Credit Score Math & Reading Quiz

advertisement

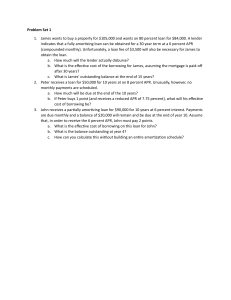

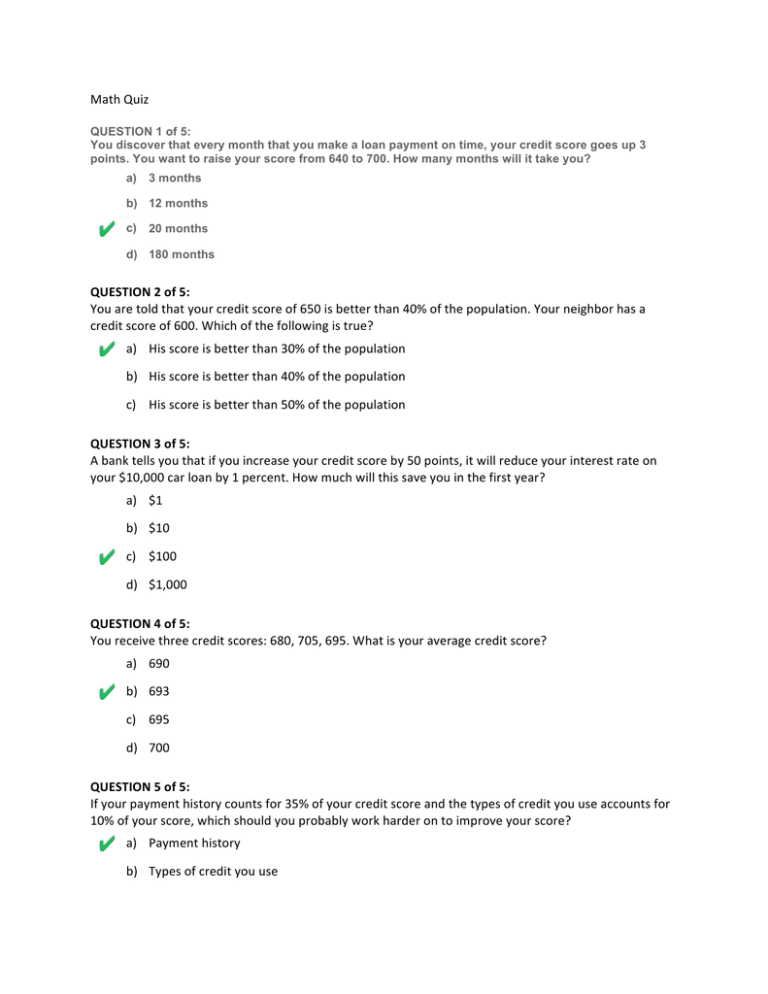

Math Quiz QUESTION 1 of 5: You discover that every month that you make a loan payment on time, your credit score goes up 3 points. You want to raise your score from 640 to 700. How many months will it take you? a) 3 months b) 12 months c) 20 months d) 180 months QUESTION 2 of 5: You are told that your credit score of 650 is better than 40% of the population. Your neighbor has a credit score of 600. Which of the following is true? a) His score is better than 30% of the population b) His score is better than 40% of the population c) His score is better than 50% of the population QUESTION 3 of 5: A bank tells you that if you increase your credit score by 50 points, it will reduce your interest rate on your $10,000 car loan by 1 percent. How much will this save you in the first year? a) $1 b) $10 c) $100 d) $1,000 QUESTION 4 of 5: You receive three credit scores: 680, 705, 695. What is your average credit score? a) 690 b) 693 c) 695 d) 700 QUESTION 5 of 5: If your payment history counts for 35% of your credit score and the types of credit you use accounts for 10% of your score, which should you probably work harder on to improve your score? a) Payment history b) Types of credit you use Reading Quiz QUESTION 1 of 5: Credit history includes: a) Library fines b) Savings and credit card accounts c) Being a good friend d) Only positive items, regardless of your borrowing past QUESTION 2 of 5: To build up a good credit history, you should: a) Get a Social Security Number if you do not already have one b) Get as many credit cards as you can c) Always pay at least the minimum amount due on your credit card d) A and C QUESTION 3 of 5: A savings account: a) Is no use in developing a credit history b) Should have your correct Social Security Number attached so that it helps your credit history c) Can be used to write checks and is a credit account d) Can only be opened once you are 18 years old QUESTION 4 of 5: A regular paycheck helps your credit score because: a) It can be cashed and spent quickly b) It has taxes pulled out c) It shows you will not pay your bills on time d) It indicates you are likely a good credit risk QUESTION 5 of 10: Negative items on a credit report that are not correct: a) Can never be removed b) Don't affect your credit rating c) Are best ignored d) Should be removed once the mistake is shown to the credit reporting company