CONTROL OF CASH ENTERING OR LEAVING THE EU

advertisement

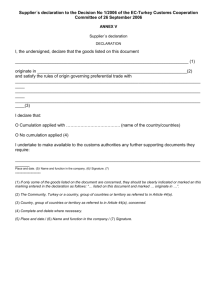

REPUBLIC OF SLOVENIA MINISTRY OF FINANCE FINANCIAL ADMINISTRATION OF THE REPUBLIC OF SLOVENIA Šmartinska cesta 55, PO Box 631, 1001 Ljubljana, Slovenia T: +386 1 478 38 00 F: +386 1 478 39 00 E: gfu.fu@gov.si www.fu.gov.si CONTROL OF CASH ENTERING OR LEAVING THE EU Detailed description 1ST version, DECEMBER 2014 TABLE OF CONTENTS 1.0 CONTROL OF CASH ENTERING OR LEAVING THE EU ............................................... 3 1.1 What is cash? ................................................................................................................ 3 1.2 Where must I make a declaration? ............................................................................... 3 1.3 Why must I make a declaration? .................................................................................. 3 1.4 What happens if I do not submit a declaration or submit a false one?........................ 3 2 1.0 CONTROL OF CASH ENTERING OR LEAVING THE EU All travellers entering or leaving the EU with EUR 10.000 or more in cash or its equivalent in any other currency must declare the sum to the customs authorities in order to comply with Regulation (EC) No 1889/2005 of the European Parliament and of the Council of 26 October 2005 on controls of cash entering or leaving the Community (UL L 309, 25. 11. 2005) and Foreign Exchange Act (Official Gazette of the Republic of Slovenia Nos 16/08, 85/09 and 109/12). This measure is applied by all EU Member States to assist the efforts made at the EU level to combat crime, improve security and prevent money laundering, terrorism and criminality. 1.1 What is cash? According to the provisions of the above mentioned EU Regulation cash means: bearer-negotiable instruments including monetary instruments in bearer form such as travellers cheques, negotiable instruments (including cheques, promissory notes and money orders) that are either in bearer form, endorsed without restriction, made out to a fictitious payee, or otherwise in such form that title thereto passes upon delivery and incomplete instruments (including cheques, promissory notes and money orders) signed, but with the payee's name omitted) and currency (banknotes and coins that are in circulation as a medium of exchange). 1.2 Where must I make a declaration? A declaration must be completed in a written form and submitted to the customs authorities of the EU Member State through which a traveller is entering or leaving the EU. An endorsed copy of the written declaration shall be delivered to the traveller upon request. More information: Cash Declaration Form 1.3 Why must I make a declaration? A declaration must be made to comply with the EU and the national legislation and to avoid penalties for non-compliance. 1.4 What happens if I do not submit a declaration or submit a false one? If you fail to comply with the obligation to declare, cash may be detained or seized, and you may be subject to penalties. More information: http://ec.europa.eu/taxation_customs/customs/customs_controls/cash_controls/index_en.htm 3