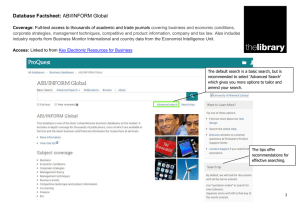

Hot spots - Citigroup

advertisement