Q b (z-b)Q=constant (v-b)Q=constant (b(z),Q(b(z)) ^

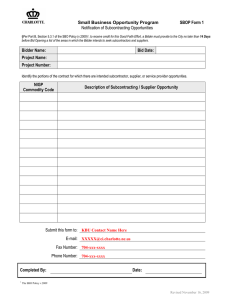

advertisement

March 7

We’ll prove the following 4 lemmas:

Lemma 139 (Property 1.) If (·) defines a symmetric equilibrium of (0 0), then for all 0:

b

() 6= , (())

0, and () .

Lemma 140 Any symmetric equilibrium (·) of the (0 0) weakly increases on (0 1].

Lemma 141 (Property 2.) Any symmetric equilibrium (·) of the (0 0) strictly increases on (0 1].

Lemma 142 (Property 3.) Any symmetric equilibrium (·) of the (0 0) is differentiable on (0 1].

Digression: Revealed Preference

The argument that we make in Lemma 137 is fundamental in microeconomics and merits some additional

discussion. We’ll present a graphical argument that a bidder’s bid and his probability of winning must be

nondecreasing in his bid.

A bidder’s expected payoff is ( − ), where is his bid and is the probability that he wins. A bidder

(of course) would prefer a low and a high ; the strategies of the other bidders, however, determines a

b

function ()

that determines his probability of winning as a function of his bid. We can imagine a bidder’s

decision problem for each value of as a constrained optimization problem,

b

max( − ) s.t. = ()

b

We’re not assuming anything here about ()

except that it is determined by an equilibrium (·). The

b

behavior of the other bidders determines a curve ( ())

that a bidder can choose along to maximize his

payoff. We’re not going to draw it because we don’t know what it looks like. We do know something about

the preferences of a bidder over values of and . First, the indifference curves of a bidder for fixed slopes

upward. Second, consider 0 . The indifference curves of a bidder with value are flatter than the

indifference curves of a bidder with value , reflecting the fact that at any point the bidder with the higher

value is willing to pay more (∆) for an increase ∆ in the probability of winning than the bidder with

lower value. This is the single-crossing property, i.e., the indifference curves for distinct values cross at

most once.

b

Let (() (())

denote the point that the bidder with value selects as best (it’s optimality is not

b

depicted below because we don’t know how to sketch the curve ( ())).

Consider the indifference curve of

b

the bidder with value that passes through this point. The point (() (())

he chooses must lie in the

closed4 shaded region between the two indifference curves, reflecting the fact that the type bidder prefers

b

b

(() (())

to (() (()),

and vice-versa for the type bidder. From the picture, we can see that for

b

b

, we must have () ≥ () and (())

≥ (()).

(z-b)Q=constant

Q

(v-b)Q=constant

^

(b(z),Q(b(z))

b

4 "Closed"

if we restrict so that 0≤ ≤ 1.

98

Question: Does the preceding discussion depend on the assumption that the other bidders are using

the same strategy (·) as the bidder whose bids are being studied, or does it only depend on the assumption

b

that the strategies of the other bidders determine some function ()?

In other words, is symmetry of the

equilibrium required in this argument to conclude that a bidder’s strategy and his probability of winning is

nondecreasing in his value ?

You should work the exercises at the back of Matthews’ paper.

Lemma 143 (Property 1.) If (·) defines a symmetric equilibrium of (0 0), then for all 0:

b

() 6= , (())

0, and () .

Proof. We first show that for almost no value will a bidder choose . Let

= Pr {() = }

If 0, the a bidder with value 0 at which () = can earn a positive expected payoff by

instead bidding 0 (he wins if everyone else chooses ). This violates the assumption that () defines an

equilibrium. Consequently, =¡0. ¢

The probability of "No Sale" is = 0, and so we can ignore this event in probability calculations

below. We have

=

X

=1

() = Pr [e

≤ for 1 ≤ ≤ ]

= Pr [e

≤ for 1 ≤ ≤ and the item is sold ]

Pr [e

≤ for 1 ≤ ≤ and the item is sold to bidder ]

≤

X

=1

Pr [e

≤ and the item is sold to bidder ]

=

Z

0

b

(())

()

In the last line, we’re "adding up" (i.e., through integration) the probability that bidder gets the item

for each possible value of . The "" represents the different values of that we must consider.

Comparison of the first and the last line implies that for each value of , there must exist of value of

b

∈ (0 ) at which (())

0.

b

We can now complete the proof. Consider a value of 0 and let 0 satisfy (())

0. If

the bidder with value bid (), his profit would be

b

b

≥0

( − ()) (())

( − ()) (())

where the last inequality holds because the bidder with value chooses to bid (he could get 0 by choosing

). Therefore, the bidder with value can earn a positive profit by bidding (), from which the 3

b

conclusions (() 6= , (())

0, and () ) follow immediately.

Lemma 144 (Property 3.) Any symmetric equilibrium (·) of the (0 0) is differentiable on (0 1].

Proof. Assume 0 . We return to our two "revealed preference" inequalities from an earlier lemma:

b

b

( − ()) (())

≥ ( − ()) (())

⇔

h

i

b

b

b

b

(())

− (())

≥ ()(())

− ()(())

b

b

( − ()) (())

≥ ( − ()) (())

⇔

h

i

b

b

b

b

(())

− (())

≥ ()(())

− ()(())

99

Therefore

which implies

h

i

h

i

b

b

b

b

b

b

(())

− (())

≤ ()(())

− ()(())

≤ (())

− (())

"

#

"

#

b

b

b

b

b

b

(())

− (())

()(())

− ()(())

(())

− (())

≤

≤

−

−

−

Taking the limit as → the left and right sides converge to5

b

(())

and so the middle term also converges to this function. We therefore have

´

b

³

(())

b

()(())

=

b

and because (())

is differentiable in , the strategy () must also be differentiable in .

Section 8 of Matthews: Abstract Auctions

We delve more deeply into the equivalence of different auction forms in this section. We consider an

enormous variety of auction rules, even ones that may seem crazy (i.e., the lowest bidder wins, or all bidders

pay their bids, or auctions such as ( ) or ( ) that take place over time, etc.).

One question that we’d like to answer is, "What is the best auction (i.e., the revenue-maximizing auction)

for the seller?" If we want to determine the optimal auction, then we need to find a way to model all possible

auctions. This seems impossibly complicated (for example, consider the difficulty of formalizing a bidder’s

strategy in an English auction if "jump" bids are allowed or if a bidder can exit and then re-enter the bidding

process). The action sets of bidders can be very complicated, especially in dynamic settings, and who knows

what we might be able to invent? To be more precise, we need a way to address all possible outcomes of

equilibria of auctions, however complicated their action sets may be. By outcome, I mean who gets the

item (possibly randomized) and how much does the seller receive.

The key insight that makes it possible to address all possible equilibrium outcomes of auctions is the

revelation principle. Suppose we have a Bayesian Nash equilibrium of some auction. The revelation

principle states that there is an auction in which (i) bidders are asked to report their values, (ii) honest

reporting is a Bayesian Nash equilibrium, and (iii) this honest equilibrium produces exactly the same outcome

as the equilibrium of the auction that we started with. The outcomes of auctions in which (I) bidders report

their values and (II) honest reporting is a Bayesian Nash equilibrium are thus a kind of "canonical form"

in which all equilibrium outcomes of all other auctions can be represented. By studying auctions with

properties (I) and (II), we can in effect study all possible (Bayesian Nash) equilibrium outcomes of all

possible auctions.

The revelation principle is subtle. We’ll actually prove it and take some time in explaining it.

To start, define a revelation auction as one in which each bidder’s action set consists of his possible

values. Let denote the actual value of bidder and ∗ his reported value (i.e., his action in the auction);

we allow ∗ 6= because it must be in bidder ’s interest to report truthfully and we verify this by evaluating

untruthful reports. What defines the auction? We must specify (i) who gets the item and (ii) what payments

are made to the seller given the reported values. For a vector of reports

∗ = (1∗ 2∗ ∗ )

let (∗ ) denote the probability that the item is given to bidder and let (∗ ) denote the expected payment

from bidder to the seller ("expected" because of randomization in the outcome). Let

( ∗ ) = ( ( ∗ ))1≤≤

5 Once we have that (·) is increasing on (0 1], it follows that the probability of winning when is one’s value is the probability

that the other − 1 values are below ,

(())

= ()

It is therefore differentiable in .

100

and

( ∗ ) = ( (∗ ))1≤≤

A revelation auction is defined by specifying the functions (·) and (·), and we’ll denote a revelation auction

by the pair ( ).

For each , define

(∗ ) = [ (∗ − )]

i.e., (∗ ) is the probability that bidder receives the item when he reports ∗ and all other other bidders

report truthfully. Similarly,

(∗ ) = [ (∗ − )]

is the expected payment of bidder when he reports ∗ and all other bidders report truthfully, We require

in a revelation auction that truthful reporting defines a Bayesian Nash equilibrium, i.e., for each bidder

and for each , ∗ ,

( ) − ( ) ≥ (∗ ) − (∗ )

(IC)

This is the constraint of incentive compatibility (IC). In words, when is one’s true value, the expected

payoff from reporting truthfully is at least as large as the expected profit from any possible "lie" ∗ . We

also require that each bidder should participate voluntarily for each of his possible valuations , i.e.,

( ) − ( ) ≥ 0

(IR)

This is the constraint of individual rationality (IR), i.e., each bidder, after learning his type, would not

be hurt by participating in the auction. We don’t model a "NO" option (a decision to not bid) here, but it

is effectively addressed with IR. More precisely, this is the constraint of interim individual rationality:

participation is voluntary at the moment at which each bidder learns his type but before the auction has

operated.

Abstract Auctions

An abstract auction is defined as follows. Let denote the action set of bidder . Let : [01] →

denote bidder ’s rule for selecting an action as a function of his value . The outcome of the auction is

specified by a function

( )

:

Y

=1

→ [0 1] × R

= ( )1≤≤

= ( )1≤≤

which specifies for each profile of actions = (1 ) and for each agent the probability () that

receives the item and his expected payment () to the seller. Let

Ã

!

Y

( )

=1

denote an abstract auction.

Theorem 145 (The Revelation Principle) Suppose the rules ∗1 ∗ define a Bayesian Nash equilibrium in the abstract auction

Ã

!

Y

( )

=1

and suppose also that this equilibrium is individually rational (i.e., each bidder’s expected payoff is nonnegative

conditional on any of his possible values). Then there exists a revelation auction ( ) that satisfies IC and

IR and with the property that

( ) = ( ) ◦ (∗1 ∗ )

that is, the revelation auction results in exactly the same outcome when the bidders report honestly as in the

equilibrium of the abstract auction.

101

The punch line: We can evaluate the IR outcomes that can arise in equilibrium of any possible auction

simply by considering the IR, honest equilibria of revelation auctions.

In a revelation auction that satisfies IC and IR, let

Π () = () − ()

denote the equilibrium expected profit of bidder given his value .

Theorem 146 (8.1, p. 34 of Matthews) Assuming (), () are differentiable, the expected profit of

bidder satisfies

Z

Π () = Π (0) +

()

0

i.e., it is completely determined by the constant Π (0) and the function (·).

Proof. The constraint of incentive compatibility implies that ∗ = maximizes

( ∗ ) − ( ∗ )

The first order condition for this maximization is

0

0

() − () = 0

We also have

0

0

0

Π () = () + () − ()

= ()

The equation in the statement of the theorem follows by taking antiderivatives of each side and solving for

the constant by which the two antiderivatives may differ.

This is an important result because it captures incentive compatibility in a single equation. The assumption of differentiability isn’t needed, however; in fact, differentiability of (·) almost everywhere is a

consequence of the following alternative proof.

Here is an alternative proof that doesn’t require the assumption that () () are differentiable:

Proof. We use the "revealed preference" argument that we used earlier in the course to analyze (0 0).6

Consider ∗ . When is his true value, bidder can’t benefit by reporting ∗ ,

Π () = () − () ≥ (∗ ) − (∗ )

≥

and when ∗ is his true value, bidder can’t benefit by reporting ,

Π ( ∗ ) = ( ∗ )∗ − (∗ ) ≥ ()∗ − ()

≥

We have

− ≤ − ≤−

( ∗ ) ( − ∗ ) ≤ Π () − Π (∗ ) ≤ () ( − ∗ )

Comparing the first and last term, if ∗ , then

( ∗ ) ≤ ()

i.e., (·) is (weakly) increasing. A theorem in real analysis states that a nondecreasing function is differentiable and hence continuous almost everywhere. (Matthews assumes differentiability to avoid citing this

theorem). From above we have

Π () − Π (∗ )

( ∗ ) ≤

≤ ()

( − ∗ )

6 I’m surprised that Matthews doesn’t use this revealed preference argument to prove the result because he discusses "revealed

preference" at some length in his paper.

102

Taking the limit as ∗ → at a value of where (·) is continuous implies

Π

() = ()

Taking antiderivatives of each side and solving for the constant implies

Z

()

Π () = Π (0) +

0

which is the desired result.

Remark 147 Notice that we also learn in this proof that (·) is (weakly) increasing in an incentive compatible revelation auction.

One implication of this theorem is that we can solve for the seller’s expected revenue in terms of the

allocation rule (·) through its determination of the functions (·) together with the constants Π (0). We

have two formulas for Π ()

Z

()

() − () = Π () = Π (0) +

0

Solving, we obtain

() − Π (0) −

Z

() = ()

0

The expected payment from bidder to the seller is

Z 1

() ()

[ ()] =

0

Z

Z 1∙

() − Π (0) −

=

0

= −Π (0) +

Z

() ()

0

() () −

Z

() () −

Z

1

0

The expected revenue of the seller is therefore

X

1

0

Z

() ()

0

[ ()]

=1

= −

¸

X

=1

Π (0) +

∙Z

X

=1

0

1

0

1

Z

0

() ()

¸

For now, this complicated expression may not seem particularly interesting. The notable fact is that the

seller’s expected revenue is determined by the allocation rule (·) and the constants Π (0). Consequently,

any two IC revelation auctions that award the item in the same way in their honest equilibria and that assign

the same expected payoff to each bidder of value = 0 necessarily produces the same expected revenue for

the seller. More interesting still, we have the following theorem through the revelation principle:

Theorem 148 (Revenue Equivalence) Any two equilibria of any two auctions that generate the same

allocation rule (·) and the same conditional expected payoffs Π (0) for each buyer with value 0 necessarily

produce exactly the same expected revenue for the seller.

Example 149 Consider the equilibria that we found in the 4 auctions, (0 0), (0 0), (0 0),

and (0 0). For good measure, also include the equilibria that you find in the 3 auctions in problems 5,

6, and 7 of Matthews (some computed only in the uniform case). All of these equilibria have the following

properties:

• the bidder with the highest value wins the item;

• a bidder with value 0 receives the item with probability 0 and makes no payment to the seller.

The first property implies that each equilibrium of each of these auctions results in exactly the same allocation

rule (·) (i.e., the bidder with the highest value wins). The second property means that Π (0) = 0 for each

bidder in each of these equilibria. Consequently, all of these equilibria of these different auctions generate

exactly the same expected revenue for the seller.

103