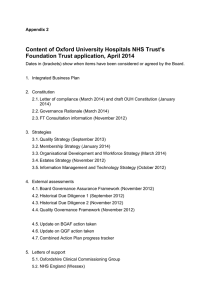

Risk assessment framework

advertisement