New Business Handbook - Hinds County Economic Development

advertisement

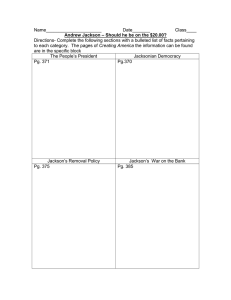

NEW BUSINESS HANDBOOK FOR HINDS COUNTY, MISSISSIPPI PREPARED BY: HINDS COUNTY ECONOMIC DEVELOPMENT AUTHORITY P. O. BOX 248 JACKSON, MS 39205-0248 TEL: 601-353-6056 FAX: 601-353-7179 www.selecthinds.com TABLE OF CONTENTS I. Local Requirements Page A. Business License …………………………………………………………………………………… 3 B. Building Permits …………………………… ……………………………………………………… 4 C. Zoning Requirements ………………………………………………………………………………. 5 II. State Requirements A. Incorporation…………………………………………………………………………………… … 6 B. Registration Application (Form 60-007)…………………………………………………………… 6 C. Franchise Tax Registration (Form 60-007) ……………………………………………………….. 6 D. Employee's Withholding Exemption Certificate (Form 62-420) ………………………………….. 6 E. Sales Tax Information …………………………………………………………………………….. 7 F. Workers Compensation … ………………………………………………………………………… 7 G. Status Report Form UC-I …………………………………………………………………………. 7 H. Safety and Health Standards ………………………………………………………………………. 7 I. Special Licenses …………………………………………………………………………………… 8 III. Federal Requirements A. Application for Employer Identification Number (Form ss-4)…………………………………..… 9 B. Social Security Taxes …….. . …………………………………………………………………….. 9 C. Employees Withholding Allowance Certificate (Form W-4)………………………………………. 10 D. Earned Income Credit Advance Payment Certificate (Form W-5)………………………………… 10 E. Safety and Health Standards… ……………………………………………………………………. 10 F. Wage and Hour Regulations ………………………………………………………………………. 11 G. Equal Employment Regulations …………………………………………………………………... 11 IV. Additional Business Resources ………………………………………………………………… 2 12 I. LOCAL REQUIREMENTS A. Business License 1. County An owner of a new business may need a county license from the county tax collector if the business is located outside of a city's corporate limits. Contact: Hinds County Tax Collector Chancery Court Building P. O. Box 1727 Jackson, MS 39215-1727 (601) 968-6587 Jackson Office (601) 857-5574 Raymond Office 2. Municipality An owner of a new business may need a municipal license if the business is located within a municipal's corporate limits. Contact: Town of Bolton P.O. Box 7 Bolton, MS 39041 (601) 866-2222 City of Clinton P. O. Box 156 Clinton, MS 39060 (601) 924-5462 Town of Edwards P. O. Box 215 Edwards, MS 39066 (601) 852-5461 City of Jackson P.O. Box 17 Jackson, MS 39205-0017 (601) 960-1148 Town of Learned P.O. Box 5 Learned, MS 39154 (601) 885-2258 Town of Raymond P.O. Box 10 Raymond, MS 39154 (601) 857-8041 Town of Terry P O Box 327 Terry, MS 39170 3 Town of Utica P. O. Box 335 Utica, MS 39175 (601) 878-5521 (601) 885-8718 B. Building Permits 1. County If a business is to be located in a new or remodeled building outside the corporate limits of a municipality, the owner should verify whether or not a county building permit is required before he begins construction or remodeling. Contact: Hinds County Department of Permits and Zoning Court House Annex P. O. Box 640 Raymond, MS 39154 (601) 857-8869 (601) 355-5424 (Jackson number) 2. Municipality If a business is to be located in a new or remodeled building inside the corporate limits of a municipality, the owner may need a building permit before beginning construction or remodeling. Contact: Town of Bolton P.O. Box 7 Bolton, MS 39041 (601) 866-2222 City of Clinton P. O. Box 156 Clinton, MS 39060 (601) 924-5462 Town of Edwards P. O. Box 215 Edwards, MS 39066 (601) 852-5461 City of Jackson P.O. Box 17 Jackson, MS 39205-0017 (601) 960-1155 Town of Learned P.O. Box 5 Learned, MS 39154 (601) 885-2258 Town of Raymond P.O. Box 10 Raymond, MS 39154 (601) 857-8041 4 Town of Terry P O Box 327 Terry, MS 39170 (601) 878-5521 Town of Utica P. O. Box 335 Utica, MS 39175 (601) 885-8718 C. Zoning Requirements 1. County The owner of a new business should check with county officials to see if there are zoning requirements. Contact: Hinds County Department of Permits and Zoning Court House Annex P. O. Box 640 Raymond, MS 39154 (601)857-8869 (601) 355-5424 (Jackson number) 2. Municipality If a business is to be located within a municipal's limits, the business owner should verify that the property is zoned appropriately. Contact: Town of Bolton P.O. Box 7 Bolton, MS 39041 (601) 866-2222 City of Clinton P. O. Box 156 Clinton, MS 39060 (601) 924-5462 Town of Edwards P. O. Box 215 Edwards, MS 39066 (601) 852-5461 City of Jackson P.O. Box 17 Jackson, MS 39205-0017 (601) 960-2071 Town of Learned P.O. Box 5 Learned, MS 39154 (601) 885-2258 Town of Raymond P.O. Box 10 Raymond, MS 39154 (601) 857-8041 5 Town of Terry P O Box 327 Terry, MS 39170 (601) 878-5521 Town of Utica P. O. Box 335 Utica, MS 39175 (601) 885-8718 II. STATE REQUIREMENTS A. Incorporation If a business is to be a corporation, a certificate of incorporation must be filed with the Office of the Secretary of State. Contact: Office of the Secretary of State P. O. Box 136 Jackson, MS 39201 (601) 359-1350 B. Registration Application This combined form allows for several registrations to be made with the same form (i.e. state [business] privilege license, employer income tax withholding, and for several other special purpose applications). Contact: Miss. Department of Revenue P.O. Box 1033 Jackson, MS 392158-1033 (601) 923-7000 C. Franchise Tax Registration A newly formed corporation must register with the Franchise Tax Division of the Mississippi State Tax Commission within 60 days after it receives its charter of incorporation. Contact: Mississippi Department of Revenue P.O. Box 1033 Jackson, MS 39215-1033 (601) 923-7000 D. Employee's Withholding Exemption Certificate 6 Each employee must fill out and give to his employer, at the beginning of his employment, a withholding exemption certificate. This document provides the employer with information concerning how much state income tax to withhold from wages. Contact: Mississippi Department of Revenue P.O. Box 1033 Jackson, MS 39215-1033 (601) 923-7000 E. Sales Tax Information Contact: Mississippi Department of Revenue P.O. Box 1033 Jackson, MS 39215-1033 (601) 923-7000 F. Workers' Compensation The worker’s compensation program provides income to employees who are injured on the job and pays medical expenses resulting from work oriented injury. It also pays benefits to the employees’ dependents in the event an employee is killed in the course or scope of his employment. Most, but not all, businesses with five or more employees must have workmen's compensation insurance. However, any business may carry this type of insurance. Contact: Mississippi Workers Compensation Commission 1428 Lakeland Drive Jackson, MS 39216 (601) 987-4200 G. Unemployment Compensation-Status Report Form UC-l The state unemployment compensation program provides income to employees who lose their job through no fault of their own. It provides temporary income to individuals while they are unemployed. Most businesses must contribute toward the state fund. Contact: Mississippi Department of Employment Security Contribution/Status Department P. O. Box 22781 7 Jackson, MS 39225-2781 (601)321-6000 H. Safety and Health Standards The Division of Occupational Safety and Health of the Mississippi State Board of Health will help state businesses meet federal safety and health standards by providing on-site surveys and consultations. It will provide assistance only if requested to do so. This agency has no enforcement power. Contact: Mississippi State Board of Health Division of Occupational Safety and Health 305 West Lorenz Boulevard Jackson, MS 39213 601) 576-7186 I. Special Licenses 1. The office of the Secretary of State can direct businesses to state agencies that may require special licenses, permits and other types of certification. The Secretary's office compiles the "Mississippi Official and Statistical Register” which provides the addresses and summaries of duties of such groups as the Board of Barber Examiners, the Board of Public Accountancy, the Commission on Health Care and others. The Secretary's office also publishes a “Mississippi Government Official Telephone Directory" with a classified section of state agencies, a summary of Mississippi local privilege tax laws and other material that can provide important direction to businesses. Contact: Secretary of State P. O. Box 136 Jackson, MS 39201 (601) 359-1350 2. A venture which entails the handling/processing of foods must meet sanitary standards of the Mississippi State Board of Health. An owner of this type of business should contact their local county health department. Stove 8 ventilation systems in restaurants must conform to local fire-prevention codes; a restaurant owner should contact the local fire department or town hall for guidance. Contact: Hinds County Health Department 350 W. Woodrow Wilson Drive Jackson, MS 39216 (601) 978-7864 MS State Dept. of Health 570 E. Woodrow Wilson Jackson, MSA 39202 (601) 576-7400 3. Businesses that sell alcoholic beverages, tobacco, firearms or ammunition should contact the following agencies that have control over the sale of these items: United States Treasury Department's Bureau of Alcohol, Tobacco and Firearms and the Mississippi State Tax Commission's Alcoholic Beverage Control Bureau (ABC). The ABC not only grants or denies licenses for the sale of alcoholic beverages, but it is also the State's only wholesaler of wines and liquors. Your local government (city/town) may have specific regulations that must be met also. Contact: U.S. Treasury, Bureau of Alcohol, Tobacco & Firearms Federal Bldg. 100 W. Capitol St., Ste.703 Jackson, MS 39269 (601) 965-4205 MS State Tax Commission Alcoholic Beverage Control P O Box 540 Madison, MS 39110-0540 (601) 856-1380 III. FEDERAL REQUIREMENTS A. 9 Application for Employer Identification Number (Form ss-4) A new business owner must obtain an employer identification number to use in all contacts with the Internal Revenue Service (IRS). Contact: Internal Revenue Service U.S. Treasury Department 1-800-829-3676 (Forms) 1-800-829-1040 (General tax information) B. Social Security Taxes An employer must deduct Social Security Tax (FICA) from wages paid to employees. The employer remits the total amount to the United States Internal Revenue Service. Withheld federal income tax is deposited using Form 501. The total amount of FICA taxes paid is reported quarterly on Form 941. Employers should get a current IRS Tax Guide Circular E which has social security tax tables for employees. Contact: Internal Revenue Service U. S. Treasury Department 1-800-829-3676 (Forms) 1-800-829-1040 (General tax information) C. Employees Withholding Allowance Certificate(Form W-4) An employee must fill out and give Form W-4 to his employer when he begins his/her employment. This form guides the employer in determining how much Federal Income Tax to withhold from wages. Internal Revenue Service's Employer's Tax Guide Circular E provides Federal Income Tax Withholding Tables. Contact: Internal Revenue Service U. S. Treasury Department 1-800-829-3676 (Forms) 1-800-829-1040 (General tax information) D. Earned Income Credit Advance Payment Certificate(Form W-5) 10 The advance payment Earned Income Credit (EIC) Program provides a means for eligible employees to receive additional income at each period instead of waiting to file for refund when their annual Federal Income Tax returns are prepared. It is then the responsibility of eligible employees who wish to receive advance payments to give their employer a completed Form W-5 each year. The employer must then include these payments with wages paid to such eligible employees. Generally, the employer pays the amount of the advance EIC payments from withheld income and Social Security Taxes. Contact: Internal Revenue Service U. S. Treasury Department 1-800-829-3676 (Forms) 1-800-829-1040 (General tax information) E. Safety and Health Standards The Occupational Safety and Health Administration (OSHA) of the United States Department of Labor enforces federal safety and health standards in business and industry. OSHA's standards apply to all business-related accidents and illnesses. Safety and health detailed guideline booklets for employers may be obtained from OSHA. Contact: United States Department of Labor-OSHA 3780 I-55 North, Suite 210 Jackson, MS 39211 601) 965-4606 F. Wage and Hour Regulations Most businesses must follow federal standards concerning minimum wage, maximum hours, overtime pay and child labor. A new business owner should check to see if his business meets these requirements. Wage and hour detailed booklets are available upon request. Contact: U.S. Department of Labor 11 Wage and Hour Division 100 W. Capitol St., Suite 224 Jackson, MS 39269 (601) 965-4347 G. Equal Employment Regulations Equal treatment of all employees, as well as equal pay, is regulated and enforced by the U. S. Equal Employment Opportunity Commission (EEOC). EEOC prohibits employment discrimination on the basis of age, color, religion, sex or natural origin. Generally, a small, independently owned and operated business with fewer than 15 employees is not subject to these regulations. Contact: U.S. Equal Employment Opportunity Commission 100 W. Capitol St., Suite 207 Jackson, MS 39269 (601) 948-8400 IV. ADDITIONAL BUSINESS RESOURCES Additional support for entrepreneurs and potential business owners may be provided by the following Small Business Development Centers. Contact: Small Business Development Center Hinds Community College P.O. Box 1263 Raymond, MS 39154-9799 (601) 857-3537 Small Business Development Center Jackson State University 931 Highway 80 West Jackson, MS 39204 (601) 965-2795 12 Other Resources: Mississippi Development Authority(state economic development) www.mississippi.org (click option on left of screen "Starting a Business') Hinds County (tax office, planning dept. etc.) www.co.hinds.ms.us Mississippi Secretary of State: www.sos.state.ms.us Mississippi Dept. of Revenue(tax commission) www.dor.ms.gov Small Business Administration Offices' on left of screen) 4836-8504-3478, v. 13 1 www.sba.gov (then click 'Local