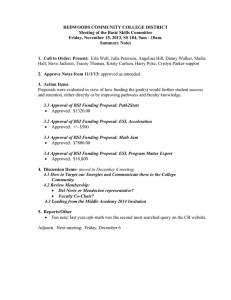

The British Standards Institution

advertisement