Determine if the adjusted total covered charges exceed the catastrophic threshold. $90,000 - $15,000 = $75,000 $75,000 > $60,000 Length of Stay 10 days 8 ICU days 2 Med/Surg days ICU rate $1000 Determine the implant allowance. Implant billed charges x Negotiated Implant Percent $15,000 x 50% = $7,500 Med/Surg rate $850 DRG 104 Days 1-8 Length of Stay $18,000 Fixed Case Rate Additional days at the Med/Surg rate Total Charges $90,000 Total Implant Charges $15,000 Negotiated Threshold $60,000 Negotiated Catastrophic Percent 45% Negotiated Implant Percent 50% Determine the applicable catastrophic reimbursement. In this case, take the total adjusted charges and multiply by the catastrophic percent. $75,000 x 45% = $33,750 Add the catastrophic payment amount and the implant amount together for the total claim allowance. $33,750 + $7,500 = $41,250