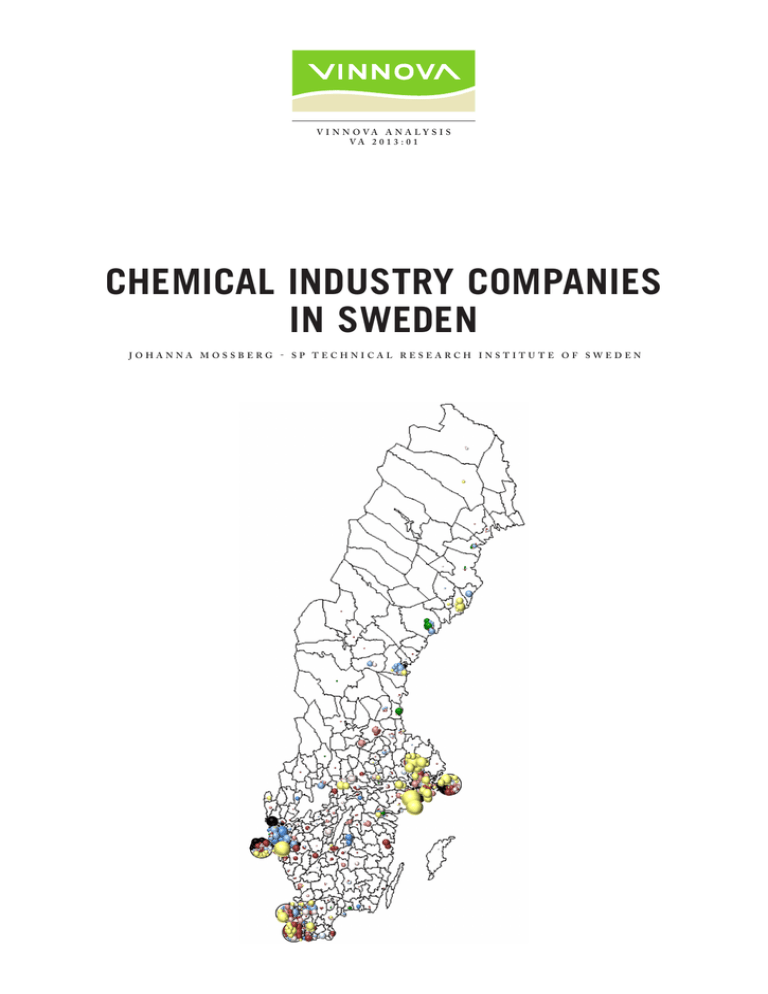

Chemical Industry Companies in Sweden

advertisement