Guidance note for Statutory Residence Test

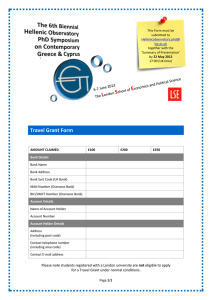

advertisement