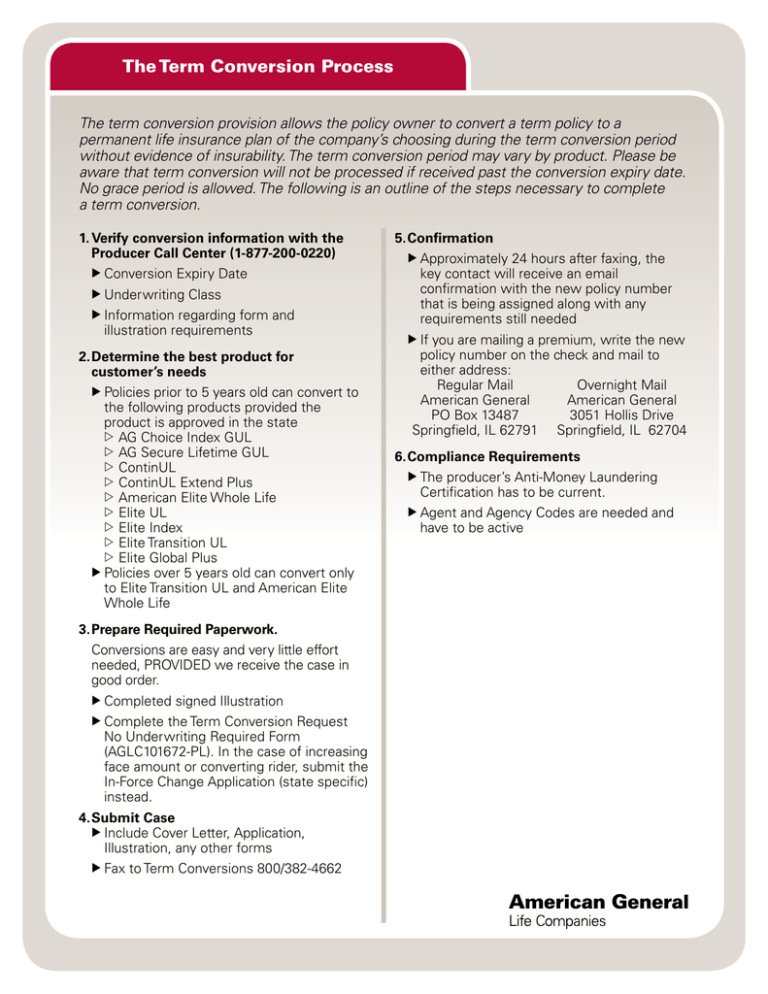

The Term Conversion Process

The term conversion provision allows the policy owner to convert a term policy to a

permanent life insurance plan of the company’s choosing during the term conversion period

without evidence of insurability. The term conversion period may vary by product. Please be

aware that term conversion will not be processed if received past the conversion expiry date.

No grace period is allowed. The following is an outline of the steps necessary to complete

a term conversion.

1.Verify conversion information with the

Producer Call Center (1-877-200-0220)

Conversion Expiry Date

Underwriting Class

Information regarding form and

illustration requirements

2.Determine the best product for

customer’s needs

Policies prior to 5 years old can convert to the following products provided the

product is approved in the state

AG Choice Index GUL

AG Secure Lifetime GUL

ContinUL

ContinUL Extend Plus

American Elite Whole Life

Elite UL

Elite Index

Elite Transition UL

Elite Global Plus

Policies over 5 years old can convert only

to Elite Transition UL and American Elite Whole Life

3.Prepare Required Paperwork.

Conversions are easy and very little effort

needed, PROVIDED we receive the case in

good order.

Completed signed Illustration

Complete the Term Conversion Request

No Underwriting Required Form (AGLC101672-PL). In the case of increasing face amount or converting rider, submit the In-Force Change Application (state specific) instead.

4.Submit Case

Include Cover Letter, Application,

Illustration, any other forms

Fax to Term Conversions 800/382-4662

5.Confirmation

Approximately

24 hours after faxing, the key contact will receive an email

confirmation with the new policy number that is being assigned along with any

requirements still needed

If you are mailing a premium, write the new policy number on the check and mail to either address:

Regular Mail

Overnight Mail

American General

American General

PO Box 13487

3051 Hollis Drive

Springfield, IL 62791 Springfield, IL 62704

6.Compliance Requirements

The producer’s Anti-Money Laundering

Certification has to be current.

Agent and Agency Codes are needed and

have to be active

Complete the Term Conversion Request No

Underwriting Required Form

Section

A – Current Policy Information.

Verify that the existing policy number and

insured match.

Section C – Conversion Request. Indicate if there will be any remaining coverage. Do not leave blank.

Section D – Effective Date. New issue “day”

must be the same issue “day” as the term

plan. For example, if the term policy was

issued September 1, then the new plan will

be issued on the 1st. Best advice is to have

the new plan issued based on the paid-to

date of the term plan. Any unearned premium

on the term plan will be refunded.

Section E – Primary Insured Information

Provide

all data, do not leave blanks. This information is compared against the policy being converted.

Make sure the name is the same on the

old policy and the new policy. If not, please

complete a Name and Address Change (Form AGLC0222).

Section F – Owner Information. Complete

only if the owner is other than the insured. If

the owner is a trust, please complete

Sections G and M as well.

Section I – Beneficiary. Percentages must add

up to 100. Full name(s) and relationship to the

insured must be included

Section J – Billing

Bank Draft information. The Term

Conversion Request allows you to choose to use existing banking information.

However, when a term plan is expiring, the

system automatically stops the draft and places it on a quarterly billing, which removes the banking information. It’s always a good idea to complete an

Electronic Funds Authorization (Form AGLC0220 for AGL or USL0058 for USL) so we have accurate data.

Draft Day – has to be the same as the issue

date or prior. Only exception is if an

additional month’s premium is received or

new policy is a whole life plan.

Section

K – Signatures. The agent and policy

owner have to sign both the application and

the illustration.

Illustration or Quote

Use Illustration Software or contact Internal Sales 800/677-3311 option 2

Signed by owner and agent and Dated

on or after the date the illustration was produced

Required if converting to a UL. Not

required if converting to whole life.

Illustration issues to avoid

a.

Pages missing

b.Run date vs. signed date. Signed date cannot be before the run date

c.Rate class must be same as the rate class as approved by the original term policy

d.Age must be the nearest insurance age, unless you are saving age

e.Riders must be illustrated. Many times the Terminal Illness Rider is on the term policy but is not illustrated for the new policy. If it is going to be on the new plan, it must be illustrated.

f. State on the illustration has to match the

state where the application was signed

Possible Other Forms

If the Insured is over age 67, Agent

Certification Form (AGLC101994) AND

Premium Finance Disclosure Form (AGLC102053)

Terminal Illness Rider (TIR) Disclosure

Form is needed for the following states: AL, AR, CT, DC, IN, KS, LA, MA, MI, MN, MS, NC, OH, OK, OR, TX, VA and WA

Change of Ownership Form (AGLC0013 or USL0057)

Electronic Funds Authorization Form (AGLC0220 or USL0058)

Enclose check for initial premium

American General Life Companies, www.americangeneral.com, is the marketing name for a group of affiliated domestic life insurers,

including American General Life Insurance Company and The United States Life Insurance Company in the City of New York. ©2011. All

rights reserved.

AGLC105323 FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC.