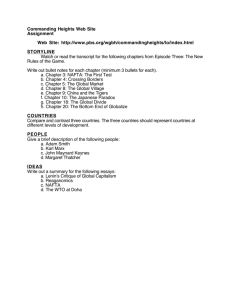

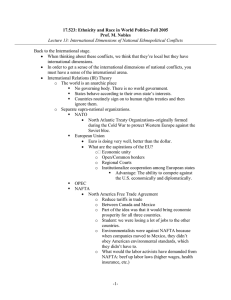

technology trade and nafta

advertisement