salient features of trade performance

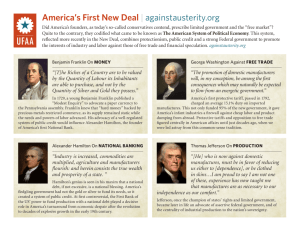

advertisement