ST BEDE`S COLLEGE LIMITED

advertisement

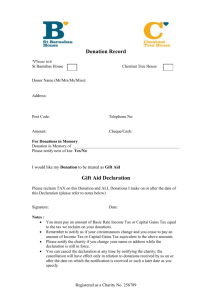

ST BEDE’S COLLEGE LIMITED - Alumni Fund CHARITY No. 700808 TEL: 0161 226 3323 REGULAR GIVING & GIFT AID DECLARATION I wish to support the Headmaster’s new Alumni Fund and I am prepared to give each month the amount outlined below. I understand that I can cancel the direct debit at any time by contacting the Bursar at St Bede’s. DETAILS OF DONOR Title: ………………… Forenames: …………………………………… Surname: ……………………………………….. Address: ……………………………………..…..……………………………………………….…………………………….. ..….…………………………………………………………… Post Code: ………………………………………. CONTRIBUTION - I wish to contribute the following amount (please tick as appropriate) each month: £1 per month [ ] £2.50 per month [ ] £5 per month [ ] £10 per month [ ] Other amount (please specify) £……………..per month I want the Charity to treat all donations I make from the date of this declaration until I notify you otherwise as Gift Aid donations. I understand that St Bede’s College Ltd will then receive £1.25 for every £1 that I contribute (see the guidance notes below). SIGNED:……………………………………………………………………………….. DATE: …………………………………… STANDING ORDER FORM To the Manager (Name & Address of your Bank)…………………………………………………………………………….. …………………………………………………….…………………………………………………………………………………. Account No:…………………………………... Sort Code…….……. /…………………. /…………………. Please Pay £…………………………………….. each month To: The Royal Bank of Scotland, St Ann Street Branch, St Ann Street, Manchester. M60 2SS Account Name: St Bede’s College Limited Account No: 41460126 Sort Code: 16 / 00 / 18 Guidance Notes: 1. You can cancel this declaration at any time by notifying the Bursar. 2. You must pay an amount of income tax and/or capital gains tax at least equal to the tax the College reclaims on your donations in the relevant tax year. 3. If in future your circumstances change and you no longer pay tax on your income and capital gains equal to the tax the College reclaims, you can cancel your declaration (see Note 1) 4. If you pay tax at the higher rate you can claim further tax relief on your Self-Assessment tax return, or ask HMRC to adjust your tax code. 5. Please notify the College if you change your name or address. NB: WHEN COMPLETED AND SIGNED please send the whole of this Declaration to: The Bursar, St Bede’s College, Alexandra Park, Manchester, M16 8HX