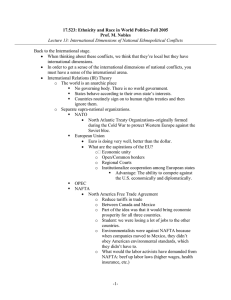

NAFTA and Convergence in North America

advertisement