Pro forma financial information

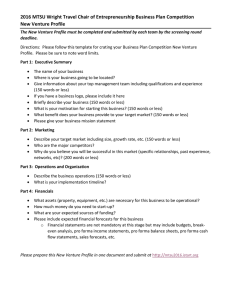

advertisement