Captive - Zurich

advertisement

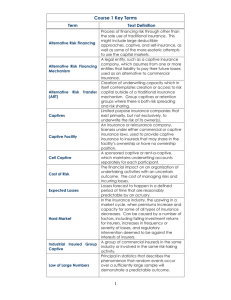

ART Alternative Risk Transfer Captive Cover the risks of your group through your own insurance company. In this way, you participate to a greater extent in a favourable claims history, earn investment income on the premiums, gain access to the international reinsurance market and attain risk transparency within your group. Take advantage of our know-how in the field of structuring, implementing and managing captive solutions. Captive A captive is an insurance company wholly owned by a company not involved in the insurance sector that provides cover for risks of the group to which it belongs. Direct Insurance Captive A direct insurance captive fulfils the same role as a direct insurer. It underwrites the policyholder’s risks directly, which in this case are risks of the group. Reinsurance Captive A reinsurance captive assumes a defined share of the group’s risks from the direct insurer in return for a premium. It therefore acts as reinsurer to the direct insurer and can in turn purchase reinsurance cover. Concept of a Reinsurance Captive: Customer Insurer Reinsurance Captive Captive management e.g. Dividend payments Retrocession Premiums Claims Retrocessionaire Captive Management The management of a captive includes administration, reporting, cash and investment management, purchase of reinsurance cover and dealing with the local authorities. Although the captive can be managed either by the captive itself or by the parent company, it is usually placed with specialised captive management companies. Zurich offers captive management services in Bermuda, Cayman Islands, Luxembourg and Switzerland. Advantages of a Captive • • • • • • • Participation in good loss history Investment income from ceded premiums and reserves Stabilisation of insurance costs Central and global risk management Extended cover for uninsured or uninsurable risks Access to the reinsurance market via the captive Increased cash flow Requirements for Setting up a Captive 1. Favourable claims history within the group (ratio between claims incurred and premiums paid) 2. Active risk management integrated into the financial management function 3. Willingness to assume a considerable share of own risks 4. Sufficient premium volume (minimum annual premium to be ceded to the captive = CHF 1,000,000.–) 5. Demonstrated financial strength of the policyholder 6. Favourable feasibility study results Structure of an International Insurance Programme: Switzerland Policyholder with insured risks Canada Finland Germany Argentina Direct insurer Direct insurer Direct insurer Direct insurer ✚ Direct insurance broker Local level Direct insurer Master Policy Programme pooling managed by Zurich Programme level Reinsurance level Retrocession Captive Retrocessionaire Other reinsurance Captive Companies throughout the World At the moment there are about 4400 captives worldwide, a third of which are based in Bermuda. Major locations within the EU are Dublin and Luxembourg. The diagram gives an overview of the distribution of the captives between the various locations. Favourable laws governing companies, supervision and taxation, which have been passed in certain European states in recent years, have made these countries attractive locations for captives. This applies in particular to Switzerland. Captives in Selected Locations: Luxembourg 273 Ireland 178 Guernsey 370 Bermuda 1405 Vermont 381 Barbados 237 Cayman 535 Others 906 Isle of Man 173 Worldwide: 4458 captives (status in 2000; source: Best’s Captive Directory 2001) Our Services Risk management Feasibility studies International insurance programmes / fronting Incorporation and licensing of captives Captive management Reinsurance coverage Run-off and liquidation of captives Zurich Continental Europe Corporate Center of Excellence ART Austrasse 46 8045 Zurich Phone +41 01 628 82 82 Fax +41 01 628 87 70 www.zurichbusiness.com/art Status: 08/2002 • • • • • • •