BG Group - QCLN Fact Sheet

advertisement

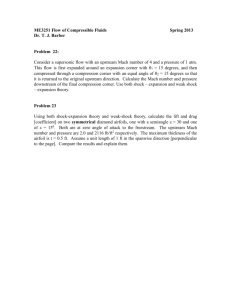

BG Group - QCLNG Fact Sheet All figures gross unless otherwise stated Costs BG Group net* capex Phase 1: $20.4 billion: c50% Upstream E&P, c50% Upstream Liquefaction 30% of $20.4 billion related to Common Facilities (Pipeline, plus jetty and LNG tanks – all included in Upstream Liquefaction segment) BG Group net** capex Phase 2 (all Upstream E&P): $1.0-1.5 billion per annum on plateau until c2020, reducing thereafter Upstream E&P opex: c$10/boe including royalties, excluding third party gas Upstream Liquefaction opex: BG Group net c$150 million per annum Accounting Revenue to profit and loss from first LNG cargo DD&A on Train 1 and Common Facilities from first T1 LNG DD&A on Train 2 from first T2 LNG Upstream E&P wells DD&A on unit of production based on 2P reserves All remaining DD&A on straight line basis 30 year Upstream E&P Infrastructure (Gas gathering, WTPs, FCSs, CPPs) 40 years Upstream Liquefaction (Pipeline, Liquefaction plants, Common facilities) 10% royalty on value at well head 30% corporation tax. BG Group has brought forward tax allowances Operational Two 4.25 mtpa trains. Total 8.5 mtpa capacity Expected throughput on plateau 8.0 mtpa 1.3 bcfd gas production (including domestic) at plateau 12-14% gas lost/used for compression, transport and fuelling LNG plant Timescales First LNG December 2014 Train 1 six month ramp up Train 2 start up in third quarter of 2015 Train 2 six month ramp up Two train plant fully on plateau by mid-2016 Commercial Third party gas to manage ramp profile Up to 20% third party gas in any one year during ramp period LNG sold into BG Group portfolio. Strong portfolio of sales contracts into high value Asian markets LNG sales contracts generally follow an S curve. This offers some protection in low commodity prices, whilst giving up some of the upside in high commodity prices. Reserves and resources 9.2 tcf reserves Further 13.1 tcf project resources 0.5 tcf annual gas requirement Ownership and structure BG Group Ownership (%) Rates of Return (%) Upstream Equity Gas 73.75 Netback, dependent on oil price Upstream Infrastructure 73.75 Fixed RROR Tolling fee less DD&A and corporation tax Pipeline Held for sale. Expect to complete H1 2015 Fixed RROR Tolling fee less DD&A and corporation tax Train 1 50.00 Fixed RROR LNG FOB less cost of gas, common facilities and pipeline tolling fees, opex, DD&A and corporation tax Train 2 97.50 Fixed RROR LNG FOB less cost of gas, common facilities and pipeline tolling fees, opex, DD&A and corporation tax Common Facilities 100.00 Fixed RROR Tolling fee less DD&A and corporation tax * Profit Equals Upstream netback less upstream infrastructure tolling fee, upstream wellhead royalty, opex, DD&A and corporation tax BG Group net as per ownership structure when guidance was provided in May 2012. ** BG Group net as per current ownership structure. -ends- Notes to Editors: BG Group plc (LSE: BG.L) is a world leader in natural gas, with a broad portfolio of business interests focused on exploration and production and liquefied natural gas. Active in more than 20 countries on five continents, BG Group combines a deep understanding of gas markets with a proven track record in finding and commercialising reserves. For further information visit: www.bg-group.com There are matters set out within this announcement that are forward-looking statements. Such statements are only predictions, and actual events or results may differ materially. For a discussion of important factors which could cause actual results to differ from these forward-looking statements, refer to BG Group’s Annual Report and Accounts for the year ended 31 December 2013. BG Group does not undertake any obligation to update publicly, or revise, forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent legally required. Contacts: Investors Mark Lidiard: Siobhan Andrews: Angus Barry: Ian Wood: Investor Relations: +44 (0) 118 929 2079 +44 (0) 118 929 3171 +44 (0) 118 929 2997 +44 (0) 118 929 3829 +44 (0) 118 929 3025 Media Lachlan Johnston: Kim Blomley: Out of Hours Media Mobile: +44 (0) 118 929 2942 +44 (0) 118 938 6568 +44 (0) 7917 185 707 Social media channels: Flickr Twitter You Tube flickr.com/bggroup twitter.com/BGGroup youtube.com/bggroupofficial invrel@bg-group.com