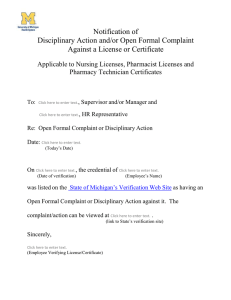

record of decision of a disciplinary

advertisement