61st Annual RIG CENSUS - National Oilwell Varco

advertisement

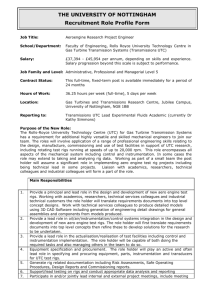

A Special Section of 61st Annual RIG CENSUS Published in November 2014 NATIONAL OILWELL VARCO’S 61ST ANNUAL RIG CENSUS Global rig fleet grows, both onshore and offshore CENSUS HIGHLIGHTS Key statistics from the 2014 census include the following: • The U.S. fleet had an overall increase of 199 rigs, pushing the total available count up about 7% to 3,254. This net increase is the result of 387 rig additions and 188 rig deletions, Fig. 1. • The number of U.S. rigs counted as newly manufactured rose in 2014, totaling 187 units. • The number of rigs that were retired or removed from service this year was 177, a slight decrease. • U.S. rigs meeting the census definition of “active” rose to 2,269, up about 10%. • Utilization of the U.S. fleet (combined land and offshore) grew three percentage points and now stands at 70%, Fig. 2. • There were 319 U.S. rig owners counted in 2014, compared with 313 last year. 2NOVEMBER 2014/WorldOil.com Available 5 4 3,254 3 Active 2 2,269 1 0 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Note: 2002 data are estimates. Fig. 2. U.S. available rigs vs. utilization, 1955-2014. 6 5 100 Utilization rate 70% 80 4 60 3 Available rigs 3,254 2 1 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Utilization rate, % United States rig owners continued adding to their fleets in 2014 and were able to put more rigs to work. According to the 61st Annual NOV Rig Census, the U.S. available fleet made a significant jump over the past year, and activity levels seemed to support this increase. When rig counts were tallied for the census in the early summer of 2014, commodity prices were strong enough to fuel additional drilling momentum. The gap between available and active rigs shrank, and showed an overall strengthening in the U.S. market. The Canadian drilling environment also showed growth in availability, as newbuilds and reactivations were added to the fleet. Canada experienced a turnaround in activity levels, regaining most of the losses seen over the past two years. Worldwide statistics were also encouraging for 2014. The global offshore mobile fleet continued to make notable gains in the number of available rigs added to the fleet. Again this year, a large number of newly manufactured units came online, with most having standing contracts to drill. Activity levels rose, as well, and kept pace with available units, causing utilization for the offshore mobile fleet to be relatively unchanged. With the exception of Asia (including China), international utilization of rigs rose in most primary areas. 6 Number of rigs, thousands BRANDON MONTAGNE and TORY STOKES, NOV Downhole Fig. 1. U.S. available vs. active rigs, 1955-2014. Number of rigs, thousands North American rig fleets expand, and more rigs are put to work, while the global, offshore mobile fleet continues to make gains with new units. 40 20 Note: 2002 data are estimates. • Drilling contractors own 85% of all U.S. drilling rigs, a one percentage point decrease this year, with operators owning the remaining 15%. • The Canadian available rig fleet rose to 796 units, up 2% from last year. • Canadian rig activity jumped 22%, with active units numbering 352 in 2014. • Utilization for Canada rebounded to 44%, compared with 37% last year. • The global offshore mobile fleet’s available count grew 5% this year, coming in at 890 units. • The active count for the global offshore mobile fleet grew 4%, and reached 725. • Utilization of the global offshore mobile fleet is now 81%, just slightly lower than 2013’s level. • All international regions, with the exception of Asia (including China), showed increases in rig utilization over the past year. • Every U.S. region had increases in available rigs, with the exception of the Gulf Coast, which was essentially flat. • Drilling contractors own 85% of the 2014 fleet, while operators own 15%. NATIONAL OILWELL VARCO’S 61ST ANNUAL RIG CENSUS Table 1. Changes in the available U.S. fleet. Previous year’s fleet 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 3,055 3,006 3,081 3,153 3,169 3,076 2,817 2,298 2,026 1,988 1,719 1,722 1,722 1,636 1,644 1,705 1,665 Reductions to fleet Removed from service –177 Moved out of the country –6 –315 –16 –212 –45 –164 –49 –59 –29 –77 –14 –99 –14 –141 –29 –68 –1 –123 –45 n/a n/a –87 –6 –76 –4 –89 –7 –59 –10 –1 –3 –410 –334 –2 –259 –5 –218 0 –88 –4 –95 –6 –119 –3 –173 0 –69 –4 –172 n/a n/a –3 –96 –2 –82 –4 –100 –3 –72 Additions to fleet Newly manufactured 187 147 223 158 131 237 202 349 238 23 32 Brought back into service 193 97 94 95 87 36 101 189 95 124 125 Moved into the country 6 9 12 6 16 30 13 5 5 6 7 Assembled from parts 1 3 6 3 9 8 31 71 53 58 79 Newly identified* – – – – – – – – – – 95 Subtotal, additions 387 256 335 262 243 311 347 614 391 211 243 Net change 199 49 –75 –72 –16 93 259 519 272 38 174 Total available rigs 3,254 3,055 3,006 3,081 3,153 3,169 3,076 2,817 2,298 2,026 1,893 48 37 10 74 – 169 –3 1,719 n/a 9 6 6 7 n/a 56 22 18 37 n/a 12 12 6 6 n/a 105 34 9 62 – – – – – 0 182 74 39 112 n/a 86 –8 –61 40 n/a 1,722 1,636 1,644 1,705 Destroyed Subtotal, deletions –182 –22 –5 –3 –188 –207 –386 –23 *2004 adjustment made in conjuction with RigData Every year, some rigs are considered “unavailable,” based on census rules, and are “retired” from the U.S. fleet. Older rigs with outdated equipment and technology, which have been sitting idle for three or more years, are no longer considered available. Units that need a significant capital expenditure, or a considerable time investment, are also not counted in the census. Accidents that damage rigs beyond repair also put rigs out of commission. When units are transferred to other countries for more profitable ventures, these rigs are taken out of the U.S. census and counted in other international tallies. Each of these cases is counted as a reduction to the U.S. fleet. Total deletions this year numbered 188 rigs, a 9% drop since last year’s 207-unit decline. This was the lowest number of rig deletions since 2008, Table 1. The largest number of rigs deleted continues to be in the “Removed from Service” category. This has remained stable over the past year, with a net drop of just five units, to 177. This is quite a different story from the reduction seen in 2013, when the number declined by about 50%. This category includes any units that require a large capital expenditure, rigs auctioned for parts or cannibalized to keep other rigs running, or units that have been stacked for three or more years. Note that some of these rigs may re-enter the census at a later date, if drilling conditions warrant, but have to be disqualified presently, to ensure an accurate representation of the current available fleet. If any of these rigs are re-introduced to the fleet, they are typically categorized under the “Brought Back Into Service” portion of the census, in the “Additions” part of this article. There is always a need for some units to be refurbished or reactivated, if economic conditions improve. Depending on worldwide market conditions, companies move their rigs into, and out of, the U.S., and we attempt to follow these rig movements on a year-to-year basis. In this year’s count, just six rigs moved out of the U.S., quite a few less than the 22 units that were exported in 2013. These units are classified in the “Moved out of the Country” category. Rig movement into the U.S. is covered in the section below. Rig accidents, where equipment was damaged beyond repair, Fig. 3. U.S. change in available rigs, 1956-2014. 1200 1000 800 Change in available rigs U.S. ATTRITION DROPS 600 400 +199 200 0 -200 -400 -600 -800 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Note: 2002 data point is an estimate. put some units in the final deletions category as “Destroyed.” Five rigs were reported to have sustained significant harm in the 2014 census and were classified in this category. Specific information was not provided for all of them, but at least two rigs were known to have burned, due to blowouts. This compares to three rigs that were counted as destroyed in the 2013 census. U.S. RIG ADDITIONS SWELL After rig building slowed in 2013, rig expansion programs accelerated in 2014, producing a significant number of new units. Refurbishments were also extremely prolific this year. As market conditions have improved, reactivations have been a cost-effective way to bring units online quickly. Several rigs were also brought into the U.S. from other countries. Census figures show that 387 rigs were added to the fleet over the last year, up 51% from the previous year. These additions considerably outnumbered the 188 deletions to the fleet, Table 1. United States newbuilds rose in 2014 after having experienced a downturn in 2013. There still appear to be a plentiful supply of innovative rigs being produced, bringing down the average fleet age. Over the past decade, 1,927 brand-new units have been introduced into the U.S. fleet, indicating that more than 60% are performing at a higher level of cost and efficiency. Of those new units, 187 were added during this year’s census, compared with 147 added in 2013. World Oil®/NOVEMBER 20143 NATIONAL OILWELL VARCO’S 61ST ANNUAL RIG CENSUS Table 2. Changes to the Canadian rig fleet. 2014 777 2013 747 2012 774 2011 795 2010 852 2009 875 2008 871 2007 799 2006 741 2005 680 2004 653 2003 640 2002 n/a –38 –11 0 –49 –52 –21 0 –73 –67 –33 0 –100 –63 –11 0 –74 –94 –17 0 –111 –17 –42 0 –59 –24 –19 –1 –44 –6 –10 0 –16 –7 –8 0 –15 –4 –5 0 –9 –8 –6 0 –14 –7 0 0 –7 n/a n/a n/a n/a Additions to fleet Newly manufactured 24 Brought back into service 32 Moved into the country 12 Assembled from parts 0 Subtotal, additions 68 Net change 19 Total available rigs 796 Total active rigs 352 Utilization 44% 64 33 6 0 103 30 777 289 37% 35 34 4 0 73 –27 747 329 44% 8 34 10 1 53 –21 774 369 48% 15 35 4 0 54 –57 795 334 42% 29 2 5 0 36 –23 852 191 22% 47 1 0 0 48 4 875 406 46% 86 0 0 2 88 72 871 371 43% 63 0 0 10 73 58 799 669 84% 43 23 1 3 70 61 741 550 74% 39 0 0 2 41 27 680 449 66% 18 0 0 2 20 13 653 450 69% n/a n/a n/a n/a n/a n/a 640 346 54% Previous year’s fleet Reductions to fleet Removed from service Moved out of the country Destroyed Subtotal, deletions The number of U.S. rigs that were “Brought Back into Service” spiked in 2014. This year’s number came in at 193, more than double the 97 units reactivated in 2013. Each of the rigs that were reintroduced had been counted previously in a prior census, but had been out of commission. Many of these 193 reactivations have been refurbished and are being counted again as part of the U.S. available fleet. Six rigs that “Moved into the Country” during the past year are also counted in the census. This is down from the nine rigs that moved into the U.S. during 2013. With six units moving in and six moving out, the net import/export count was stable. In recent years, more rigs typically have moved out of the U.S. than moved in, so it’s noteworthy that this was not the case in 2014. Differences in rig movements are often minor, so it can be difficult to tell when trends are reversing. However, strict U.S. drilling regulations have been burdensome, and rig owners have been drawn, justifiably, to other markets for many years. Lastly, just one rig “Assembled from Parts” was added to the fleet in 2014. Although there are probably more units that could be classified in this category, it is becoming increasingly difficult to quantify, based on the data that are gathered. It also can be hard to differentiate between refurbishments and new assemblies, especially when rigs have changed ownership and are renamed. For these reasons, beginning in 2015, the “Assembled from Parts” category will be absorbed into the “Brought Back into Service” category. Total rig additions numbered 387, while deletions totaled 188 units. The net change in the fleet over the past year was a 199-unit gain, up about 7%. This is compared with a fleet increase of just 2% in 2013, Fig. 3. CANADIAN FLEET REBOUNDS The Canadian available fleet has made another significant gain in rigs during 2014. This is the second year of increase after several years of declining counts. Rigs retired from service matched fairly closely in number to those reactivated, but newly manufactured rigs helped gains overcome losses to achieve a further increase. Rigs “Removed from Service” continues to be the primary cause of Canadian fleet attrition. This includes rigs idle for greater than three years, or those requiring a large 4NOVEMBER 2014/WorldOil.com capital outlay. Data gathered about these units indicated that 38 fell into this category and were, therefore, dropped from the census available count. This is less than the 52 rigs removed in 2013. Eleven rigs also were taken out of the census in 2014, due to being “Moved out of the Country.” This was a noteworthy decline, compared with the 21 rigs that were relocated last year. Most of these rigs were headed to the U.S. market, but several were bound for Latin America. No Canadian units were reported as “Destroyed” over the past year. The sum of all deletions totaled 49 units in 2014. The number of “Newly Manufactured” rigs entering the Canadian fleet has declined this year after a resurgence in 2013. For 2014, the number of brand-new rigs totaled 24. This was a decrease from the 64 units that were built from scratch in 2013. Rigs “Brought Back into Service” have been stable for the past five years, with 32 being the number reactivated for 2014. Rigs “Moved into the Country” for Canada doubled over the past year, as 12 were counted as being imported. This makes a net addition of one rig, when looking at the import/ export balance. No units were indicated as “Assembled from Parts.” Total rig additions came to 68 units, overall, for Canada. Although this was 35 units less than the previous year, additions still outnumbered deletions, causing the available count to rise by 2% or 796 rigs, Table 2. GLOBAL OFFSHORE MOBILE FLEET EXPANDS Rig-building accelerated in the offshore sector this year and was the dominant reason that units were added to the fleet. Overall attrition was slightly higher than last year, but did little to offset the gains, due to the newly manufactured units. Reductions to the fleet this year included 22 rigs that were “Removed from Service,” some of which are undergoing conversions to non-drilling. This compares to 17 rigs that were retired in the previous census. Three offshore units were reported as “Destroyed,” due to accidents, Table 3. If an offshore rig has not worked for more than five years, and does not have upcoming contracts, it is removed from the census until this status changes. This is to prevent rigs, which cannot be reactivated quickly, from being counted as available. Although the census is able to track the majority of platform and inland barge rigs in the U.S., the global mobile offshore NATIONAL OILWELL VARCO’S 61ST ANNUAL RIG CENSUS Table 3. Changes to the global offshore mobile fleet. 2014 850 2013 824 2012 794 2011 745 2010 705 2009 675 2008 650 2007 654 2006 641 2005 673 2004 678 2003 677 2002 670 2001 n/a –22 –3 –25 –17 –1 –18 –18 –2 –20 –7 0 –7 –2 –4 –6 –11 –3 –14 –7 0 –7 –26 0 –26 –10 –6 –16 –42 –3 –45 –15 –1 –16 –2 –3 –5 –2 0 –2 n/a n/a n/a Additions to fleet Newly manufactured 63 Brought back into service 2 Assembled from parts 0 Subtotal additions 65 Net Change 40 Total Available Rigs 890 Total Active Rigs 725 Utilization 81% 42 2 0 44 26 850 697 82% 44 4 2 50 30 824 626 76% 47 9 0 56 49 794 559 70% 40 6 0 46 40 745 572 77% 43 1 0 44 30 705 571 81% 28 4 0 32 25 675 592 88% 11 11 0 22 –4 650 574 88% 9 20 0 29 13 654 557 85% 4 8 1 13 –32 641 545 85% 9 1 1 11 –5 673 486 72% 5 1 0 6 1 678 479 71% 8 1 0 9 7 677 460 68% n/a n/a n/a n/a n/a 670 488 73% Previous year’s fleet Reductions to fleet Removed from service Destroyed Subtotal deletions Fig. 4. 2014 Global offshore mobile fleet, by region. Far East 5% Other* 4% Fig. 5. Makeup of the Global Offshore Mobile Fleet. Med/Black Sea 3% Middle East 17% Tenders Submersibles* Drill barges 38 rigs 2 rigs Semisubmersibles 24 rigs 23 active 0 active 214 rigs 19 active 61% util. 0% util. 167 active 79% util. 78% util. Indian Ocean 6% Mexico 7% Jackups 506 rigs 421 active 83% util. Drillships 106 rigs 95 active 90% util. SE Asia 14% West Africa 10% *Arctic rigs are included with submersibles. This does not include platform and inland barge rigs. NW Europe 11% Total fleet = 890 Active rigs = 725 Utilization = 81% U.S. - GOM, Pacific, Alaska 12% South America 11% *Total of regions with less than 2%, each, including: Australia/New Zealand, Baltic, Canada, Caspian, Central America and Russian Arctic. statistics do not reflect these units, since worldwide statistics are particularly hard to obtain. Another 63 brand-new rigs came online and entered the census for the first time. The rate of increase in the fleet has been especially noteworthy for the past six years, with 40 or more rigs added each year. Another 81 units are scheduled for worldwide delivery by the middle of 2015, according to IHS. Even though all of these rigs will not meet that schedule, another prolific year of fleet additions is likely, possibly surpassing the number of new units reported in the 2014 census. In addition to these newbuilds, two offshore rigs also were “Brought Back into Service.” No units were added after being “Assembled from Parts.” The available count for the global offshore mobile fleet now stands at 890 units, a net increase of 40 rigs, and a 5% increase from last year. The worldwide offshore mobile fleet is widely distributed, with the Middle East in the lead, followed by Southeast Asia, and the U.S., Fig. 4. Fleet composition by specific rig type is shown in Fig. 5. U.S. ACTIVITY SURGES After showing a lagging year in 2013, U.S. drilling activity picked up considerably this year, numbering 2,269 for 2014, versus 2,055 last year. This resulted in a jump of about 10%, and a rebound to the 2012 level. Active rigs rose to a greater extent than available rigs this year, shrinking the gap between the two and indicating stronger market conditions. The methodology used to count active rigs for the NOV census is different from other published rig counts. This census counts a rig as active, if it has “turned to the right” at any time during a defined 45-day period in the late spring, this year between May 9 and June 22. Other active counts typically report shorter windows of time, such as a week. When a longer period is used to monitor activity, a larger pool of working rigs will be counted, and the count will be higher. This is a better indication of activity, since fewer active rigs will be left out of the count, due to relocations. Rig utilization, the ratio of active to available rigs, is a statistic that gives an indication of the demand/supply balance. Gains in utilization can show increasing economic strength in the industry. This year, U.S. utilization has improved and is now 70%, rising three percentage points since 2013. Although this year’s utilization is still below the historical average of 74%, it has reached the 70% mark, which typically indicates a healthier drilling market. World Oil®/NOVEMBER 20145 NATIONAL OILWELL VARCO’S 61ST ANNUAL RIG CENSUS CENSUS GROUND RULES Company sales regions were used for the geographical breakdown shown in Table 4. Contractor-owned rigs are those belonging to companies whose primary business is offering drilling contracting services. To be considered active, a rig must be drilling at least one day during the 45-day qualification period. Only workable rotary rigs are included; cable tool rigs are excluded. To be considered available, a rig must be able to go to work without requiring a significant capital expenditure. Rotary land rigs stacked for an extended period of time, typically three years or longer, are not counted as available. A rig must be capable of, and normally employed for, drilling deeper than 3,000 ft. Therefore, some shallow drilling rigs are excluded, but this is necessary to ensure well-servicing rigs are not counted. • Electric rigs include all those that transmit power from prime movers to electrically driven equipment. • Inland barges include barge-mounted rigs that may be moved from one location to another via canal, bayou or river, and drill in sheltered inland waters. Offshore rigs include stationary platform units (both self-contained and tender-supported), bottom-supported mobile units, and floating rigs (both drill ships and semi-submersibles). • • • • • • • Table 4. U.S. regional census results. Region Alaska Year Available Active Utilization 2014 29 2013 27 Northern 2014 384 Rockies 2013 350 Southern 2014 281 Rockies 2013 278 Northeast 2014 330 states 2013 313 Permian 2014 767 basin 2013 649 Gulf Coast 2014 498 2013 499 ArkLaTex 2014 173 2013 172 California 2014 110 2013 108 Southeast 2014 242 states 2013 225 Mid2014 440 Continent 2013 434 Total 2014 3,254 2013 3,055 18 16 253 231 193 205 202 154 588 456 360 350 128 124 56 66 167 137 304 316 2,269 2,055 62% 59% 66% 66% 69% 74% 61% 49% 77% 70% 72% 70% 74% 72% 51% 61% 69% 61% 69% 73% 70% 67% Ownership Driller Operator 26 24 347 309 246 241 256 253 682 581 418 435 153 156 97 96 228 209 329 321 2,782 2,625 3 3 37 41 35 37 74 60 85 68 80 64 20 16 13 12 14 16 111 113 472 430 Power source Mechanical SCR/Electric 7 7 99 103 173 175 180 193 407 431 117 110 95 91 65 63 65 63 232 218 1,440 1,454 There were 985 available U.S. rigs that were inactive during this year’s 45-day census period. These units may have been idle as they waited for contracts or were being moved to their next drilling location. These viable, but inactive rigs, were classified according to the length of time that they have been idle. Rigs stacked less than one year numbered 529; one to two years, 338; and two to three years, 118. If land rigs are stacked longer than three years, census rules state that they should be removed from the available count. Assuming no changes occur in their status over the coming year, most of the 78 rigs stacked for more than two years will leave the census in 2015. Often, idle rigs are retired for other reasons before their stacked status targets them for deletion. Rigs that require a large capital expenditure to be up and running are removed from the fleet, and fall into the category “Removed from Service.” Full-year utilization is another statistic used to measure overall fleet dynamics. This percentage is the ratio of active to available rigs that drilled at any time during the past year. Adding the 2,269 active rigs, to the 529 rigs stacked less than one year, provides the total number of rigs that drilled between the end of the 2013 census and the end of the 2014 census. This full-year utilization figure indicates that rig owners used 2,798 6NOVEMBER 2014/WorldOil.com 22 20 285 247 108 103 150 120 360 218 381 389 78 81 45 45 177 162 208 216 1,814 1,601 Land 27 26 384 350 281 278 330 313 767 649 486 475 173 172 105 103 69 77 440 434 3,062 2,877 Rig type Barge Floating 0 0 0 0 0 0 0 0 0 0 2 1 0 0 0 0 43 34 0 0 45 35 0 2 0 0 0 0 0 0 0 0 4 7 0 0 0 0 53 40 0 0 57 47 Platform 0 0 0 0 0 0 0 0 0 0 5 8 0 0 5 5 33 25 0 0 43 38 Bottom Total Supported Offshore 2 1 0 0 0 0 0 0 0 0 1 8 0 0 0 0 44 49 0 0 47 58 2 3 0 0 0 0 0 0 0 0 12 24 0 0 5 5 173 148 0 0 192 178 units, or 86% of all available rigs this year. This compares with 91% during the past census period. So, although utilization increased during the census active period, full-year utilization shows a decline. This indicates that the rig activity upswing was a relatively recent occurrence. Regional results are also computed for the census and often show variations based on area market conditions. Every U.S. region had increases in available rigs for 2014, with the exception of the Gulf Coast, which only declined by one rig. Seven out of 10 regions experienced increases in rig activity. The regional breakdown, which compares this year’s numbers to 2013, is shown in Table 4. The regions with the greatest percentage increases in activity were the Northeast states, up 31%; the Permian basin, up 29%; and the Southeast states, up 22%. It is believed that the Permian basin region, in particular, experienced a bump in activity, due to increased horizontal drilling. California was the area showing the greatest decline in activity, down 15%. Utilization, by region, also shows mixed results, with six out of 10 regions having increases. The regional figures just mentioned are a combination of land and offshore statistics. Looking only at U.S. land rigs, however, we also see a modest increase in utilization. For NATIONAL OILWELL VARCO’S 61ST ANNUAL RIG CENSUS 2014, land rig utilization was up to 70%, versus 68% in 2013. The U.S. marine fleet made a significant utilization gain in 2014, rising another seven percentage points to 69%. Rigs in greatest demand were inland barge rigs at 78% utilization, and floating rigs at 77%. Analyzing the U.S. land and offshore rigs by depth capacity, differences are visible between units in various ranges. The rigs with the highest utilization, 78%, continue to be those in the 16,000-to-19,999ft range. Those with the lowest were the most shallow (3,000 to 5,999 ft), with a utilization of 57%, Table 5. CANADIAN ACTIVITY RISES SHARPLY Canada experienced a noteworthy increase in rig activity over the past year. Since the census is taken every year in the late spring and early summer, the timing of the spring thaw, and the ensuing road restrictions put in place to avoid environmental damage, often cause big differences in year-to-year active count statistics. For 2014, the active count surged, as total units drilling numbered 352 during the 45-day active window. This was a 22% increase from the same time in 2013. Utilization was pushed up this year, because active rigs rose at an even greater rate than available rigs. Canadian utilization measured 44%, versus 37% the previous year, Fig. 6. Subdividing the fleet, more than 60% of available rigs in Canada have drilling capacities between 6,000 and 12,999 ft. However, utilization by depth capacity shows that demand is now greatest for units in the 13,000-to15,999-ft range, where the demand-andsupply ratio comes in at 63%. We have been told that some of the major players are transitioning to deeper rigs, as drilling focuses more on the long-reach horizontal market. INTERNATIONAL RIG UTILIZATION INCREASES Table 5. U.S. rig utilization by depth capacity. By region Alaska Status Available Active Idle Utilization, % Northern Available Rockies Active Idle Utilization, % Southern Available Rockies Active Idle Utilization, % Northeast Available States Active Idle Utilization, % Permian Available Basin Active Idle Utilization, % Gulf Coast Available Active Idle Utilization, % ArkLaTex Available Active Idle Utilization, % California Available Active Idle Utilization, % Southeast Available States Active Idle Utilization, % MidAvailable Continent Active Idle Utilization, % By rig type Inland Available Barge Active Idle Utilization, % Floating Available Active Idle Utilization, % Land Available Active Idle Utilization, % Offshore Available Platform Active Idle Utilization, % Bottom Available Supported Active Idle Utilization, % Total Available Active Idle Utilization, % NOV personnel are asked each year to examine rig counts on a country-by-country basis and then calculate international rig utilization for the primary areas. Accuracy in counting rigs can vary greatly, depending by country, but best-guess estimates are still included in the averages. For 2014, all areas, with the exception of Asia (including China), show increases in utilization. Many of the increases since 2013 can be attributed to improved data sources and record-keeping, as NOV attempts to better understand the international market. Depth rating, ft Over 16,000 to 13,000 to 10,000 to 6,000 to 3,000 to 20,000 19,999 15,999 12,999 9,999 5,999 9 4 8 7 0 1 6 2 3 7 0 0 3 2 5 0 0 1 67% 50% 38% 100% – 0% 130 139 48 32 21 14 98 94 28 17 9 7 32 45 20 15 12 7 75% 68% 58% 53% 43% 50% 13 38 56 59 82 33 10 28 43 33 61 18 3 10 13 26 21 15 77% 74% 77% 56% 74% 55% 15 62 63 65 101 24 9 58 51 31 43 10 6 4 12 34 58 14 60% 94% 81% 48% 43% 42% 125 131 170 227 96 18 107 119 122 157 71 12 18 12 48 70 25 6 86% 91% 72% 69% 74% 67% 208 125 69 38 50 8 157 91 47 25 35 5 51 34 22 13 15 3 75% 73% 68% 66% 70% 63% 13 43 23 24 49 21 6 38 20 16 35 13 7 5 3 8 14 8 46% 88% 87% 67% 71% 62% 18 8 12 22 19 31 8 5 1 9 12 21 10 3 11 13 7 10 44% 63% 8% 41% 63% 68% 153 15 32 23 13 6 106 15 25 12 6 3 47 0 7 11 7 3 69% 100% 78% 52% 46% 50% 98 80 86 102 49 25 69 54 74 64 28 15 29 26 12 38 21 10 70% 68% 86% 63% 57% 60% 20 16 4 80% 56 43 13 77% 641 475 166 74% 25 16 9 64% 40 26 14 65% 782 576 206 74% 3 3 0 100% 1 1 0 100% 634 495 139 78% 6 4 2 67% 1 1 0 100% 645 504 141 78% 9 7 2 78% 0 0 0 – 550 402 148 73% 5 4 1 80% 3 1 2 33% 567 414 153 73% 4 3 1 75% 0 0 0 – 589 367 222 62% 3 1 2 33% 3 0 3 0% 599 371 228 62% 6 3 3 50% 0 0 0 – 471 296 175 63% 3 1 2 33% 0 0 0 – 480 300 180 63% 3 3 0 100% 0 0 0 – 177 101 76 57% 1 0 1 0% 0 0 0 – 181 104 77 57% Total 29 18 11 62% 384 253 131 66% 281 193 88 69% 330 202 128 61% 767 588 179 77% 498 360 138 72% 173 128 45 74% 110 56 54 51% 242 167 75 69% 440 304 136 69% 45 35 10 78% 57 44 13 77% 3,062 2,136 926 70% 43 26 17 60% 47 28 19 60% 3,254 2,269 985 70% The latest counts in the FSU countries of Kazakhstan, Uzbekistan, Azerbaijan and Turkmenistan brought utilization figures up for Europe (including the FSU). Asia (including China), is especially difficult to get a handle on, due to secrecy in the Chinese oil field, but our focus on this area facilitated greater accuracy in determining the active-versus-idle count. Middle Eastern rig counts were up significantly, as Saudi Arabia required more rigs to maintain its oil production levels. World Oil®/NOVEMBER 20147 NATIONAL OILWELL VARCO’S 61ST ANNUAL RIG CENSUS Table 6. International land rig utilization. Europe, incl. FSU Africa Middle East Asia, incl. China Latin America Overall 2006 96% 99% 88% 97% 92% 95% 2007 97% 86% 94% 95% 90% 94% 2008 90% 85% 94% 96% 90% 92% 2009 78% 70% 82% 93% 81% 84% 2010 86% 77% 90% 96% 74% 88% 2011 80% 83% 97% 96% 93% 90% Fig. 6. Canadian available vs. active rigs, 2002-2014. 1,000 900 741 Number of rigs 800 700 640 600 653 500 450 680 875 871 799 852 Available 795 774 747 777 796 U.S. INDUSTRY TRENDS 669 550 Active 449 406 400 334 371 369 352 329 300 346 289 200 191 100 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Fig. 7. Global offshore mobile available vs. active rigs, 2001-2014. Number of rigs 1,000 900 800 670 677 700 600 500 400 488 460 300 200 100 0 2001 2002 678 673 641 654 650 675 Available 479 557 486 545 574 592 705 745 794 824 571 572 559 850 890 697 Active 727 626 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 In Latin America, overall utilization was up, although it was due primarily to available rigs being down, instead of overall activity being lower. Venezuela was the country with the greatest increase in active rigs, due to the growth of proven reserves in the Orinoco Belt. Mexico had somewhat of a utilization increase, but overall rig counts were actually down, due primarily to PEMEX budget issues. In Brazil, Petrobras’ drilling activities were negatively influenced by economic and political issues, which did cause activity to decline, although rig utilization rose. Colombia saw rig activity decrease, as well, due to community issues and strikes in oil states. Worldwide, it is known that some areas have large numbers of available rigs, but these units are often saddled with older technology and may not be universally mobile or marketable. Also, in some cases, available rigs are actually under contract awaiting a project start, and are, therefore, unavailable for other work, Table 6. MOBILE FLEET CONTINUES ITS ASCENT The global offshore mobile fleet continued to show activity gains during the 45-day, census active window of May 9 to June 22. The count rose to 725, an increase of 28 units or 4%. 8NOVEMBER 2014/WorldOil.com This is the highest number of active rigs recorded for the global offshore mobile 2012 2013 2014 fleet since statistics started being kept in 94% 75% 96% 2001. This compares to an active count 96% 83% 87% of 697 in 2013, and it is the first time that 100% 94% 100% the count has surpassed the 700 mark. 96% 96% 86% 88% 80% 84% With the exception of platform and in95% 85% 91% land barge rigs, all offshore mobile units are included in these figures. Utilization didn’t change much in 2014 for the fleet, since both available rigs and active rigs increased at similar rates. It fell just one percentage point to 81%, Fig. 7. In addition to looking at rig statistics, the census determines the total number of rig owners each year. The number of owners has, essentially, leveled off for the last several years, with the number of new drilling companies being added balancing closely with the number of companies ceasing operations. For 2014, the net number of rig owners increased slightly, by six companies, to 319, Fig. 8. Drilling contractors always have owned considerably more drilling rigs than operators, although the percentage of operator-owned rigs has grown slightly over the years. For 2014, the operators’ portion of the fleet went up to 15%, a one-percentage-point increase. This translates to operators owning 472 rigs out of the 3,254 total units. Contractors own 85% of the fleet, or 2,782 rigs. Rig ownership in the U.S. also can be examined by the fleet sizes of individual companies. When industry consolidation began accelerating in the late 1980s, many companies grew quickly as they bought up their competitors. These larger companies (those with more than 20 rigs) continue to hold the largest percentage of the fleet, again, this year, about 59% of all rigs. However, when the market is good, new companies tend to enter the drilling arena. There are 87 companies that own a single rig and are able to capitalize on unique market conditions in their area of expertise. CREW CONCERNS An annual survey is mailed out to drilling contractors every summer, inviting them to provide data about their current business environment and their opinions about the industry. The 2014 survey was completed by 39 contractors, which is about 12% of all U.S. rig owners. A variety of company sizes and regional areas were represented by this year’s respondents. Every year, owners are asked to rank a list of eight key issues that are typically of concern in the industry. In recent years, three issues have continued to surface as the top concerns. “Crew Availability” was the number-one problem mentioned in 2014, moving “Rig Rates,” the top problem in 2013, down in importance. The skilled labor shortage is becoming acute and may be slowing the industry’s rate of growth. The second-highest problem this year is “Government Regulation,” remaining in the same position as last year. For the past several years, there has been anxiety about new mandates that could impact the drilling industry in a negative manner. Hydraulic fracturing, especially, has been on the regulation forefront recently. “Rig Rates” were ranked as the NATIONAL OILWELL VARCO’S 61ST ANNUAL RIG CENSUS Fig. 9. Top contractor concerns. Fig. 8. U.S. rig owners, 1987-2014. 800 Number of rig owners 700 600 500 400 319 300 200 100 0 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Note: 2002 data point is an estimate. third-highest problem this year, after falling from the numberone ranking in 2013. Although rates affect profitability and are always a concern, when active rig counts climb and business is better, other issues tend to move up in importance. More advanced mobile rigs may be able to demand higher rates in some areas. However, better rig rates can only go so far in helping alleviate severe crew shortages, when crucial training time is needed, Fig. 9. Respondents are asked to share some of their company’s current business figures. Labor rates on average have gone up another 5% over the past year, and continue to rise as companies try to recruit and maintain crews. The cost of insurance and benefits also has an impact on expenses, which continue to escalate. Rig maintenance is another significant expense for contractors, and it tends to increase annually. This year, contractors told us that maintenance costs were going to be about 2% higher than in 2013. There are still a number of older rigs in the fleet that are very costly to maintain. Contractors told us that, on average, their rig activity has gone up almost 8%, compared to a year ago. This estimated percentage is a little lower than the overall increase of 10% measured in the census this year. Respondents also had an average increase of 2% in their land rig rates over the past year. This increase is in line with higher rig activity, but does show that rates have not kept up with activity levels. Contractors seem optimistic that rig activity will continue to improve over the next year, and they forecast an increase of almost 7% for 2015. Along with horizontal drilling and hydraulic fracturing, pad drilling has been one of the most important innovations in recent industry history. Therefore, a new question was added to the survey this year, which asked contractors to estimate what percentage of their wells used pad drilling. This number was almost 31%, a significant percentage for a technology that has been around for less than a decade. In actuality, we know that in many of the big plays and among some operators, an even higher percentage of wells are drilled using pad drilling. CONTRACTORS PLAN TO EXPAND FLEETS The 2014 Contractor Survey also asked rig owners to choose among several statements that best described their company’s plans for the next five years. Recent economic prosperity, and an optimistic outlook, are apparent in this year’s results. About 51% of contractors told us that they expect to 2013 No.1 Rig rates No.2 Government regulations No.3 Crew availability 2014 No.1 Crew availability No.2 Government regulations No.3 Rig rates “Expand Current Fleet” in the next few years. With advanced technology, rigs are able to optimize output at a faster rate, so it isn’t surprising that a majority of contractors would expect to increase profits by adding newer models to their fleets. The next highest number of responses, 31%, included contractors who predicted “No Plans for Change” in the next five years. Fewer owners checked the boxes for “Unknown” (10%), “Diversification into Other Businesses” (8%), “Pursuing International Opportunities” (5%), “Seeking Merger Opportunities” (5%), and “Downsizing Current Fleet” (3%). It is important to note that contractors were allowed to choose more than one category, so the total is greater than 100%. FORECAST FOR 2015 The outlook for 2015 is more of a good news/bad news scenario. Market conditions remain good in North America, especially in the shale plays and other unconventional resources. Demand for the best rigs is expanding. Advances in rig technology will continue to improve drilling efficiency, safety, and the environmental impact of drilling. Growth in land rigs is expected in Canada, Latin America and the Middle East. The offshore global mobile fleet will continue to add to its numbers with state-of-the art rigs. Furthermore, analysts expect the world’s energy consumption to continue to grow. However, combining higher rig efficiency with crude prices that have slumped in recent days, does impact our optimism. It’s possible that in 2015, if supplies are still high, U.S. utilization may fall slightly, since fewer rigs will be necessary for new production. Hopefully, the recent commodity price dip is just an aberration, and this dynamic industry will continue to prosper in innovative ways. ACKNOWLEDGEMENT NOV partnered with several companies to collect industry statistics published in this article. IHS is the primary source used for the U.S. land rig fleet and global offshore mobile fleet. Nickle’s Energy Group is the principal source for the Canadian figures. Information for some areas, particularly the international fleet, was collected and analyzed by NOV personnel. The following individuals are recognized for their specific contributions to this year’s rig census: Tom Kellock (IHS); Jacoby Garcia (RigData); Melissa Brouillard, Franklin Pinerua Cardozo, Kristin Gilbertson, Keith Joseph, David Nassif, Tim Tynan, Adriana Vizcarrondo (NOV). BRANDON MONTAGNE is the director of Market Intelligence for NOV’s Wellbore Technologies segment. He began his career with NOV Downhole in Houston, seven years ago. At NOV, Mr. Montagne has held various other positions, including Commercialization Process manager and then Market Intelligence manager. He received a BBA degree in marketing from Sam Houston State University in 2007. TORY A. STOKES is a consultant for NOV’s Downhole division, after being employed at ReedHycalog as senior marketing analyst for eight years. She graduated with a BS degree in applied mathematics from Texas A&M University in 1985, and earned an MBA from the University of Houston in 1993. World Oil®/NOVEMBER 20149 NATIONAL OILWELL VARCO’S 61ST ANNUAL RIG CENSUS U.S. rig census historical data, 1955–2014 Depth rating, ft Unit change 71 -201 -105 86 20 -303 -219 226 -29 -138 -90 -116 -297 -51 -162 -39 -91 -1 127 134 176 278 369 331 490 1131 841 -371 -693 -171 -416 -662 -579 -210 -222 -69 -255 -143 -12 -112 -80 16 40 -61 -8 86 n/a -3 269 38 272 519 259 93 -16 -72 -72 % change 2% -6% -3% 3% 1% -10% -8% 9% -1% -5% -3% -5% -12% -2% -8% -2% -5% 0% 7% 7% 9% 13% 15% 12% 15% 31% 18% -7% -13% -4% -9% -17% -17% -8% -9% -3% -11% -7% -1% -6% -5% 1% 2% -4% 0% 5% n/a 0% 16% 2% 13% 23% 9% 3% -1% -2% -2% Active 2,654 2,836 2,519 1,909 2,476 2,150 2,064 1,835 2,002 2,048 1,934 1,714 1,573 1,508 1,649 1,331 1,308 1,381 1,473 1,769 1,877 1,979 2,399 2,785 2,874 3,542 4,703 3,225 2,539 3,090 2,625 1,052 1,388 1,532 1,444 1,677 1,485 1,192 1,279 1,221 1,232 1,263 1,447 1,305 860 1,215 1,593 n/a 1,334 1,674 1,920 2,200 2,402 2,541 1,264 2,024 2,059 2,248 Util. rate 83% 87% 82% 64% 81% 70% 74% 72% 72% 74% 74% 68% 65% 71% 80% 70% 70% 78% 83% 93% 93% 90% 97% 98% 90% 96% 98% 57% 48% 67% 60% 26% 42% 56% 57% 72% 66% 60% 69% 66% 71% 77% 87% 77% 52% 74% 93% n/a 78% 84% 95% 96% 85% 83% 40% 64% 67% 75% Idle 552 441 557 1,062 581 927 710 720 779 704 680 810 835 603 411 567 551 387 294 125 151 225 83 66 308 130 100 2,419 2,734 1,490 1,784 2,941 1,943 1,220 1,098 643 766 804 574 620 497 386 218 400 784 421 129 n/a 385 314 106 98 415 535 1,905 1129 1,022 758 Driller owned 2,806 2,911 2,796 2,735 2,848 2,874 2,606 2,406 2,672 2,644 2,531 2,472 2,359 2,067 2,033 1,869 1,832 1,741 1,739 1,881 2,014 2,180 2,451 2,818 3,144 3,626 4,762 5,606 5,241 4,553 4,386 3,961 3,299 2,716 2,508 2,294 2,209 1,956 1,806 1,789 1,680 1,597 1,606 1,640 1,599 1,557 1,643 n/a 1,648 1,896 1,962 2,191 2,511 2,698 2,729 2,702 2,626 2,567 Operator owned 400 366 280 236 209 203 168 149 109 108 83 52 49 44 27 29 27 27 28 13 14 24 31 33 38 46 41 38 32 27 23 32 32 36 34 26 42 40 47 52 49 52 59 65 45 79 79 n/a 71 92 64 107 306 378 440 451 455 439 Over 16,000 to 20,000 19,999 –––––– 104 –––––– –––––– 110 –––––– –––––– 111 –––––– –––––– 141 –––––– –––––– 184 –––––– –––––– 210 –––––– –––––– 193 –––––– –––––– 218 –––––– –––––– 272 –––––– –––––– 305 –––––– –––––– 322 –––––– –––––– 350 –––––– –––––– 375 –––––– –––––– 372 –––––– –––––– 366 –––––– –––––– 343 –––––– –––––– 361 –––––– –––––– 397 –––––– –––––– 413 –––––– –––––– 425 –––––– –––––– 448 –––––– –––––– 498 –––––– –––––– 577 –––––– –––––– 693 –––––– –––––– 872 –––––– –––––– 1,059 –––––– –––––– 1,405 –––––– –––––– 1,717 –––––– –––––– 1,639 –––––– –––––– 1,408 –––––– –––––– 1,332 –––––– –––––– 1,220 –––––– –––––– 991 –––––– –––––– 771 –––––– –––––– 704 –––––– 399 221 380 210 315 175 303 152 326 147 317 148 311 139 339 137 376 142 375 134 392 134 424 161 n/a n/a 390 205 424 230 375 251 394 287 453 347 471 378 478 449 517 472 498 523 514 589 13,000 to 15,999 445 453 425 405 424 378 356 307 298 251 242 206 199 185 188 219 198 171 164 214 225 239 274 313 350 419 595 717 662 591 570 496 427 365 329 313 304 267 240 245 239 221 230 238 232 231 254 n/a 274 295 311 384 508 605 670 662 646 606 10,000 to 12,999 613 562 553 487 520 477 399 471 479 463 449 461 435 381 352 322 329 301 318 339 380 366 461 565 631 704 950 1104 993 933 894 789 637 529 515 488 491 441 420 411 393 384 387 391 368 355 373 n/a 368 473 472 562 658 741 754 721 667 616 Year 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Available 3,206 3,277 3,076 2,971 3,057 3,077 2,774 2,555 2,781 2,752 2,614 2,524 2,408 2,111 2,060 1,898 1,859 1,768 1,767 1,894 2,028 2,204 2,482 2,851 3,182 3,672 4,803 5,644 5,273 4,580 4,409 3,993 3,331 2,752 2,542 2,320 2,251 1,996 1,853 1,841 1,729 1,649 1,665 1,705 1,644 1,636 1,722 n/a 1,719 1,988 2,026 2,298 2,817 3,076 3,169 3,153 3,081 3,006 2013 3,055 49 2% 2,055 67% 1,000 2,625 430 706 561 551 2014 3,254 199 7% 2,269 70% 985 2,782 472 782 645 567 599 AVG. 2,692 1 0% 1,948 74% 744 2,566 126 528 285 363 530 Note: The data for 1953, 1954 and 2002 are not available. 10NOVEMBER 2014/WorldOil.com 600 NATIONAL OILWELL VARCO’S 61ST ANNUAL RIG CENSUS Power source 6,000 to 9,999 1,237 1,256 1,075 1,067 996 1,033 937 823 964 1,029 936 863 776 680 626 580 535 490 517 529 579 633 628 723 783 885 1,080 1,285 1,233 1,077 1,084 971 841 751 700 623 603 553 513 499 453 435 421 412 395 381 371 n/a 359 435 474 521 609 621 577 555 552 496 3,000 to 5,999 SCR/Elec. 807 30 896 34 912 52 871 49 933 54 979 73 889 66 736 63 768 106 704 113 665 138 644 164 623 206 493 189 528 177 434 154 436 170 409 176 355 164 397 159 396 164 468 192 542 217 557 283 546 420 605 490 773 656 821 896 746 851 571 771 529 748 517 815 435 681 336 561 294 498 276 408 263 438 245 395 225 380 213 418 179 414 159 408 151 456 146 497 140 499 143 520 139 582 n/a n/a 123 592 131 627 143 603 150 826 242 1,104 260 1,170 241 1,211 226 1,316 195 1,386 185 1,499 Mechanical Diesel Gas Steam n.a. n.a. 285 n.a. n.a. 247 n.a. n.a. 195 n.a. n.a. 158 n.a. n.a. 113 1,039 1,864 101 1,092 1,549 67 913 1,525 54 1,027 1,600 48 1,040 1,577 22 1,051 1,404 21 964 1,376 20 955 1,239 8 882 1,037 3 952 928 3 895 847 2 937 750 2 955 637 0 1,007 596 0 1,200 535 0 1,339 525 0 1,535 476 1 1,943 321 1 2,309 259 0 2,521 241 0 3,023 159 0 4,000 146 1 4,647 100 1 4,344 77 1 3,747 61 1 3,621 40 0 3,139 39 0 2,626 24 0 2,167 24 0 2,025 19 0 1,891 21 0 1,798 15 0 1,589 12 0 1,460 13 0 1,402 21 0 1,305 10 0 1,234 7 0 –––––– 1,209 –––––– –––––– 1,208 –––––– –––––– 1,145 –––––– –––––– 1,116 –––––– –––––– 1,140 –––––– –––––– n/a –––––– –––––– 1,127 –––––– –––––– 1,361 –––––– –––––– 1,423 –––––– –––––– 1,472 –––––– –––––– 1,713 –––––– –––––– 1,906 –––––– –––––– 1,958 –––––– –––––– 1,837 –––––– –––––– 1,695 –––––– –––––– 1,507 –––––– Rig type Land 2,996 3,025 2,793 2,715 2,811 2,837 2,535 2,300 2,514 2,479 2,343 2,259 2,114 1,825 1,827 1,662 1,592 1,551 1,570 1,715 1,839 1,964 2,186 2,524 2,802 3,255 4,316 5,139 4,832 4,102 3,940 3,573 2,956 2,429 2,249 2,061 2,006 1,809 1,660 1,613 1,500 1,425 1,428 1,449 1,384 1,370 1,452 n/a 1,488 1,736 1,813 2,100 2,598 2,871 2,971 2,938 2,885 2,828 Inland barge 162 175 184 185 190 178 173 178 179 162 144 128 121 114 98 106 124 77 71 66 74 76 77 91 109 115 161 157 128 131 121 90 91 63 63 54 51 47 46 45 45 46 44 47 46 47 38 n/a 43 51 48 47 55 52 51 55 50 37 Floating 10 14 32 37 34 39 28 41 50 50 67 58 72 77 50 55 62 60 59 54 58 81 120 123 144 34 32 25 31 51 58 70 53 48 40 30 24 20 19 21 19 22 28 35 37 33 37 n/a 36 45 37 42 43 41 43 41 38 41 Offshore Bottom platform supported –––––– 38 –––––– –––––– 63 –––––– –––––– 67 –––––– –––––– 34 –––––– –––––– 22 –––––– –––––– 23 –––––– –––––– 38 –––––– –––––– 36 –––––– –––––– 38 –––––– –––––– 61 –––––– –––––– 60 –––––– –––––– 79 –––––– –––––– 101 –––––– –––––– 95 –––––– –––––– 85 –––––– –––––– 75 –––––– –––––– 81 –––––– –––––– 80 –––––– –––––– 67 –––––– –––––– 59 –––––– –––––– 57 –––––– –––––– 83 –––––– –––––– 99 –––––– –––––– 113 –––––– –––––– 127 –––––– 149 119 155 139 167 156 129 153 123 173 107 183 89 171 77 154 62 150 60 130 46 129 48 122 41 79 36 92 39 123 43 122 39 117 42 123 45 129 45 132 42 144 43 152 n/a n/a 34 118 41 115 31 97 28 81 38 83 39 73 39 65 34 85 31 77 35 65 Offshore stationary 38 63 67 34 22 23 38 36 38 61 60 79 101 95 85 75 81 80 67 59 57 83 99 113 127 268 294 323 282 296 290 260 231 212 190 175 170 120 128 162 165 156 165 174 177 186 195 n/a 152 156 128 109 121 112 104 119 108 100 Subtotal offshore 210 252 283 256 246 240 239 255 267 273 271 265 294 286 233 236 267 217 197 179 189 240 296 327 380 417 487 505 441 478 469 420 375 323 293 259 245 187 193 228 229 224 237 256 260 266 270 n/a 231 252 213 198 219 205 198 215 196 178 469 168 1,601 ––––––1454 –––––– 2,877 35 47 38 58 96 178 480 181 1,814 ––––––1440–––––– 3,062 45 57 43 47 90 192 712 443 504 n.a. 2,422 93 47 63 116 130 270 World Oil®/NOVEMBER 201411